By Gaurav Jain, Chartered Accountant, and Priya Bhutani, New Delhi, India

India’s Central Board of Direct Taxes (CBDT) on September 24 extended the application of the existing transfer pricing safe harbour rules to financial year 2020-21. The extension comes as welcome news to corporations that are eligible for the rules, but certain stakeholders, such as small and medium enterprises, waiting for meaningful overhaul of the rules will have to keep waiting.

The transfer pricing safe harbour rules were introduced in India with effect from financial year 2013. The original scheme covered five consecutive years for eligible transactions. However, the initial scheme could not attract many applicants due to the steep price/margin prescribed by the CBDT for some of the most litigated transactions – namely software development, information technology enabled services and contract research & development.

To augment the acceptance of this dispute avoidance tool, the CBDT moderated the safe harbour rules in 2017. The new rules were applicable for a period of three consecutive financial years with effect from FY 2016-17 to FY 2019-20. A new eligible transaction in the nature of inbound low value-adding services was also introduced in this revised scheme.

Close to the expiration of the safe harbour window in FY 2020, corporations were hopeful for overhauled rules addressing their primary concerns from the earlier scheme. Some of these concerns were in relation to wider applicability of the rules by moderation of turnover limits prescribed earlier, coverage of permanent establishments and an alternate interest rate benchmark for the London inter-bank offered rate (LIBOR). However, the emergence of the global pandemic had shifted the Indian government’s focus to more grave areas for containing the effects of Covid-19 on the larger economy. As a result, CBDT extended the applicability of the safe harbour rules for another year until financial year-end 2021.

With the phasing out of the second wave of Covid-19 towards the end of June 2021, the industry pundits were once again optimistic for a renewed safe harbour framework specifically addressing the pandemic’s impact on small and medium enterprises. However, the CBDT, vide notification no. 117/2021/F. No. 370142/44/2021-TPL, only extended the applicability of the existing transfer pricing safe harbour rules to financial year 2020-21.

Safe harbour benefits

The value chain of every business in the pre- and post-covid era has been disrupted due to remote operations, loss of business, shift of value-adding functions from one geography to another, and other factors. As a result, the likelihood of increased litigation in the coming years has increased more than ever before. The Indian government has always endeavoured to advocate policies focused on reducing the litigation burden for taxpayers. Introduction of transfer pricing safe harbour rules were one such policy.

However, over time the efficacy of the scheme and intent with which safe harbour rules were introduced has faded. If adequately modified, this scheme can anchor the confidence of multinational corporations in the Indian market. For now, the revised rules are welcomed by taxpayers who can opt for this scheme and assure themselves of temporary relief from impending litigation exposure.

The expectation for the government to revise this scheme and make it worthwhile for the small and medium enterprises predominating the Indian economy continues.

Current safe harbour terms

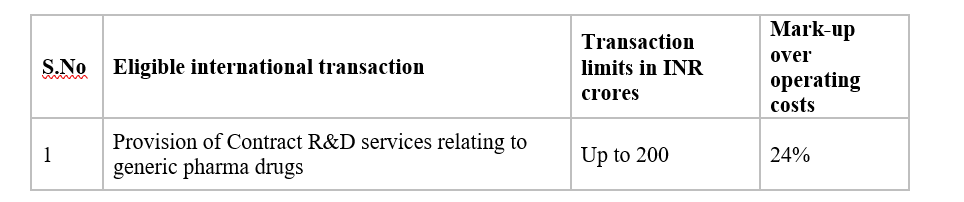

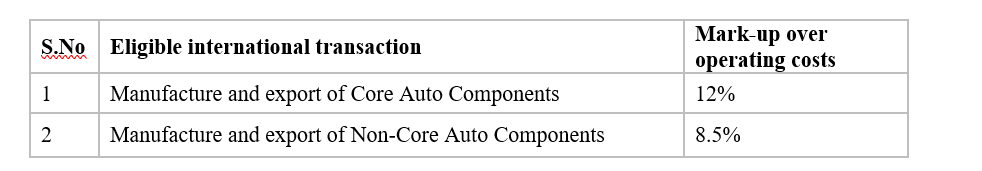

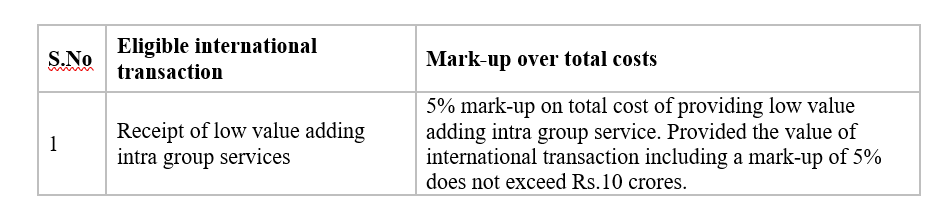

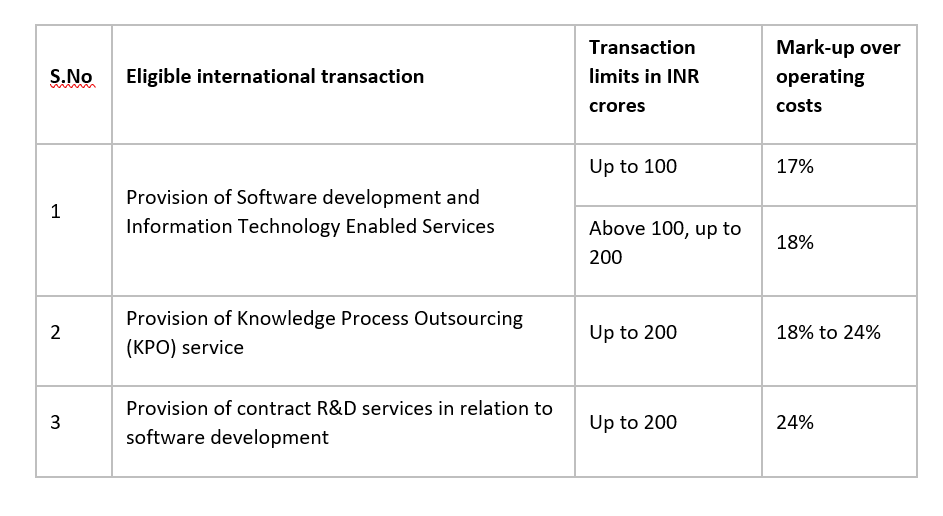

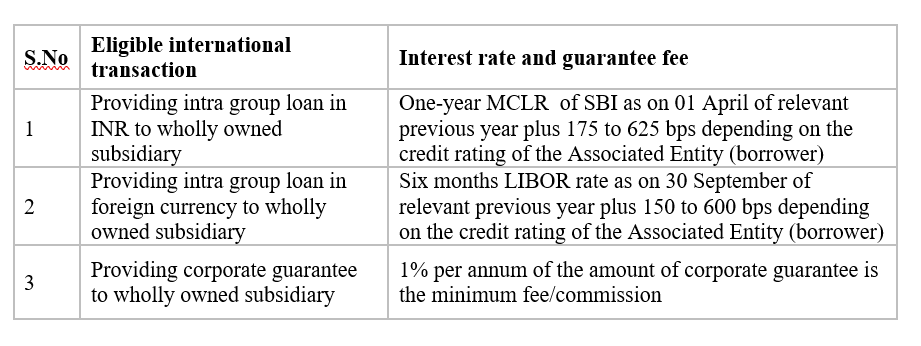

The following charts summarize the safe harbour rules by sector that are in force for FY 2020-21.

Information technology sector

Pharmaceutical sector

Automobile sector

Financial transactions

Low value-adding intra-group services

Be the first to comment