By Susi Baerentzen, Ph.D., Carlsberg Foundation Postdoctoral Fellow, Amsterdam

On November 25, the High Court of Eastern Denmark ruled in two of the famous beneficial ownership cases. Part of a group of six such cases, these two domestic rulings are on interest – the NTC Parent S.a.r.l. case, known as C-115/16 N Luxembourg 1, and the Takeda (Nycomed) case, known as C-118/16 X Denmark A/S.

Two of the other six cases are on dividends, and the High Court issued rulings on those cases on May 3. The two remaining cases are on interest as well (C-119/16 C Danmark 1 and C-299/16 Z Denmark ApS), and these rulings are expected in spring 2022. Finally, one “extra” beneficial ownership case on interest will be handed down from the High Court around the same time – case C-682/16 from the Court of Justice of the European Union (CJEU). This case was also submitted to the CJEU for a preliminary ruling, which never came since the case was put on hold, pending the decisions in the other six cases.

The CJEU made the cases world-famous when they delivered their preliminary rulings on February 26, 2019, and stated once and for all that a general principle on prohibition of abuse exists in EU law and that beneficial ownership is not just a notion to be taken into consideration in international tax law, but also in EU tax law. In addition, the Court provided six indications for what would be considered as abuse of EU law:

(1) if the group structure is put in place to obtain a tax advantage,

(2) that all or almost all of the dividends or interest are passed on by the company that has received it to entities that do not fulfill the conditions for the application of the Interest and Royalties Directive and the Parent-Subsidiary Directive,

(3) if the interposed holding company has an insignificant income due to the redistribution of the dividends or interest,

(4) if the sole activity of the holding company is to redistribute the dividends or interest based on the lack of management, balance sheets, expenses, employees, and office facilities,

(5) if the contractual obligations (both legal and actual) render the holding company unable to enjoy and use the dividend or interest,

(6) if there is a close connection between the establishment of complex financial transactions and structures and new tax legislation.

The consequences of these rulings cannot be understated, and since they came in 2019, the indications for abuse have been applied in similar cases before domestic courts all over Europe.

The background in a nutshell

The cases arose from Denmark changing its tax policy in the early 2000s. Before that, the clear policy had been to attract holding companies by not levying withholding taxes on payments of interest and dividends. That changed in 2001 following a critique from the EU that it was unfair competition, and Denmark reintroduced the withholding taxes. For interest, this happened in 2004 with an adjustment in 2006 that broadened the definition of intra-group debt.

The problem hereafter was whether there was actually a domestic legal basis for denying the benefits according to the Parent-Subsidiary Directive or the Interest and Royalties Directive, i.e., the exemption of withholding taxes on intra-group payments of dividends or interest within the EU.

The Ministry of Taxation claimed that the parent companies were not the “beneficial owners” of the received interest or dividends and that the “beneficial owners” are residents of states outside of the EU, with whom Denmark has not concluded a double tax treaty. The result being that the directive benefits should have been denied and tax at source withheld.

The issue was that Denmark had not transposed the anti-abuse provisions in the Parent-Subsidiary Directive or the Interest and Royalties Directive into domestic legislation by a statutory provision. There may or may not have been a non-statutory case law-based provision, but essentially the Ministry clung to the notion of “beneficial ownership” even though only the Interest and Royalties Directive mentions this requirement and even though it is not a notion described in Danish law.

In the end, this domestic legal discussion was somewhat obsolete as the preliminary rulings from the CJEU meant that EU member states can rely on the general EU principle on prohibition of abuse irrespective of whether any domestic anti-abuse provisions had been transposed. This was of course before the EU Anti-Tax Avoidance Directive introduced a mandatory general anti-avoidance rule, before the most recent amendments to the Parent-Subsidiary Directive making the anti-abuse provisions mandatory and before the OECD base erosion and profit shifting (BEPS) project requiring states to implement some form of a principal purposes test or limitation of benefits in their double tax treaties.

The NTC Parent S.a.r.l. v. The Ministry of Taxation case – C-115/16

The case concerns a leveraged buyout of TDC A/S, which is a Danish telephone company. The acquisition was done by five private equity funds resident in third countries by incorporation of several companies in Luxembourg and Denmark. The acquisition was financed in part by a special type of convertible loan granted by the private equity funds directly to Nordic Telephone Company Investment ApS. The company used the money to acquire approximately 80% of the share capital of TDC A/S.

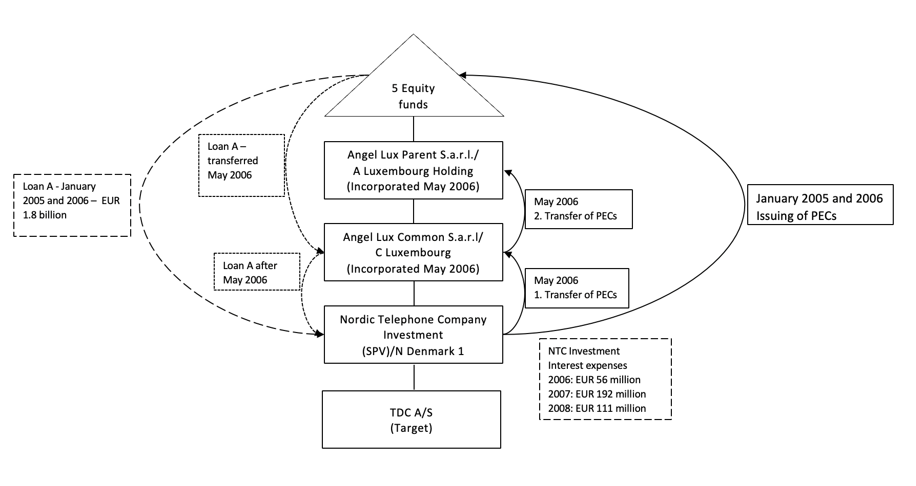

After the restructuring, the group can be illustrated like this (simplified):

In December 2005 and January 2006, the five private equity funds provided loans in total of EUR 1.8 billion to Nordic Telephone Company Investment ApS. In return for the loans, so-called “preferred equity certificates” were issued. It is undisputed that the amendments to the legislation in 2006 – in unaltered circumstances – would have resulted in the interest on these loans being taxable according to Danish domestic legislation. In this regard, it is undisputed that none of the private equity funds were corporations that could apply Directive 2003/49/EC (Interest and Royalties Directive) or a double tax treaty entered into with Denmark.

However, a few days before the amendments entered into effect, a number of reorganizations took place, which involved that the company Angel Lux Common S.a.r.l., which was also incorporated a few days before the amendments entered into effect, was the new creditor of the abovementioned loans from the private equity funds to Nordic Telephone Company Investment ApS.

The heart of the matter is whether the company Angel Lux Common S.a.r.l., which is resident in Luxembourg, can claim the tax exemption according to the Danish domestic provisions, according to which the limited tax liability does not comprise interest, provided that the taxation must be lowered or waived according to the Interest and Royalties Directive or a double tax treaty.

Through a series of transfers in 2006, new debt relations were created between the private equity funds and Angel Lux Parent S.a.r.l. and between Angel Lux Parent S.a.r.l. and Angel Lux Common S.a.r.l., respectively, with the same principal of the loan and with virtually the same interest rate. Preferred equity certificates from Angel Lux Parent S.a.r.l. to the private equity funds and from Angel Lux Common S.a.r.l. to Angel Lux Parent S.a.r.l. were issued for the debt. The majority of the interest was attributed to the principal of the loan for the individual debts, whereas a minor part of the interest was effectively paid back.

During the period 6 October to 10 November 2006, Nordic Telephone Company Investment ApS paid interest in the amount of EUR 56 million (equivalent to DKK 416 million) and paid down the principal of the loan with EUR 39 million (equivalent to approximately DKK 294 million), in total EUR 95 million (approximately DKK 710 million). Of the total amount of EUR 95 million, interest and instalments in the amount of EUR 0.6 million were paid to Angel Lux Common S.a.r.l, and EUR 0.4 million were paid to Angel Lux Parent S.a.r.l., while all other payments were made directly to the private equity funds. Following these payments, the debt between all the companies – i.e., between Nordic Telephone Company Investment ApS and Angel Lux Common S.a.r.l., between Angel Lux Common S.a.r.l. and Angel Lux Parent S.a.r.l., and between Angel Lux Parent S.a.r.l. and the private equity funds – was reduced with an amount almost equivalent to EUR 39 million.

For the income years 2007 and 2008, it is stated that Nordic Telephone Company Investment ApS has deducted interest expenses for tax purposes in the amount of EUR 192 million (equivalent to DKK 1.4 billion) and EUR 111 million (equivalent to DKK 825 million). The interest paid to Angel Lux Common S.a.r.l. comprise EUR 0.5 million in 2007 and EUR 2.9 million in 2008, respectively, of the abovementioned amount, while the remaining amount is accrued interest. Equivalent amounts have been booked as interest income for both years for both Angel Lux Common S.a.r.l. and Angel Lux Parent S.a.r.l., just like both companies have expensed interest of a similar size for both years. The outstanding debt of Nordic Telephone Company Investment ApS and the accrued interest were converted into additional share capital for Angel Lux Common S.a.r.l. in Nordic Telephone Company Investment ApS on 10 July 2008.

Ruling from the High Court in the NTC Parent S.a.r.l. case

Initially, the High Court notes that the interposed Luxembourg entities did not carry out any activity significant for the administration of the debts based on the accounting information. The court further noted that the companies did not own any assets and that they did not receive much income. As Nordic Telephone Company Investment ApS was initially directly indebted to the private equity funds in question, the Court found that the interposition of the two Luxembourg companies and the subsequent dispositions relating to the debts, by and large, must be considered as one whole and as a preordained arrangement. Subsequently, the court concludes that the main purpose of the arrangement was to obtain a tax benefit for the interest, which would have been subject to tax without this arrangement.

Since the two Luxembourg entities shared the same board of directors as the other companies involved, and since the consortium agreements contained specifically determined principles for the arrangement and the decision-making power, the two entities had no real right to dispose of the interest income.

Finally, the court concludes that the two Luxembourg entities were conduit companies and that, consequently, the arrangements constitute an abuse of law. Subsequently, the court finds that the Luxembourg entities cannot be regarded as the beneficial owners of the interest, meaning that they cannot claim the exemption according to the Interest and Royalties Directive or the Denmark-Luxembourg double tax treaty.

The court adds that the fact that the main part of the interest was not paid continuously, but added to the principal of the loan, cannot change this outcome since the tax implication occurred already in relation to the accrual/ bookkeeping.

Likewise, the court dismisses the claim from the taxpayer that the underlying investors of the private equity funds can be regarded as the beneficial owners as no documentation is found to substantiate what has happened with the financial flow after it ended up in the funds.

The Nycomed/Takeda case – C-118/16 X Denmark A/S

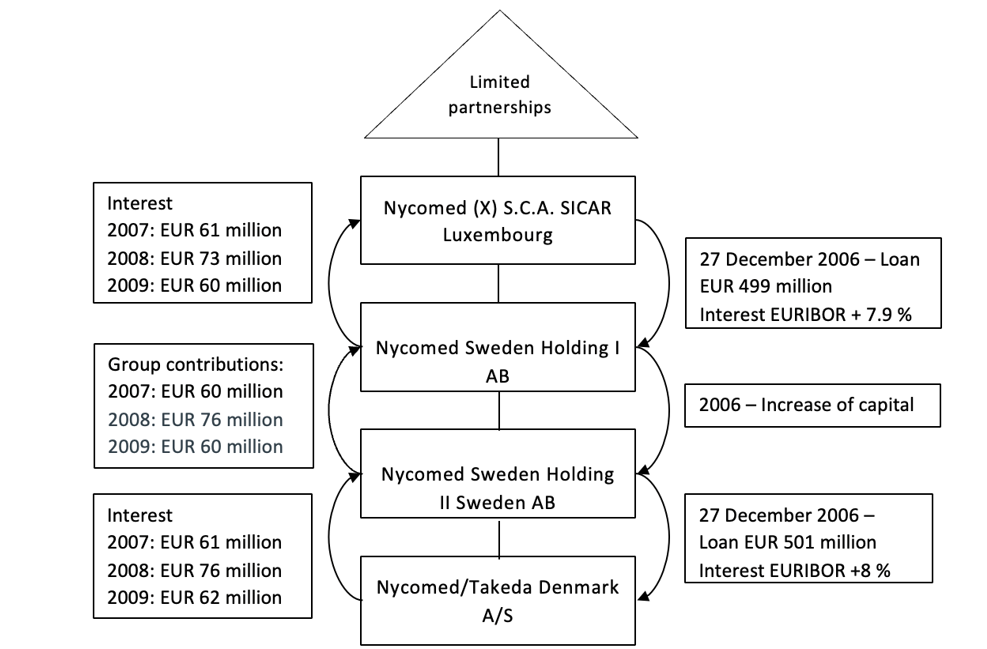

The Nycomed group (later Takeda) is a global pharma multinational, which was acquired by a consortium of private equity funds in 2005. To facilitate the acquisition, external loans of EUR 400 million were established, and in 2006 this debt was refinanced by establishing a new group structure which looked like this (simplified):

In the income years 2007-2009, all the shares in Nycomed Denmark A/S were owned by Nycomed Sweden Holding II AB, resident in Sweden. The shares in Nycomed Sweden Holding II AB were 97.5% owned by Nycomed Sweden Holding I AB, while the remaining 2.5% were owned by the management of the company.

On 27 December 2006, Nycomed Denmark A/S borrowed EUR 501 million from its parent company Nycomed Sweden Holding II AB. It is stated that the loan was financed by an increase of capital from Nycomed Sweden Holding 1 AB to Nycomed Sweden Holding 2 AB. The interest was fixed at EURIBOR + 8 percentage points. The loan was used to pay another loan granted to finance the acquisition of the group in 2005.

On the same day, Nycomed Sweden Holding 1 AB borrowed a corresponding amount (EUR 499 million) from Nycomed S.C.A. SICAR. The interest, at EURIBOR + 7.9 percentage points, was almost identical. Both loans had similar conditions as the accrued interest was added to the principal amount and none of the debtors were obligated to make down payments.

Interest accrued on the loan between Nycomed Denmark and Nycomed Sweden Holding 2 AB in the amount of EUR 61 million in 2007, EUR 76 million in 2008, and EUR 62 million in 2009. During those same years, Nycomed Sweden Holding II AB made group contributions to X Sweden Holding in an amount almost corresponding to the sum of EUR 60 million, EUR 76 million and EUR 60 million. Finally, interest accrued on the loan between Nycomed Sweden Holding I and Nycomed S.C.A. SICAR of EUR 61 million, EUR 73 million, and EUR 60 million, respectively.

Ruling from the High Court in the Nycomed/Takeda case

Essentially, the court finds that the interest in question remains within the borders of the EU since the beneficial owner is established as Nycomed S.C.A., SICAR.

The High Court initially states that several transactions must be considered as one whole and preordained arrangement: the loan between Nycomed A/S and Nycomed Sweden Holding 2 AB, the simultaneous loan between Nycomed Sweden Holding 1 AB and Nycomed S.C.A., SICAR, the increase of capital in Nycomed Sweden Holding 2 AB, and the annual approval of group contributions from Sweden Holding 2 AB to Nycomed Sweden Holding 1 AB.

The taxpayer has directly stated in their list of claims that the purpose of the specific structure was “to ‘optimize’ the effective tax rate of the Nycomed group by Nycomed A/S obtaining a deduction for the interest on the debt to Nycomed Sweden Holding 2 AB without having to pay taxes on the interest anywhere else.”

This leads the court to conclude that the interposition of the two Swedish companies in the arrangement – instead of Nycomed S.C.A., SICAR providing the loan directly to Nycomed A/S – did not have any commercial reasons other than potentially obtaining a tax benefit.

Neither Nycomed Sweden Holding 2 AB nor Nycomed Sweden Holding 1 AB had any real rights to dispose of the interest accrued or the group contributions, which flowed on to Nycomed S.C.A., SICAR in accordance with the arrangement. Consequently, the overall assessment of the circumstances leads the court to establish that none of the two interposed Swedish corporations may be considered the beneficial owner of the interest, neither according to Article 1(1) of the Interest and Royalties Directive nor according to Article 11(1) of the Nordic double tax treaty.

Interestingly, the court points out that the fact that the interest and group contributions were not effectively distributed up the group chain before the sale of Nycomed in 2011 is considered insignificant, given that the tax implication occurred already in relation to the accrual/bookkeeping in 2007, 2008 and 2009, respectively.

Just like for the NTC Parent case, the court adds that the investors of the private equity funds cannot be considered the beneficial owners of the interest either, and emphasis is made on the fact that no information to support a direct correlation between the accrual of interest at Nycomed, S.C.A., SICAR, and the distribution through reduction of capital, etc., from this company to the private equity fund consortium, which would result in Nycomed S.C.A., SICAR being a conduit company in this specific context.

Subsequently, the court examines whether Takeda A/S can claim that Nycomed S.C.A., SICAR is covered by the double tax treaty between Denmark and Luxembourg as a basis for tax exemption, as the company is exempted from taxation in Luxembourg and therefore cannot claim the benefits of the Interest and Royalties Directive. Interestingly, with regard to the double tax treaty with Luxembourg, the court finds that Nycomed S.C.A., SICAR is covered by the final protocol of the treaty, meaning that the company is liable for tax on the interest according to Danish domestic tax legislation.

Conclusively, the court finds that Nycomed S.C.A., SICAR is the beneficial owner of the interest, that the company is not entitled to benefits according to the Interest and Royalties Directive or the double tax treaty between Denmark and Luxembourg, and therefore the company is liable for tax on the interest according to Danish domestic tax legislation.

Takeaway from the High Court rulings

Since the High Court ruled in the dividend cases in May 2021, those rulings have already been submitted to the Supreme Court, and due to the very large potential taxable amounts involved, it is likely that the NTC Parent case and the Nycomed/Takeda will continue to the Supreme Court as well. These final rulings are expected by the end of 2022/beginning of 2023.

Compared to the dividend rulings from May, the current interest rulings provide additional interpretative aid on the implications of the indications of abusive structures provided by the CJEU in their preliminary rulings.

In both the NTC Parent case and the Nycomed/Takeda case, the High Court examines whether the interposition of the holding companies was in fact indifferent to all business reasons safe for tax reasons, and in doing so, the court assesses what difference the interposition made. In the Nycomed/Takeda case, the taxpayer had originally argued that certain transfers were commercially justified because they were intended to provide a more efficient group structure. Against this, the Ministry of Taxation had argued that in fact, the transfers did the exact opposite, as they led to additional bureaucracy, as the transfers necessitated the conclusion of two continuous agreements between the companies. The importance of the transferred group function was negligible and therefore it was considered as “window dressing”, rendering the interposed holding company an indifferent intermediary.

From a practical point of view, it is interesting to note that in relation to the assessment of the interposed Swedish holding companies as beneficial owners of the interest in the Nycomed/Takeda structure, the court emphasizes that it is insignificant that the redistributions were not effectively carried out before the sale of Nycomed in 2011. Here, the court downplays the correlation in time of the actual redistribution and instead focuses on the fact that the tax implications occurred already in relation to the accrual/bookkeeping in 2007, 2008, and 2009, respectively.

Furthermore, the court highlights another argument put forward by the Ministry of Taxation in the Nycomed/Takeda case in relation to the insignificant income earned by the interposed entities. In this regard, the Ministry had previously argued that none of the holding companies incorporated during the restructuring were expected to generate any future business activity other than the holding activity and therefore they were not expected to generate any future income. Essentially, the heavy loan structures established, therefore, require the interposed entities to receive group contributions to fulfill their debt obligations. The court reaffirms this in stating that the interposed entities are so highly leveraged that it creates a co-dependent relation to the parent company that they are not likely to be able to freely determine the use of the interest received.

Ultimately, it is interesting that even though the court finds that the Luxembourg entity is the beneficial owner, and therefore the interest remains within the European Union, no tax exemption is granted because of the way the court interprets the Denmark-Luxembourg double tax treaty.

An interesting aspect of the NTC Parent case is the emphasis the High Court places on the strict requirements for the taxpayer’s evidence to substantiate that the purpose of the arrangement was not to abuse the Interest and Royalties Directive or the Denmark-Luxembourg double tax treaty after all. It is noted that no documentation is found that substantiates what has happened to the financial flow after it ended up in the private equity funds, and therefore it has not been substantiated that the underlying investors in the five private equity funds must be regarded as the beneficial owners of the interest.

This aspect about the documentation of the financial flows contrasts with the High Court ruling in the NetApp dividend case from May 2021, in which the court found that the taxpayer had substantiated that part of the dividend flows did in fact end up in the US global ultimate parent company. Perhaps the main difference, in that case, was the fact that the dividend could have been distributed directly to this US ultimate parent company without any withholding tax due to the Denmark-US double tax treaty. In other words, it was not merely a question about the documentation being sufficient, but also a question about the objective element of the abuse analysis not being fulfilled as, objectively speaking, another tax-exempt distribution route could have been chosen, and, therefore, there was no advantage.

Be the first to comment