By Dr. J. Harold McClure, New York City

On November 12 the OECD published the first of several planned case studies demonstrating how developing country tax authorities can address tax avoidance and evasion with the assistance of tools and capacity building services provided by the OECD and the Global Forum on Transparency and Exchange of Information for Tax Purposes.

The first case study, “Landmark Supreme Court victory in Zambia: collecting millions in tax revenues and sending a message across borders,” highlights Zambia’s significant improvements in the area of transfer pricing. In the past few years, Zambia has put in place a transfer pricing legislative framework and regulations and has greatly improved its transfer pricing audit capacity.

These efforts have borne fruit. The OECD case study notes that on May 20, the Supreme Court of Zambia upheld the tax authority’s 240 million Kwacha (USD 13 million) transfer pricing assessment in a transfer pricing dispute involving Zambia’s Mopani copper mines.

In the case, the Zambian tax authority asserted that the intercompany prices paid by Swiss affiliate and copper distributor, Glencore International AG, to Zambian mining affiliate, Mopani Copper Mining plc., from 2006 to 2009 were substantially below the arm’s length standard.

The favorable ruling for the Zambian tax authority on the transfer pricing for copper produced by the Mopani mines is a noteworthy development.

The economic issues involved in the case concerned how to apply the comparable uncontrolled price (CUP) approach in markets where hedging is involved, a topic that required significant transfer pricing capability on the part of the Zambian tax authority. The taxpayer lost, in part, because its defense of its intercompany pricing was less than compelling.

The economic issues involved in the case concerned how to apply the comparable uncontrolled price (CUP) approach in markets where hedging is involved, a topic that required significant transfer pricing capability on the part of the Zambian tax authority. The taxpayer lost, in part, because its defense of its intercompany pricing was less than compelling.

While copper exports represent 70 percent of Zambia’s exports, the major exporters of copper include Chile, Peru, Australia, and Indonesia. Tax authorities in Australia and Canada have lost litigations involving intercompany pricing for copper but for reasons other than those at issue in the Mopani Copper case.

Zambia’s transfer pricing arguments

The Zambian revenue authority initially hired Grant Thornton to analyze the potential transfer pricing issues associated with the Mopani copper mines. A copy of Grant Thornton’s “Pilot Audit Report – Mopani Copper Mines Plc” became publicly available.

While the report noted that the mine’s operating costs were high, it never identified any specific transfer pricing issues with respect to its expenses.

The transfer pricing focus was instead on the intercompany revenues received from the Swiss affiliate. While the report suggests that the intercompany price did not rise in accordance with rising market copper prices from 2005 to 2008, it noted the existence of a “Copper Marketing and Off-Take Agreement.”

Grant Thornton’s only mention of the terms of this intercompany agreement was to note that “sales are to be made at Official LME Copper Grade settlement quotation averaged over the relevant quotation period plus a premium/less a discount and less a realization charge for freight.”

Copper pricing

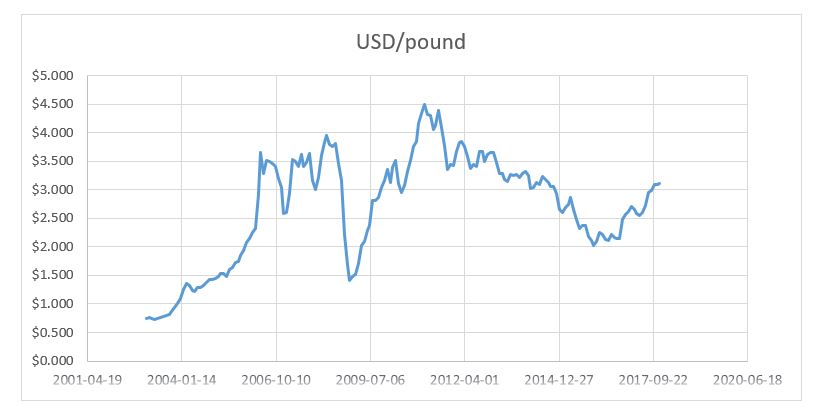

Copper prices have exhibited tremendous variability since 2003, including in 2006 to 2009, the years at issue in the Mopani copper mines dispute.

Prices rose from USD0.75 per pound to USD1.00 per pound during 2003 and then soared to USD3.96 per pound by April 2008.

The commodity boom was temporarily interrupted during the Great Recession, but copper prices rose to USD4.49 per pound by February 2011.

The following figure shows copper prices from 2003 to 2017 on a monthly basis.

The Zambia tax authority’s initial transfer pricing adjustments would have increased the Zambian affiliate’s taxable income by 311 million Kwachas for the first two years and an additional 141 million Kwachas for the latter years.

Zambia’s transfer pricing arguments

The approaches taken by the tax authority and the rebuttals from the taxpayer play out the often-seen debates with respect to the application of the sixth method, which is a variation of the comparable uncontrolled price (CUP) method popularized by South American tax authorities such as Chile and Peru.

The tax authority compared the intercompany prices paid by the Swiss affiliate to the Zambian affiliates to prices paid by domestic third party buyers. The taxpayer, on the other hand, claimed it relied on the LME Copper Grade cash settlement.

The taxpayer also accused the tax authority of ignoring its hedging agreements and commissioned Deloitte and Touche to write a report evaluating its hedging transactions.

Hedging copper pricing risk

The volatility of spot copper prices poses business risks for both buyers of copper as well as for copper mines. A lot of copper trade occurs using futures markets to hedge this risk. The London Metals Exchange (LME) offers spot price quotes as well as future prices for grade A copper.

The Grant Thornton report claimed that the intercompany prices diverged from LME prices during the commodity boom. It is unclear how this report derived its graph of LME prices and alleged intercompany prices. This report provided figures on what intercompany revenues would be under LME prices versus intercompany prices.

If its calculations were correct, the implication is that revenues under LME pricing minus intercompany revenues would represent an 18.34 percent shortfall.

The Supreme Court decision noted that neither party offered expert testimony to explain or justify the positions of the various reports. Its ultimate ruling maintained the 141 million Kwacha adjustment for the latter years and lowered to the adjustment for the former years to 100 million Kwachas.

Transfer pricing implications of off-take agreements

I noted the failure of the Grant Thornton report to identify the contractual terms in the “Copper Marketing and Off-Take Agreement” between Glencore International AG and Mopani Copper Mining in two papers on the transfer pricing between mining affiliates and their marketing affiliates (“Evaluating Whether a Distribution Affiliate Pays Arm’s-Length Prices for Mining Products,” Journal of International Taxation, July 2014; “Gross Margins for Mining Marketing Hubs: Applications and Critiques of TNMM,” Journal of International Taxation, January 2020).

Off-take agreements vary. In some cases, they simply specify that the marketing entity agrees to purchase the mine’s production at the market price. In such cases, the mine takes the entrepreneurial risk being subject to the risk of falling prices as well as the upside potential from commodity booms.

The Grant Thornton report, however, referred to the intercompany agreement as a long-term contract. As discussed in MNE Tax in the context of the dispute between Cameco and the Canadian Revenue Agency, in such long-term contracts, the distributor can be viewed as the entrepreneur. Since the distributor takes the downside risk that spot prices will be below the agreed-on future price, it also should receive the upside potential.

Significant profits could be realized by a distributor who took entrepreneurial risk during a period when market prices unexpectedly rose under this latter interpretation of the Mopani mines off-take agreement. However, if the mining affiliate bore the entrepreneurial risk under the intercompany agreement, its profits would be limited to the routine returns for the functions it bore under the arm’s length standard.

Significant profits could be realized by a distributor who took entrepreneurial risk during a period when market prices unexpectedly rose under this latter interpretation of the Mopani mines off-take agreement. However, if the mining affiliate bore the entrepreneurial risk under the intercompany agreement, its profits would be limited to the routine returns for the functions it bore under the arm’s length standard.

The calculations of the alleged difference between LME pricing versus intercompany pricing made by Grant Thornton suggested an 18.34 percent gross margin for the Swiss affiliate. Their report also suggests that the Swiss affiliate received a 2 percent commission rate for shipping with the suggestion that this commission was generous relative to the actual cost of shipping.

If we assume that these alleged figures reflect the actual financials for the Swiss affiliate, then its gross margin would be 20 percent or more.

A 20 percent gross margin would certainly be generous if the only functions of the Swiss affiliate represented selling and shipping activities. Selling costs for copper multinationals tend to be 2 percent of revenue, which would suggest a 2.5 to 3 percent gross margin if the mining affiliate were responsible for both shipping and smelting costs.

Without further information about the terms of the off-take agreement, it is not possible to assess whether the transfer pricing position of either party is justified. This is a key issue not addressed in this particular transfer pricing litigation.

Be the first to comment