By Dr. J. Harold McClure, New York City

The General Court of the European Union on May 12 ruled that the European Commission failed to establish that Luxembourg’s tax treatment of Amazon violated EU state aid law.

The decision notes the transfer pricing approach adopted by Amazon for its European operations:

Amazon entered a cost sharing arrangement with a Luxembourg affiliate – Amazon Europe Holding Technologies SCS (LuxSCS). Amazon also established a Luxembourg operating entity = Amazon EU Sàrl (LuxOpCo). The operating entity booked European sales and was responsible for the fulfillment activities. LuxSCS was responsible for the European share of intangible development costs including technology development and marketing expenses. LuxSCS charged Lux OpCo royalties for the use of the intangible assets.

The decision noted a 2003 transfer pricing report, which relied on two methods to determine the royalty rate. One approach was based on a third party agreement:

[T]he 2003 transfer pricing report contained a section dealing with the selection of the most appropriate transfer pricing method for determining whether the royalty rate complied with the arm’s length principle. Two methods were considered in the report: one based on the comparable uncontrolled price method (‘the CUP method’) and another based on the residual profit split method. Applying the CUP method, the 2003 transfer pricing report calculated an arm’s length range for the royalty rate of 10.6 to 13.6% on the basis of a comparison with an agreement between Amazon.com and a retailer in the United States

The primary approach was to determine the royalty rate as the residual of operating profits minus a routine return for the operating affiliate.

Applying the residual profit split method, the 2003 transfer pricing report estimated the return associated with LuxOpCo’s ‘routine functions in its role as the European operating company’ based on a mark-up on costs to be incurred by LuxOpCo. The Commission also stated that, on the basis of that calculation, the authors of the 2003 transfer pricing report had concluded that a royalty rate in a range of 10.1% to 12.3% of LuxOpCo’s net revenues would be consistent with the arm’s length standard

The mark-up over the operating affiliate’s operating costs was translated into an operating margin equal to 0.5 percent.

For the 2011 to 2013 period, Amazon’s worldwide sales average $61 billion per year, with approximately $20 billion from European customers. Its cost of goods sold was 75 percent, so its gross margin was 25 percent.

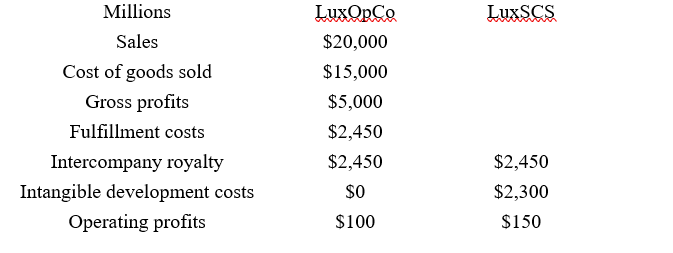

Total operating expenses represented 23.75 percent of sales, so consolidated operating profits represented 1.25 percent. The following table captures these assumptions.

Amazon’s European Operations and Transfer Pricing

Operating expenses are divided between the operating affiliate and the cost-sharing affiliate, where the operating affiliates incur fulfillment costs = 12.25 percent and the cost-sharing affiliate incurs intangible development costs = 11.5 percent.

If the intercompany royalty rate is set at 12.25 percent of sales, then the operating affiliate’s operating profits = 0.5 percent of sales or $100 million. The cost-sharing affiliate captures the remaining $150 million in operating profits.

The European Commission had several objections to Amazon’s 2003 transfer pricing report.

One critique was that the CUP approach would suggest a fixed royalty rate, which would expose the operating affiliate to commercial risk and could result in operating losses.

This objection is odd for two reasons. One reason is that third-party licensees bear commercial risk. The other reason is that the actual transfer pricing policy guaranteed the operating affiliate with a fixed 0.5 percent operating margin and hence did insulate the operating affiliate from commercial risk.

One would think that the European Commission would object to this low guaranteed operating margin, especially since it represented a mark-up over operating expenses that was just over 4 percent. While representatives of multinationals often assert that operating affiliates are low-risk service providers, the usual benchmarking to justify such low mark-ups strain credibility.

The European Commission asserted that the cost-sharing affiliate should have been selected as the tested party on the grounds that it did not perform any ‘unique and valuable’ functions in relation to the intangible assets. Rather, it merely held the legal title, the Commission said.

The compensation that this affiliate should receive would be limited to the intangible costs incurred with no mark-up plus a 5 percent mark-up on the costs incurred to maintain its legal ownership of the intangible assets. Since the cost incurred to maintain legal ownership were very modest, the approach suggested by the European Commission would have granted the cost-sharing affiliate with virtually no profits.

One problem with the European Commission’s approach was that Amazon had sold the European rights to the intangible assets to the cost-sharing affiliate in 2015.

While the IRS asserted that the compensation paid for these rights was below its fair market value, an Appeals Court affirmed the Tax Court’s ruling on this valuation issue in Amazon.com v. Commissioner, No. 17-72922 (9th Cir. 2019).

The General Court rejected the approach suggested by the European affiliate in favor of the use of the transactional net margin method (TNMM) with the operating affiliate as the tested party.

Since the European Commission did not challenge the low mark-up suggested by the 2003 transfer pricing report commissioned by Amazon for this issue, the General Court ruled in favor of Amazon.

Be the first to comment