By Susi Baerentzen, Ph.D., Carlsberg Foundation Postdoctoral Fellow, Copenhagen

On May 3, the High Court of Eastern Denmark ruled in two of the most famous tax cases in modern times: the beneficial ownership cases.

These two domestic rulings, the TDC case known as C-116/16 T Danmark and the NetApp case known as C-117/16 Y Denmark ApS on dividends, form part of a group of six cases, of which the remaining four are on interest.

They became famous when the Court of Justice of the European Union handed down their preliminary rulings in the cases on February 26, 2019, and stated once and for all that a general principle on the prohibition of abuse exists in EU law and that beneficial ownership is not just a notion to be taken into consideration in international tax law, but also in EU tax law.

In addition, the EU court provided six indications for what would be considered as abuse of EU law:

(1) if the group structure is put in place to obtain a tax advantage,

(2) that all or almost all of the dividends or interest are passed on by the company that has received it to entities that do not fulfil the conditions for the application of the Interest and Royalties Directive and the Parent-Subsidiary Directive,

(3) if the interposed holding company has an insignificant income due to the redistribution of the dividends or interest,

(4) if the sole activity of the holding company is to redistribute the dividends based on the lack of management, balance sheets, expenses, employees and office facilities,

(5) if the contractual obligations (both legal and actual) renders the holding company unable to enjoy and use the dividend,

(6) if there is a close connection between the establishment of complex financial transactions and structures and new tax legislation.

The consequences of these rulings cannot be understated. Since they were decided in 2019, a number of domestic courts, for example, in France, Italy, the Netherlands, Switzerland, and Belgium, have referred to them in landmark cases.

The background in a nutshell

The cases arose from Denmark changing its tax policy in the early 2000’s. Before that, the clear policy had been to attract holding companies by not levying withholding taxes on payments of interest and dividends. That changed in 2001 following a critique from the EU that this was unfair completion, and Denmark reintroduced withholding taxes.

The problem thereafter was whether or not there was actually a domestic legal basis exempting withholding taxes on intragroup payments of dividends or interest within the EU, i.e., according to the EU Parent-Subsidiary Directive or the Interest and Royalties Directive, when the ultimate parent was resident outside the EU.

The Danish Ministry of Taxation claimed that the interposed holding companies were not the “beneficial owners” of the received interest or dividends and that the “beneficial owners” are residents of states outside of the EU, with whom Denmark has not concluded a double tax treaty. The result being that the directive benefits should have been denied and tax at source withheld.

The issue was that Denmark had not transposed the anti-abuse provisions in the Parent-Subsidiary Directive or the Interest- and Royalties Directive into domestic legislation by a statutory provision. There may or may not have been a non-statutory case law-based provision, but essentially the Ministry clung to the notion of “beneficial ownership” even though only the Interest- and Royalties Directive mentions this requirement, and even though it is not a notion described in Danish law.

In the end, this domestic legal discussion was somewhat obsolete as the preliminary rulings from the CJEU meant that the States could rely on the general EU principle on the prohibition of abuse irrespective of whether any domestic anti-abuse provisions had been transposed. This was, of course, before the EU Anti-Tax Avoidance Directive introduced a mandatory general anti-avoidance rule, before the most recent amendments to the Parent-Subsidiary Directive making the anti-abuse provisions mandatory, and before the OECD BEPS project requiring states to implement some form of a principal purpose test or limitation of benefits in their double tax treaties.

Today, there are an abundance of anti-abuse provisions, but prior to these developments, the world looked different, and plenty of cases are pending, awaiting rulings to decide on old structures established before these amendments.

The TDC Case – C-116/16 T Danmark

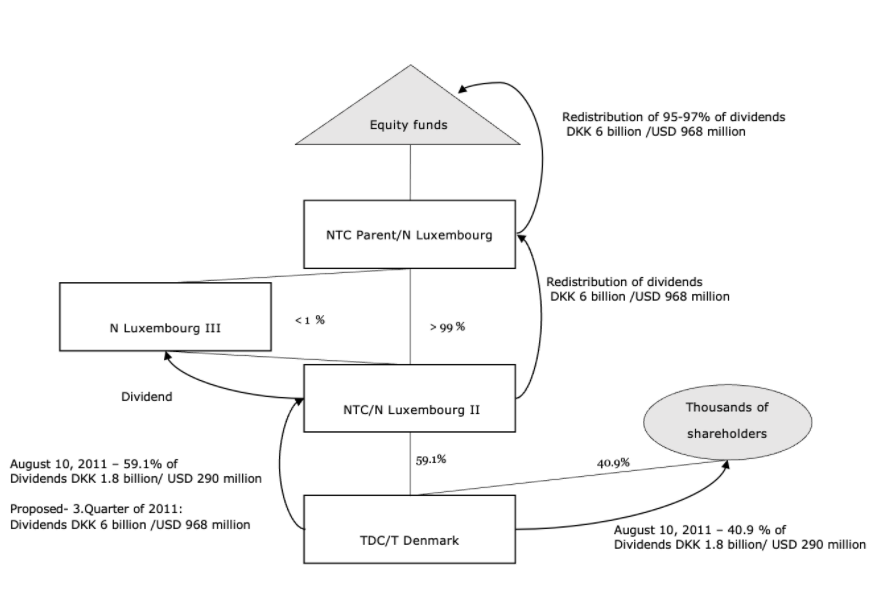

TDC/T Denmark is a Danish phone company with a structure that can be illustrated like this:

More than 50% of the shares in the company were owned by N Luxembourg II, and the remaining shares were owned by thousands of shareholders. (TDC/T was a listed company at the time). N Luxembourg II was a company in Luxembourg incorporated by N Luxembourg in 2009. In 2010, N Luxembourg II acquired a large block of shares in TDC/T.

In 2011, TDC/T paid its shareholders dividends totaling DKK 1.8 billion, 59.1% of (DKK 1 billion) which were paid to NTC/N Luxembourg II and the remaining 40.1% to the other shareholders. In the third quarter of 2011, it was proposed to distribute dividends to NTC/N Luxembourg II, amounting to DKK 6 billion/ USD 968 million.

The vast majority of the dividends from TDC/T to N Luxembourg II were to be paid up the chain to the owners of N Luxembourg II (N Luxembourg and N Luxembourg III) and subsequently redistributed to N Luxembourg III’s owners (N Luxembourg) and hereafter paid up the chain to companies controlled by equity funds that were likely located outside the EU or by N Luxembourg’s creditors. A small percentage of the dividends (3-5%) was to be used by the interposed companies to cover certain costs or allocated to a reserve for future expenses.

The same year, TDC/T requested an advanced binding ruling to ascertain whether the dividends distributed to NTC/N Luxembourg II were exempt from withholding taxes according to the Parent-Subsidiary Directive. The Danish Tax Board answered in the negative. The ruling was brought before the Danish National Tax Tribunal, and, in a ruling of March 13, 2012, (Decision no. 11-02359), the decision from the Danish Tax Board was overturned, and the Tribunal decided in favor of the taxpayer, i.e., N Luxembourg could benefit from the Parent-Subsidiary Directive, as it contains no beneficial ownership requirement. This ruling was then brought before the national courts by the Danish Ministry of Taxation and after the preliminary ruling from the CJEU on February 26, 2019, it was referred back to Denmark’s High Court, which ruled in the case on May 3, 2021.

Ruling from the High Court in the TDC case

In its decision, Denmark’s High Court highlighted that the information supporting the economic and business aspects of the group structure was very scarce, just like there was no exact information on or documentation for the decisions regarding the redistribution of the dividends in question.

Against this background, the High Court took the view that the dividends distributed up the group chain were merely redistributed to the private equity funds and perhaps ultimately to the investors, and that the interposed entities did not have any independent function apart from this.

The High Court further noted that TDC/T has not argued that the private equity funds would have obtained tax exemption for the dividends had TDC distributed the dividends directly to them. Subsequently, TDC/T cannot claim tax exemption according to the Parent-Subsidiary Directive or the double tax treaty with Luxembourg.

The NetApp Case – C-117/16 Y Denmark ApS

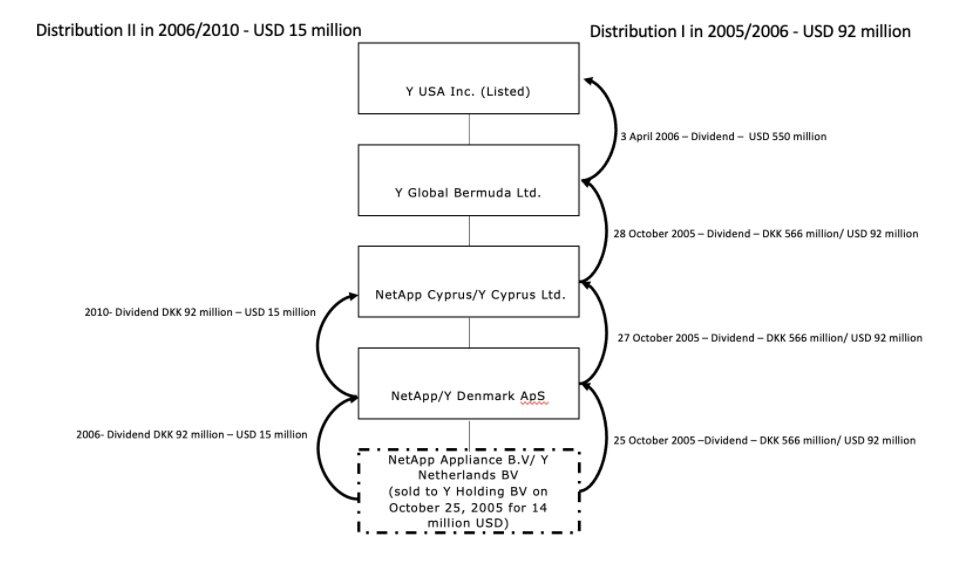

NetApp/Y Denmark ApS is a Danish subsidiary and part of the NetApp Group, with the ultimate global parent being a listed US corporation with its head office in Silicon Valley. Net App Group produces and sells hardware and software to network systems. The group structure can be illustrated like this:

The case concerns NetApp Denmark’s distribution of dividends to its Cyprus parent (Y Cyprus), which was granted a loan by its Bermuda shareholder (Y Bermuda) and used the dividends to repay this loan. The loan was originally intended to be used in the acquisition of Y Denmark. Y Cyprus’s only activity was being a traditional holding company for Y Denmark. It has no office, staff, or other business activities.

After its incorporation in 2000, Y Denmark acquired the shares in the company Y Netherlands by a group contribution from Bermuda Ltd. This was done to minimize tax, as there would be no withholding tax on the distribution of dividends. Until September 2005, Y Bermuda owned Y Denmark directly. The ultimate global owner of the group structure was Y USA, which is a listed US corporation. In September 2005, Y Bermuda incorporated Y Cyprus, and this company was interposed between Y Denmark and the previous global ultimate parent company in Bermuda by way of an intra-group restructuring. The price for the acquisition was USD 180 million, and, following the acquisition, Y Denmark sold the shares in Y Netherlands to an affiliated Netherlands company for USD 17 million, and Y Denmark recorded a receivable for the sales price from Y Netherlands.

In October 2005, Y Denmark distributed dividends equivalent to USD 92 million to Y Cyprus (Distribution I), and these dividends were used to pay off the receivable of Bermuda Ltd. Five months later, these dividends were redistributed to the listed global ultimate Y USA.

In October 2006, Y Denmark declared another distribution of dividends to Y Bermuda, this time equivalent to USD 15 million (Distribution II). Like the first dividends distributed, these dividends were also passed on to Y Bermuda, but not until 2010.

The Danish tax authorities did not regard Y Cyprus as the beneficial owner of the dividends received from Y Denmark under the Denmark-Cyprus double tax treaty (1981) since Y Cyprus did not have any activities or any right of disposal with respect to the dividends. On September 17, 2010, the Danish tax authorities decided that Y Denmark should have withheld tax at source relating to the two dividend distributions from 2005 and 2006.

This decision was brought before the Danish National Tax Tribunal, which held, in its ruling (SKM2012.26.LSR) that Y Cyprus could benefit from the Parent-Subsidiary Directive as it contains no beneficial ownership requirement, so no tax should have been withheld even though the Tribunal did not consider Y Cyprus the beneficial owner of the dividends.

This ruling, too, was brought before the national courts by the Danish Ministry of Taxation. Following the preliminary ruling from the CJEU on February 26, 2019, the Danish High Court ruled in the case on May 3, 2021.

Dividend I 2005 – 92 million USD

On September 28, 2005, NetApp Denmark declared a dividend of 568,896,000 DKK (approximately 92 million USD) to its parent company NetApp Cyprus.

On October 25, 2005, NetApp Denmark received a corresponding dividend from its Dutch subsidiary. On October 27, 2005, NetApp Denmark distributed the dividend to NetApp Cyprus, which redistributed a corresponding amount on October 28, 2005, to its parent company, NetApp Bermuda. On April 3, 2006, NetApp Bermuda transferred 550 million USD as a dividend to its parent company, NetApp USA.

NetApp Cyprus was incorporated on September 5, 2005, by NetApp Bermuda. The share capital was 20,000 USD according to the information provided, and only an amount of 2,000 USD was deposited. It is undisputed that NetApp Cyprus was interposed between NetApp Denmark and NetApp Bermuda in order to facilitate NetApp Denmark’s redistribution of the received dividends without triggering Danish taxation at source. This was done because of the reintroduction of Danish withholding taxes on dividends at the time.

The expected tax exemption was achieved by ensuring that the newly incorporated NetApp Cyprus acquired NetApp Bermuda’s shares in NetApp Denmark by agreement of September 16, 2005, so that NetApp Cyprus was obligated to pay the acquisition prize of 108 million USD, approximately 670 million DKK, to NetApp Bermuda no later than April 30, 2006.

Dividend II 2006 – USD 15 million

In the annual report 2005/2006 for NetApp Denmark, it was proposed to distribute a dividend of USD 15 million; however, it is also mentioned in the 2006/2007 annual report that the amount was not received. In relation to the subsequent transactions, it is merely stated that the amount was not transferred to NetApp Cyprus until 2010 and that the amount was redistributed to NetApp Bermuda as an additional repayment of debt.

According to the information provided, the amount was deposited in NetApp Denmark for four years, and NetApp Cyprus received interest income of the amount during this period. NetApp Denmark has described the matter as a loan in its argumentation without further explanation.

As the case is stated, the dividends were distributed from NetApp Denmark to NetApp Cyprus at an unspecified date in 2010 and subsequently redistributed to NetApp Bermuda at an also unspecified time in 2010, based on a declaration of dividend from 2006. No real reasons are provided as to why the dividend was distributed to NetApp Cyprus, apart from the NetApp group’s desire to avoid Danish taxation at source.

Ruling from the High Court in the NetApp Case

NetApp Cyprus was only capable of repaying its debt to NetApp Bermuda because of the dividends it received from NetApp Denmark, i.e., it did not have any actual disposal of the dividends received, and the purpose of the transactions has indisputably been to avoid Danish taxation of the dividends. Therefore, the High Court found that NetApp Cyprus cannot be regarded as the beneficial owner of the dividend, cf. Article 10(2) in the double tax treaty between Denmark and Cyprus, so there could be no lowering of the tax according to this treaty.

The overall assessment by the Court led to the tax exemption in the Parent-Subsidiary Directive being non-applicable since NetApp Cyprus must be considered a conduit without any independent economic reasoning for existence. Therefore it must be considered as a wholly artificial arrangement established with the aim of achieving a tax advantage according to the Directive. In other words: the structure was considered abusive, and therefore the benefits of EU law could not apply.

The question about the significance of the Denmark-US double tax treaty still remained, as some dividends had, in fact, been redistributed all the way up the group chain to the listed US global parent. The Ministry of Taxation argued that since the structure was put in place to abuse the Parent-Subsidiary Directive and the Denmark-Cyprus double tax treaty, high requirements should be made for the taxpayer’s documentation that NetApp Bermuda was in fact not entitled to redistribute the dividends to the US parent. The taxpayer, on the other hand, argued that this was exactly the point of the distribution of USD 550 million in 2005, as the point was to repatriate dividends to the US under the Jobs Creation Act from 2004, which made this particularly attractive.

The High Court referred to point 12.2 in the commentary to the OECD Model Tax Convention from 2003. The Court stated that if it can be ascertained for certain that the beneficial owner of the dividends is resident in another country than the country where the intermediary is resident, and provided that the country where the beneficial owner is resident has entered into a double tax treaty with Denmark, the beneficial owner can claim the provisions in that double tax treaty as grounds for lowering the tax. The Court went on to clarify that “the situation does not constitute abuse of law, since the dividends could have been distributed tax exempt from the Danish subsidiary to the beneficial owner in the country in question.“

In other words: after disregarding the two interposed entities in Cyprus and Bermuda, the Court conducts a comparative benefit analysis in order to determine whether a tax benefit was actually achieved by the interposition.

In other words: after disregarding the two interposed entities in Cyprus and Bermuda, the Court conducts a comparative benefit analysis in order to determine whether a tax benefit was actually achieved by the interposition.

For distribution I from 2005 in the amount of USD 92 million, the High Court stated that it would have been possible to distribute these dividends directly to the US ultimate parent company without triggering Danish withholding taxes, and as it was considered part of the plan to repatriate the dividends under the Jobs Creation Act.

For these reasons, the Court did not find that the Parent-Subsidiary Directive or the Denmark-Cyprus double tax treaty had been abused. The Court further states that the fact that NetApp Bermuda had the dividends at its disposal for five months until April 3, 2006, and that it would hypothetically have been possible for the company not to redistribute to the US (which would have constituted an abuse of the Parent-Subsidiary Directive and the Denmark-Cyprus double tax treaty), did not change the outcome. The dividends were actually redistributed to the US within a reasonable timeframe and according to the plan, the Court reasoned. To sum up: no tax at source should have been withheld for this amount.

For distribution II from 2006 in the amount of USD 15 million, the High Court highlighted that no real reasons for the distribution had been provided, except the desire to avoid Danish withholding tax. The Court adds that since NetApp Cyprus is considered a wholly artificial conduit, and since the dividends were placed in the company for about four years, the Court did not find that it had been part of the full distribution of dividends all the way up the chain to the US parent company of USD 550 million from April 3, 2006.

To sum up: the structure was considered an abuse of EU law. Therefore, there could be no exemption or lowering of the tax according to the Parent-Subsidiary Directive or the Denmark-Cyprus double tax treaty. Since the amount was not considered redistributed to the US, the advantages in the Denmark-US double tax treaty could not be granted either, and, consequently, Danish tax at source should have been withheld.

Takeaway from the High Court rulings

It is important to note that both the TDC and the NetApp cases are likely to continue to the Supreme Court simply due to the very large potential taxable amounts involved, so the final outcome may be years away yet. In addition, the rulings from the beneficial ownership interest cases, which were also part of the preliminary ruling from the CJEU, are to be decided by the High Court in the Fall of 2021.

That being said, these High Court rulings are already important contributions because of the logic followed by the Court in granting the taxpayer the advantages of the Denmark-US double treaty for the dividends that were proven to be redistributed to the US.

Countless cases about these old structures are waiting before the domestic courts, including in Denmark. In reality, many of these old structures are from a different time, where the global and EU tax policy was immensely more in favor of the taxpayer. Now, they are stuck in a new global tax environment where the OECD and EU initiatives have significantly changed the game.

Even though these structures are a thing of the past in many ways, the amounts involved in clearing them up are astronomical. In addition, when these structures were put in place back in the day, global tax policy was just beginning to change, and in reality, no one could have foreseen where we would end up today.

Some of the old, aggressive structures were undoubtedly put in place to adapt and continue to avoid taxes, and some have been implemented as safe bets because no one really knew how to navigate the new waters for certain. According to the High Court, the TDC structure falls in the first category, and the NetApp, for the most part, falls in the second.

The rulings are significant for practitioners because they emphasize the immense importance of actually sticking to the business plan in terms of declaring dividends and the equal importance of actually documenting what is being done.

Finally, the rulings contribute to a very hands-on dilemma about what to do when interposed entities are deemed to be conduits and disregarded.

Essentially, the High Court states that if intermediaries are disregarded, it is necessary to look beyond them and determine if a beneficial owner may be proven to exist above them. If that is the case, the intermediary mess of holding companies interposed is to be disregarded, and the benefits that would have been granted in a direct distribution around this mess are still to be had.

Dear Susi,

My name is Boris Bruk and I am Of Counsel working with the tax team of Dentons Moscow. It was my pleasure reading your article. The BO topic is currently very hot in Russia, we have more than 30 published cases on the issue. I would like to draft an alert in the Russian language on the Danish case for our clients and for the tax professionals. Is it possible to get the decision of the court in the English or in the Danish language? Would very much appreciate if you could provide me with the appropriate link.

Sincerely yours, Boris Bruk

Hi Boris,

I have made my own translation of the rulings and the reasonings of the High Court. The translation is available on my LinkedIn in one of my most recent posts here : https://www.linkedin.com/in/susi-baerentzen-4600326/ Please feel free to send me a LinkedIn message if you have any questions.

All the best,

Susi

Dear Ms. Susi,

This article is very clarifying.

I wonder whether Danish Supreme Court has already granted its decision referred to interest cases, following the guidelines set up by the European Court of Justice.

Kind regards,

Dear Ms Susi,

This article is immensely clarifying.

I’d like to know whether Danish Supreme Court has already granted its decision referring to interest cases, following the guidelines set up by the European Court of Justice.

Kind regards,