By Elisa Kaminsky, Transfer Pricing Manager, BaseFirma, Miami

The US tax court on May 5 issued its written opinion in Whirlpool’s tax dispute with the IRS, ruling against the home appliance company and increasing its taxable income for 2009 by almost USD 50 million.

Background

During 2009, the year under examination, Whirlpool Financial Corporation acted as a manufacturer and distributor of household appliances. Whirlpool’s Luxembourg subsidiary acted as the nominal manufacturer of appliances, using a Mexican maquiladora structure with tax and trade incentives.

The Luxembourg entity sold the finished products to Whirlpool Financial Corporation and the Mexican controlled foreign corporation (CFC) for distribution in their respective markets.

During 2007-2009, Whirlpool restructured its Mexican manufacturing operations, apparently driven by tax considerations.

The restructuring

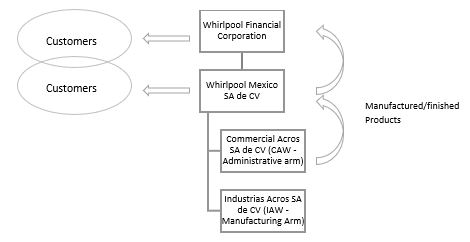

The group’s organizational structure prior to 2007 is shown in the below figure:

Whirlpool’s Mexico subsidiary, IAW, performed manufacturing activities and then sold the finished products to Whirlpool Mexico, which in turn sold the products to Whirlpool Financial Corporation and unrelated distributors.

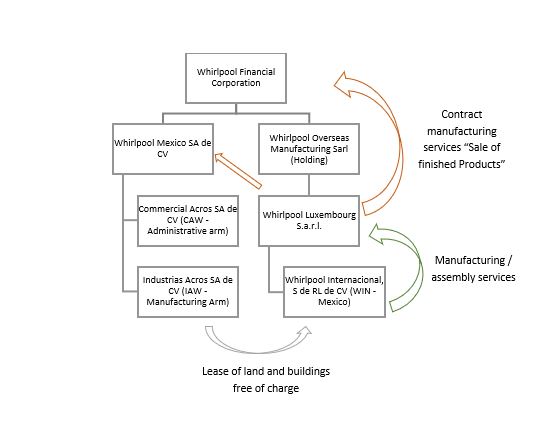

In 2009, Whirlpool organized a new CFC in Luxembourg, which nominally took over the manufacturing operations performed by the Mexican entity. The group’s reorganization is shown below:

Notice WIN-Mexico is treated as a disregarded entity with no employees.

In summary, after the restructuring in 2009, Whirlpool Luxembourg Sarl owned the machinery and equipment used in the manufacturing process and held title to the related raw materials and inventory. After the manufacturing process concluded, Whirlpool Luxembourg Sarl would transfer title and risk of loss to Whirlpool Financial Corporation and Whirlpool Mexico SA de CV.

Whirlpool Luxembourg Sarl, having no employees of its own (other than a half-time administrative employee), contracted with WIN to supply the necessary manufacturing services. WIN, having no employees or manufacturing plant of its own, leased the factory plants from IAW and arranged to have IAW’s and have employees of another Mexico sub-subsidiary, CAW, seconded or subcontracted to it.

Mexican maquiladoras

Mexico maintains a maquiladora regime to incentivize foreign principals to set up manufacturing operations in Mexico.

Under Mexican customs rules, a Mexican maquiladora must perform the manufacturing activity; its foreign principal must retain title to the raw materials, parts, and inventory during the manufacturing process, then take title to and sell the finished goods. The same structure maintained within the Whirlpool group during 2009.

In 2009, maquiladora companies were subject to a 17% tax rate rather than a 28% rate. By locating its manufacturing operations in Mexico, the foreign principal would ordinarily be considered to have a permanent establishment in Mexico (and thereby be subject to the 28% tax rate). However, if the maquiladora meets certain transfer pricing rules, its foreign principal is considered to have no permanent establishment in Mexico and is thus exempt from Mexican income tax.

On Luxembourg’s side, the income earned by a Luxembourg company that is deemed to have a permanent establishment in Mexico is exempt from Luxembourg tax, as stated on the Mexico-Luxembourg tax treaty.

Whirlpool’s transfer pricing structure in Mexico

WIN qualified under the maquila regime. It thus paid Mexican tax at a 17% rate on the income it earned from its manufacturing services.

Correspondingly, Whirlpool Luxembourg Sarl took the position that it was a foreign principal with no permanent establishment in Mexico so that it was exempt from Mexican tax on the income it earned under its contract manufacturing services (i.e., the sale of finished products to Whirlpool Financial Corporation and Whirlpool Mexico SA de CV).

Whirlpool’s transfer pricing structure in Luxembourg

For Luxembourg tax purposes, Whirlpool Luxembourg Sarl took the position that it did have a permanent establishment in Mexico.

Whirlpool Luxembourg Sarl obtained a ruling from the tax authorities for the income earned on its contract manufacturing services, which were attributable to its Mexican permanent establishment.

Triple nontaxation

On its 2009 US tax return, Whirlpool Financial Corporation took the position that none of the income derived by Whirlpool Luxembourg Sarl on its sale of finished products was subject to tax under subpart F.

As such, the income Whirlpool Luxembourg Sarl earned on the sale of finished products to Whirlpool Financial Corporation and Whirlpool Mexico SA de CV is a case of triple nontaxation, eschewing income taxes in Mexico, Luxembourg, and the US.

Whirlpool’s arguments

To support its scheme, Whirlpool Financial Corporation argued that Luxembourg’s sales income did not constitute foreign base company sales income because the products sold were substantially transformed by the Mexican branch.

Whirlpool Financial Corporation also argued the Luxembourg entity derived sales income by selling the finished products and that WIN conducted no sales activities in connection with the products sold and only derived manufacturing income.

Foreign base company sales income

After extensive considerations, the IRS determined that whether or not the products sold by Whirlpool Luxembourg Sarl were actually manufactured by it, the income earned by Whirlpool Luxembourg Sarl constitutes foreign base company sales income and, as such, is subject to tax as subpart F income.

Foreign base company sales income is income derived from channeling sales of goods through a low-tax foreign entity that has no significant economic relation to the sales.

It also includes income a CFC earns through activities carried out through a branch or similar establishment in a different country that has substantially the same effect as if the branch were a wholly-owned subsidiary of the controlled entity, as it seems was the case in Luxembourg.

As such, the Tax Court verdict states the sales income attributable to activities conducted through Whirlpool Luxembourg’s Mexican branch should be treated as income earned by a wholly-owned subsidiary.

By carrying on its activities through a branch in Mexico, Whirlpool Luxembourg Sarl avoided taxation in that country. It thus achieved substantially the same effect (i.e., the deferral of tax on its sales income) that it would have achieved under US tax rules if its Mexican branch were a wholly-owned subsidiary of Whirlpool Luxembourg Sarl deriving such income.

The takeaway

The maquila regime is a popular structure used in many multinational corporations primarily located in the US.

The Whirlpool court case will set precedent on future transfer pricing examinations. This case also serves as an example of aggressive tax schemes multinational corporations should avoid.

The tax court decision is not consistent with the law and should be reversed. See in depth analysis in BNA article by Lowell D. Yoder published January 10, 2020.

Greetings Whirlpool Mexico, I’m trying to contact someone involved with the decision making for transportation from all of your Mexican plants. Please provide me with a name and contact number and I’ll contact them to discuss this matter with. Thanks David Valdez – Brock Transportation – 817-822-4294 – [email protected]