By Gaurav Jain & Priya Mani Bhutani

Agreements reached by nations in 2015 as a result of the OECD’s action plan to curb base erosion and profit shifting (BEPS) have changed the transfer pricing landscape.

On the one hand, BEPS action plans 8-10 emphasized the importance of aligning transfer pricing outcomes with value creation and, on the other, action plan13 globally aligned and unveiled high-level information about the global operations of multinational enterprises (MNEs) that met requisite thresholds.

Revenue authorities around the world, upon completion of the first phase of country-by-country reporting and master file compliance, received a bird’s eye view of the jurisdictional profit allocation among the group entities of a given MNE across which their supply chain was spread and identified potential risks emanating therefrom.

From the perspective of a taxpayer, what transpired was the necessity to conduct robust value chain planning across the group assuring that tax efficiency is in line with the principles laid down by BEPS action plans, i.e., aligning profits to the value creation. This article describes the workings of the continuous process industries, their supply chain, and potential areas of concern necessitating transfer pricing planning.

Continuous process industries

Continuous process industries are manufacturing setups that follow an uninterrupted exercise of manufacturing, production, or processing of materials. Oil refining, chemicals, fertilizers, pulp and paper, float glass, etc. are few of the industries under this category.

MNEs categorized as continuous process industries follow a supply chain that is driven by varying factors such as raw material quality, product yields, shelf life of raw materials. The supply chain followed in these industries focuses not just on movement of physical products, but continuous flow of strategic, tactical, and operational information.

Oil and gas industry transfer pricing

The oil and gas industry is not only sensitive to regulated price fluctuations but is also affected by the incessant evolution of technological improvement and techniques.

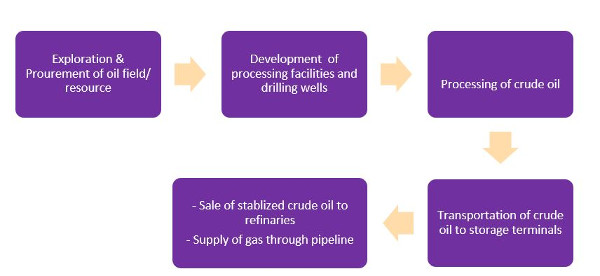

Typically, a company in this industry is driven by the following supply chain:

In an MNE, the above supply chain is decentralized and is laid out across jurisdictions. What becomes vital in such a set-up is that the allocation of profits amongst the contributors be in line with their value addition to the overall schema. Transfer pricing regulations require this to be at arm’s length.

In the oil and gas industry, two or more players vesting their funds in a single project enter into a production sharing contract (PSC). Their respective rights in the PSC are determined on the basis of their contribution, which could be in the form of the resources, engineering technology, funds, etc.

The legal ownership of the oil block/ resource customarily lies with the host government. Accordingly, the majority of the production yield in such arrangements is allocated to the resource owner which is usually a government-owned oil company.

Inter-party transactions among the PSC stakeholders are also guided by the terms and conditions of the binding PSC. However, when the parties are ‘related parties’ or ‘associated enterprises’, the arm’s length price of such transactions must be separately evaluated.

Some of the representative related party transactions under such arrangement include:

- Sale/purchase of resources such as hydrocarbon, refined products etc.

- Sale/purchase/leasing of drilling equipment and other assets

- Rendering of consultancy services in the nature of engineering or construction consultancy

- Management and administrative services

- Capital loans and performance guarantees

- Use of trademarks/technical know-how

Globally, oil and gas companies have yet to battle many transfer pricings cases in court. Even when such companies have been scrutinized, the litigated issues aren’t in relation to critical transactions such as services and tangible and intangible asset movement. These areas could be vulnerable to scrutiny, however.

Services and intangibles transactions

In line with the fundamentals of economics and business rationale, all services that are value-adding in nature or that provide benefits to the service recipient (such as availing technical consultancy services etc.) warrant a remuneration built with a profit mark-up. However, those services that are provided for mere administrative convenience (such as allocation of common operating costs) are pass-through in nature. Tax authorities may challenge the bucketing of such expenses under value-adding or non-value-adding classes given the uncertainty and subjectivity surrounding them.

Given the complexity of the above oil and gas supply chain, the creation of intangibles may be foursome i.e. the intangibles created in such processes may not just be hard-to-value but would also be owned collectively. Tax authorities may under these circumstances challenge the allocation of products and profits between related parties subject to their individual contribution towards the intangible. They may also challenge the economic ownership of the said intangible by one or more than one group entity.

Offshore marketing hubs, financing arrangements

Globally, specifically in Australia and Africa, there has been widespread litigation revolving around transfer pricing issues in the natural resource industry. This is because the availability of natural resources is concentrated in these jurisdictions and have matured overtime.

MNEs structure their supply chain to ensure that the commodity produced is delivered to the customer at the right form, in the right place, and at the right time. Therefore, marketing and logistics management may be concentrated within dedicated entities. Tax authorities may question the pricing and allocation of profit in such centralised operating models, irrespective of the commercial rationale behind such arrangements.

Further intercompany financing arrangements are common in MNEs due to commercial and operational reasons. However, such arrangements are required to be at arm’s length. Tax authorities may scrutinise the terms of the financing arrangements including the amount of loan, interest rates, currency, guarantees, etc.

Paper and pulp industry transfer pricing

Paper consumption worldwide is close to 400 million tonnes per year. Its widespread use from everyday necessity (newspaper, tissues, printing etc.) to luxury (handmade, silk coated etc.) varieties makes it an industry that never halts.

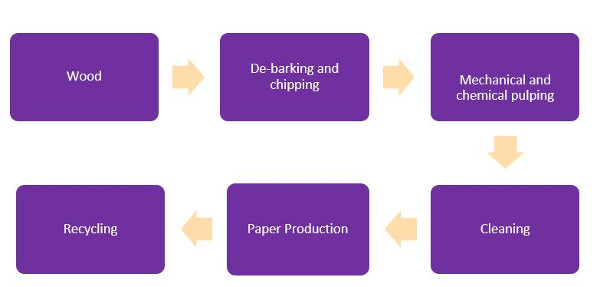

Typically, a company under this industry is driven by the below supply chain:

Paper manufacturing set-ups may not be spread across jurisdictions operationally; however, the following transactions are commonly undertaken between related parties:

- Sale/purchase of resources such as wood, pulp etc.

- Rendering of consultancy services in the nature of technical or process consultancy

- Use of trademarks/ technical know-how

- Location savings

Intangible transactions and location savings

Similar to the oil and gas industry, the paper and pulp industry is very niche and has not been critically scrutinized by tax authorities yet.

This is due to the reason that, though over the years both import and export of paper, paperboard, and newsprint have demonstrated an upward trend, its contribution to an economy’s gross domestic product hasn’t been very significant.

However, potential issues that may trigger litigation include intangible transactions and location savings.

Tax authorities may challenge the royalty rate, most appropriate method selected, and the corresponding arm’s length price determined. In the light of the current litigation trend where royalty/technical know-how pay outs are baptized to be tools of cash repatriation, stringent scrutiny may be predictable.

Relocation of manufacturing operations to low-cost jurisdictions yield cost savings to an enterprise such as labour costs and raw material costs, referred to as location savings. Tax authorities. in these cases, may challenge the quantification and allocation of such savings among related parties, attributing additional the profits from such savings to the parties based on their effective contribution etc.

The armour of transfer pricing planning

Many transfer pricing issues in the global showground have evolved and attained maturity over time with repeated rounds of litigation at various levels across administration.

Though they might not have attained finality, both taxpayers and revenue authorities have assimilated each other’s’ viewpoints. In related party transactions involving intragroup services, for example, the importance of robust documentation (including need benefit analysis) has been consciously realised and diligently maintained to avoid unwanted scrutiny.

Some of the major contributors to such an evolution are global referral points such as the BEPS actions plans, international committee reports (such as UN tax committee reports on international cooperation), and findings in international case law providing diverse perspective to a given issue.

Over the years, many guiding techniques have laid down fundamentals on which a robust policy framework can rest. The development, enhancement, maintenance, protection, and exploitation (DEMPE) analysis for transactions involving intangibles, the functional, asset, risk, and market (FARM) analysis to evaluate the persuasive value a market can have on a given inter-company transaction, and guidance on the application of profit split method, to name a few.

Although effective tax planning may not certainly mitigate the risk of litigation, it offers an effective tool to safeguard companies from the mundane litigation rounds over a never-ending span of time.

At present, probable issues highlighted in the continuous process industries haven’t been extensively litigated globally. However, taxpayers need to be aware of the benefits of the protective covering that effective tax planning can provide for their value chain to work in seamless unison.

A beautiful document for various stakeholders.

VKJAIN

B.E., M.B.A.

[email protected]