By Dr. J. Harold McClure, New York City

On March 16, the Norwegian tax authority prevailed in its challenge to the intercompany interest rates paid by a Norwegian borrowing affiliate of ConocoPhillips in Norway vs ConocoPhillips Skandinavia AS (Court of Appeal, Case No LG-2021-38180). The intercompany interest rate was set at the six-month Norwegian interbank rate (NIBOR) plus a 1.25 percent loan margin, which the tax authority should have reduced to 0.75 percent. Norway vs. Exxonmobil Production Norway Inc. (Lagsmanret no LB-2016-160306, January 2018) involved an intercompany loan from a Norwegian lending affiliate to the U.S. parent where the initial loan margin was 0.3 percent but the tax authority successfully increased the loan margin to 0.75 percent.

A standard model for evaluating whether an intercompany interest rate is arm’s length can be seen having two components: the intercompany contract and the credit rating of the related-party borrower. Properly articulated intercompany contracts stipulate: the date of the loan; the currency of denomination; the term of the loan; and the interest rate.

The first three items allow the analyst to determine the market interest rate of the corresponding government bond. This intercompany interest rate minus the market interest rate of the corresponding government bond can be seen as the credit spread implied by the intercompany loan contract.

Floating rate loans have the interest rate change with variations in the base rate, which is often a rate that can range from a month to a year. The base rate can be Treasury bill rates or interbank rates. In the case of Treasury bill rates, the loan margin is the credit spread. The TED spread is formally the difference between the three-month London Interbank Offer Rate (LIBOR) and the three-month Treasury bill rate for instruments denominated in U.S. dollar. Similar spreads can be calculated for longer terms such as six-month interbank rates and for other currencies including the Norwegian krona (NOK).

Exxonmobil Production Norway

This litigation involved an NOK 20 billion 10-year intercompany loan from Exxonmobil Production Norway Inc. to Exxon Mobile Delaware Holdings Inc. (EMDHI) on November 16, 2009. The interest rate was set at three-months NIBOR plus a margin of 30 basis points. At the time, Treasury bill rates were near 1.8 percent, while the three-month NIBOR rate was near 2.05 percent. As such, the Norwegian version of the TED spread was near 0.25 percent. The intercompany policy implied a credit spread near 0.55 percent, while the Norwegian tax authorities argued for a credit spread closer to 1 percent arguing for a higher loan margin.

Both the taxpayer and the tax authority agreed that EMDHI had an AA+ credit rating with the sole issue being how to translate this credit rating into a credit spread. The Norwegian version of the TED spread during November 2009 was approximately 0.25 percent so the 0.3 percent loan margin in the intercompany contract represented a credit spread equal to 0.55 percent. TED spread is the spread between the 3-month U.S. LIBOR and the 3-month U.S. Treasury bill. During November 2009, this spread was approximately 0.25 percent. Our Norwegian version of the TED spread is the difference between the 3-month Norwegian interbank rate and the 3-month Norwegian Treasury bill rate, which was also approximately 0.25 percent at the time.

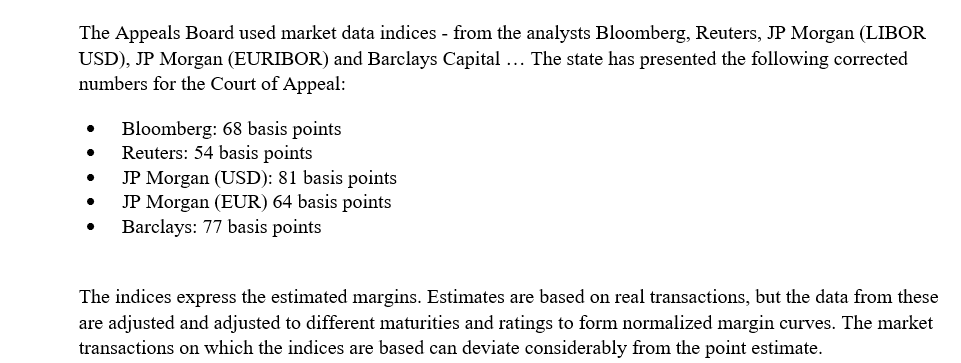

The Norwegian tax authority, however, presented evidence that suggested that this loan margin be at least 0.54 percent—that is, a credit spread near 0.8 percent. An English translation of the court decision noted:

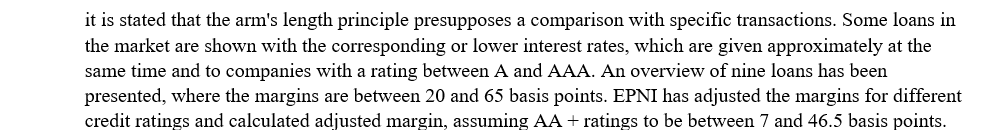

The taxpayer objected to the use of point estimates, insisting that a range based on individual transactions must be constructed:

The court disagreed, relying on the testimony of Espen Henriksen:

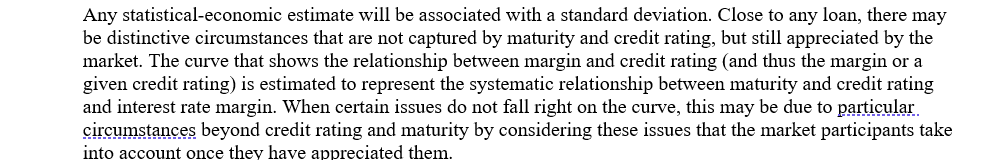

The loan information from Reuters suggested an intermediate position where the arm’s length intercompany rate would be the three-month Norwegian interbank rate near 0.55 percent, while the information from other sources suggested a loan margin closer to 0.8 percent. The litigation notes that there are various sources for loan data and within each source, there is some observed variability of loan margins for any given credit spread.

Norway vs ConocoPhillips Skandinavia

During May 2013, this Norwegian affiliate was extended a five-year intercompany loan of NOK 20 billion where the interest rate was set at the six-month NIBOR plus a 1.25 percent loan margin. At the time, Treasury bill rates were near 1.45 percent, while the six-month NIBOR rate was near 1.8 percent. As such, the Norwegian version of the TED spread was near 0.35 percent. The intercompany pricing policy was consistent with a 1.6 percent credit spread. The Norwegian tax authority argued that the loan margin should be only 0.75 percent, which would be consistent with a 1.1 percent loan margin.

The taxpayer’s initial position for the higher loan margin was based on a report prepared by PwC. This report estimated that the credit rating might be as low as BBB- or as high as BBB+. The court of appeals did not find these estimates of the appropriate credit rating to be credible. The Norwegian tax authority convinced the court of appeals that the appropriate credit rate should be A-.

Several conflicting presentations of market evidence on the translation from credit ratings into credit spreads were presented by the expert witnesses. The taxpayer relied on a report prepared by Halvor Hoddevik who was the expert for Exxonmobil in the other litigation. His report used the various pieces of market evidence to argue for an arm’s length range from 0.4 percent to 1.4 percent. The court of appeals did not find such a wide range to be credible. Hoddevik relied primarily on evidence from Bloomberg Energy. We note, below, that this data source suggested a loan margin of only 0.74 percent for loans where the borrower had an A- minus credit rating.

The PwC report suggested a loan margin equal to 1.48 percent if the credit rating was as low as BBB. This report suggested a loan margin equal to only 0.69 percent if the credit rating was BBB+. Information from Reuters Industrial and Bloomberg Industrial was presented. Both sources suggested loan margins near 0.95 percent if the credit rating was BBB. If the credit rating was BBB+, these sources suggested a loan margin between 0.72 percent and 0.8 percent.

Information from five reporting sources were used to present loan margin estimates for borrowers with credit ratings of A-. These estimates were: DNB Markets Industrial: 1.08 percent; Moody’s Implied Ratings: 0.78 percent; Bloomberg Energy: 0.74 percent; Bloomberg Industrials: 0.61 percent; and Reuters Industrials: 0.5 percent.

The court of appeals ruled that the 0.75 loan margin proposed by the Norwegian tax authorities was reasonable in light of this evidence and its acceptance that the appropriate credit rating should be A-.

Concluding remarks

The key to understanding evaluating what represents an arm’s length interest rate is to begin with a clear understanding of the relevant intercompany loan contract, which allows the analysis to define the credit spread implied by the intercompany contract.

Justifying this implied credit spread is the more difficult and controversial issue, which has been at the heart of recent litigations. Credit ratings are letter grades, which require translating into a numerical credit spread or loan margin. Even if consensus can be reached on the appropriate credit rating for the borrowing affiliate, the evaluation requires reliable information on how to turn the credit rating into a numerical estimate the appropriate credit spread or loan margin. The Norwegian tax authority’s recent wins in the Exxon and ConocoPhillips litigations highlight the role of carefully examining the market evidence provided by the various databases of loan margin data.

Be the first to comment