By Susi Baerentzen, Ph.D., Carlsberg Foundation Postdoctoral Fellow, Amsterdam

On June 3, the Danish parliament finally passed a bill to adopt the changes to the controlled foreign corporation (CFC) regime necessary for the implementation of the EU Anti-Tax Avoidance Directive (ATAD). The proposal is quite the compromise, as it is highly complex and essentially expands what constitutes Danish CFC income compared to previous proposals.

Background – The long way round

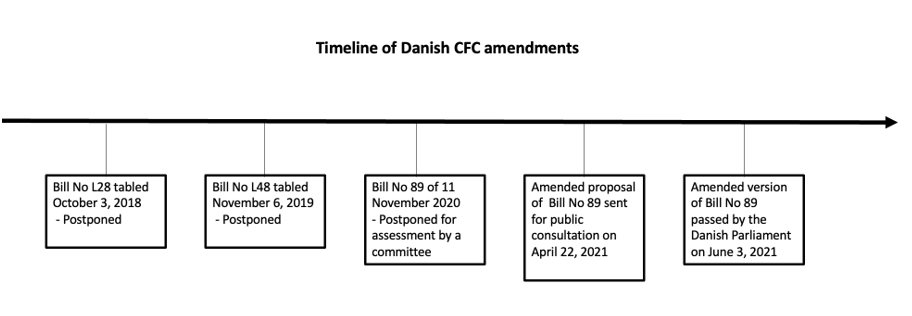

Traditionally, Denmark tends to be first in class when it comes to anti-tax avoidance measures, but it was not until June 3 that the Danish Parliament passed the final bill to implement the final CFC changes to comply with the EU Anti-Tax Avoidance Directive. The amendments have been a long way coming after they were initially tabled for the first time in October 2018 and subsequently in November 2019.

The proposal has changed shape underway due to massive pressure from industry, academia, and large Danish multinationals. The amendments should have been implemented no later than January 1, 2019, so they are way overdue. Even so, they apply to income years that commence on July 1, 2021, or later.

In April 2021, the amended proposal was sent for public consultation following harsh criticism from industry that the initial proposals would result in disproportionately high Danish CFC taxation compared to other EU member states, and that it might not be in accordance with EU law. Essentially, this proposal is quite the compromise to satisfy industry and at the same time maintain a hardline in the Danish CFC regime, which is still criticized for being contrary to EU law.

The new rules in a nutshell

The fundamental mechanism in the Danish CFC rules remains the same and ensures that a Danish parent company is taxed on income earned in a foreign subsidiary. The objective remains the same as well, as the rules are intended to prevent financial income from being shifted to foreign subsidiaries away from the Danish parent company. Simultaneously, the rules must comply with EU law and specifically with the fundamental freedoms. The question is whether this is still achieved following the amendments.

Subsidiaries qualifying as CFCs

The bill introduces a new definition of a parent company. Under the new definition, for a Danish company to be obligated to include the total taxable income of its foreign subsidiary in its taxable income, two criteria apply. First, the Danish company, together with other group member companies, must directly or indirectly own more than 50% of the capital or control more than 50% of the voting rights or be entitled to more than 50% of the profit. Second, the CFC income of the subsidiary must make up more than one-third of the total income.

Under the previous rules, a Danish parent company was obligated to include a subsidiary’s total taxable income in its taxable income if the subsidiary’s CFC income exceeded more than 50% of its total taxable income, and if the value of the subsidiary’s financial assets exceeded more than 10% of the value of the company’s total assets.

Exemption for financial service companies and general selections

The previous rules included an exemption for financial service companies, according to which subsidiaries licensed to engage in insurance, brokerage, mortgage, investment management or banking activities could obtain permission to be exempt from Danish CFC rules for up to 10 years, subject to a number of conditions.

The Anti-Tax Avoidance Directive provides for the possibility to exempt financial service companies by way of an objective test, meaning that these financial service subsidiaries will only be subject to CFC taxation if more than one-third of the CFC income derives from transactions carried out with the parent company or affiliated corporations. Denmark has made use of this possibility, and therefore the previous rules have been replaced with the objective test for financial service companies, as defined in article 2(5) of the Anti-Tax Avoidance Directive.

Finally, the Danish parent company can now elect only to include the CFC income of the subsidiary rather than its entire income. This election must be made no later than at the time of the tax return for the first income year in which the parent company is subject to CFC taxation. This election is binding for a period of five years and applies to all subsidiaries, if chosen.

Income qualifying as CFC income and other income from intangible assets

The amendments to the Danish CFC regime also entail an expansion of what is to be considered CFC income. Previously, this was limited to financial income, royalties, and gains from disposal of intangible assets. However, the new definition also includes income from invoicing companies and other income from intangible assets, including so-called embedded royalties.

Essentially, this means that there is a greater risk of CFC taxation under the new rules, and the embedded royalties category especially can cause issues for taxpayers.

According to the Anti-Tax Avoidance Directive, it is a requirement that income from invoicing companies be included in the CFC income, and it is likely that income from these companies is already covered by the existing transfer pricing rules. In short, the rule merely pertains to companies that derive their income from the sale and provision of goods and services that are purchased and sold by affiliated persons that contribute little or no economic value.

Other income comprises the part of income from disposal of goods and services that relates to the royalty gain from an intangible asset, when considered from an economic perspective. The intangible assets in question can be patents, know-how, and trademarks, but not goodwill according to the Danish tax legislation. Disentangling the embedded royalties from the rest of the income related to intangible assets will presumably be a difficult task to perform in practice, and one that will be subject to great uncertainty.

To quote Karl Berlin, Vice President, Head of Tax at Ørsted, one of Denmark’s largest MNEs: “The new rules are of a very broad nature, and it is a novelty that embedded royalties are now included in the CFC taxation. It is not yet known what it is exactly, and it not very clearly defined in the proposal.”

Even though gains and losses on the disposal of intangible assets were already included in the CFC income under the previous rules, the separation of the embedded royalties will require the use of transfer pricing principles. Not much guidance is provided, as the preparatory work merely refers to section 4.2. of the OECD BEPS Action 3 final report on how to determine other income form intangible assets. Further reference is made to the transfer pricing guidelines, chapter II, point 2.152-2.153 and the annex for chapter 2 with an example to illustrate the application of the residual profit split method.

The great compromise – a partial substance test

The new Danish CFC rules introduce an interesting cross between an EU law substance test and an assessment of the activities of the foreign subsidiary, which is presumably a unique Danish specimen not found in other EU member states: a partial substance test.

The Anti-Tax Avoidance Directive permits member states to implement a substance carve-out to limit the impact of the CFC rules in cases where the foreign subsidiary does not carry on a substantive economic activity. It is directly stated in the directive that the income categories should be combined with such a carve-out to comply with the fundamental freedoms of the EU.

Against this background, it is no surprise that the Achilles heel in implementing the directive changes to the Danish CFC regime has been the reluctance from the Danish government in introducing a substance test to make it possible to avoid CFC taxation when the foreign subsidiary carries out substantive economic activity.

This reluctance resulted in a severe backlash from industry in the public consultation rounds right from the beginning in 2018, so much so that a public hearing was established at the Danish Parliament on January 15, 2020. During this public debate, representatives from three of the largest Danish MNEs, Danish industry, the European Commission, and academia thrashed out the challenges in implementing the changes to the Danish CFC regime.

According to the industry representatives, the lack of a substance test could prove detrimental to Danish corporations, because as Karl Berlin put it: “We can handle a substance test, but we simply cannot handle the lack of one. This will create a great uncertainty accompanied by a great risk.”

A lot of the debate revolved around the lack of a substance carve-out, and it would appear that it was at least somewhat effective, as the amended proposal from April 21 did indeed include the partial substance test.

On the face of it, this is good news for any Danish group with subsidiaries with valuable intellectual property, as the new partial substance carve-out makes it possible to avoid CFC taxation from embedded royalties if the subsidiary conducts “a substantial economic activity in relation to the intellectual property, which is supported by personnel, equipment, assets and premises.”

However, as eluded by the “partial” description, there is a catch as the carve out does not apply if the subsidiary manages the ownership and potential sales and distribution functions in relation to the intellectual property, while the other functions relating to the assets are carried out in an insignificant way or are carried out in the country where the subsidiary is resident. The carve out also does not apply if the subsidiary is resident in a country which does not exchange information with Denmark, unless the income derives from intellectual property, which is for the main part the result of research and development conducted by the subsidiary itself or by a related entity resident in the same country.

Furthermore, a few formal requirements must be met for the partial substance test to apply. Namely, the parent company must elect to apply the substance test no later than at the time of the tax return, and it must file special CFC documentation for the tax authorities no later than 60 days after the deadline for the tax return.

Initially, it is positive to see that the Danish substance test is not limited to subsidiaries in other EU member states but is defined according to the countries with which Denmark has concluded an agreement on exchange of information.

This is also in line with the European Court of Justice’s ruling in case C- 135/17 X GmbH, in which the court addressed the compatibility of the German CFC rules with EU law in relation to the free movement of capital and third states. The outcome here was that limitations to the free movement could not be justified in terms of third states if a double tax treaty was concluded and if it included a clause on exchange of information.

Outlook and things to watch out for

Fundamentally, Denmark has chosen a unique CFC approach compared to the rest of the EU member states, which will inevitably result in some disadvantages.

One of the main challenges will be for corporations to assess whether a subsidiary has the necessary amount of both physical and economic substance. Reference is made to the EU abuse assessment in the preparatory work, and simultaneously it is mentioned that the full extent of the notion of abuse in EU law is not yet known. In other words, a great amount of uncertainty is to be expected in this area, and concerns have been raised about the interplay between the new CFC rules and the existing anti-abuse provisions and the need to assess both the physical and the economic substance.

Questions have been raised in this regard specifically in relation to the ownership of the intellectual property and where this is placed. The preparatory work specifies that a structure does not generally equate an abusive situation merely because the ownership of the intellectual property and the management of the crucial functions relating to it have been split between different corporations. This assessment still mandates an in-depth understanding of the business activities of the group and the structures that support it.

Another challenge for corporations is to manage the administrative burdens from the CFC documentation to substantiate that they meet the requirements. It has been argued that it should be clear from the existing transfer pricing master files and country-by-country reports that the companies fulfill the substance requirements.

In the preparatory work, the Danish Ministry of Taxation has stated that it is supposed to be easy for corporations to estimate whether they fall under the partial substance test. However, no specific guideline is given at this point. Instead, the Danish tax agency has been authorized to further establish the necessary documentation requirements at a later stage. The Ministry has indicated that it will endeavor to provide for the existing documentation to be recycled for the CFC documentation, but for now nothing is certain. One positive point is that the deadline for submitting the CFC documentation has been aligned with the deadline for filing the transfer pricing documentation in the final bill.

Time will tell how the new CFC rules will fare, but the innovative partial substance test is likely to result in a lot of uncertainty and, consequently, litigation. While it is generally positive that the politicians have listened and introduced a carve out for other income from intellectual property, the question remains whether this constitutes a substance carve out as mandated by “Model A” of the Anti-Tax Avoidance Directive article 7(2)(a). This provides for a general exemption where the CFC carries on a substantive economic activity supported by staff, equipment, assets, and premises, as evidenced by relevant facts and circumstances.

While the partial substance test may very well codify this carve out with regard to other income from intellectual property, it does not form a general exemption to ensure that the Danish CFC rules are in accordance with the fundamental freedoms of the EU. Going forward, it will be interesting to see how this develops, so stay tuned for updates.

Be the first to comment