By Dr. J. Harold McClure, New York City

The OECD announced on March 18 that Mongolia made its first transfer pricing assessment of a multinational enterprise in December of last year.

The announcement noted that technical assistance for this transfer pricing assessment was provided by the World Bank Group, the International Monetary Fund; the Japan International Cooperation Agency; the Intergovernmental Forum on Mining, Minerals, Metals, and Sustainable Development; and Tax Inspectors Without Borders.

The only information in this announcement regarding the specific transfer pricing dispute at issue was that it involved the extractives sector. The taxpayer was also not identified, but it was disclosed that the taxpayer was assessed approximately USD 228 million and that USD 1.5 billion in carried forward losses were denied.

The transfer pricing dispute described by the OECD most likely involved the Oyu Tolgoi mine as the Mongolian government has previously disclosed a high-stakes transfer pricing dispute with this taxpayer.

What is the issue?

The Oyu Tolgoi mine is a joint venture between the Mongolian government and Turquoise Hill Resources, a publicly-traded Canadian company that owns 66 percent of the mine. Rio Tinto owns 50.8 percent of the shares of Turquoise Hill Resources.

Turquoise Hill Resources began exploration for copper, gold, and other metals in 2003, and the first production occurred in 2013. The mine contains an estimated 2.7 million tons of copper and 1.7 million ounces of gold, and modest amounts of molybdenum and silver.

The Mongolian government issued a press release on December 23, 2020, following an audit of the 2016–2018 tax returns for Turquoise Hill Resources. The Mongolian government had also audited Turquoise Hill Resources’ 2013 to 2015 returns, raising similar concerns.

The concerns center on the high development cost for the Oyu Tolgoi project and projections that little corporate income taxes would be paid over the next 30 years. High development costs, however, are not unusual for mining projects even under arm’s length pricing. Whether a mining affiliate turns out to be profitable over the long-run depends also on the prices it receives for its production, which is a potential issue discussed below.

The Mongolian government raised two specific issues related to the expenses for the mining affiliate. One issue relates to management service charges from Rio Tinto. The other issue related to interest expenses.

The Mongolian government press release noted the imposition of USD 228 million in taxes and penalties based on reductions in the amount of these two expenses on the claim that they exceeded arm’s length pricing.

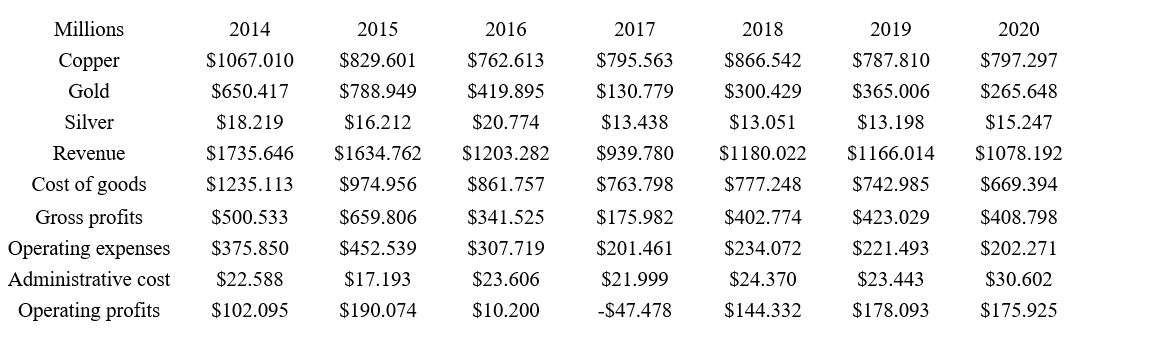

Turquoise Hill Resources Income Statement – 2014 to 2020

Turquoise Hill Resources’ 40-F filings provide some useful information on these issues. Our table provides revenues by product as well as overall operating costs by year for 2014 to 2020.

Copper revenue represented 66.1 percent of total revenue, while gold revenue represented 32.7 percent of total revenue. The cost of goods sold was 67.4 percent, so the gross profit margin was 32.6 percent over this period.

Potential intercompany expense issues

The 40-F separately reported corporate administrative costs in addition to other operating expenses. Reported corporate administrative expenses were just over 1.8 percent of revenue, while other operating expenses represented 22.33 percent of sales.

Over 60 percent of these other operating expenses were described as Oyu Tolgoi administration expenses. The combined reported administration expenses were over 15 percent of revenues.

The 40-F filings note that Rio Tinto International Holdings, Inc. is the manager of the Oyu Tolgoi project, including having responsibility for its development and construction. As such, the intercompany administrative fees represent intercompany charges which certainly should be scrutinized under the arm’s length standard.

The financial footnotes note royalty expenses that represented 30 percent of other operating expenses, which would equate to almost 7 percent of sales. A second intercompany issue might be what these expenses represented and which entity received them.

The financial footnotes note royalty expenses that represented 30 percent of other operating expenses, which would equate to almost 7 percent of sales. A second intercompany issue might be what these expenses represented and which entity received them.

The Oyu Tolgoi mining affiliate had over $4 billion in debt from its financing facilities.

The interest rates on this debt was based on the London Interbank Offer Rate (LIBOR) plus loan margins that ranged from 3.65 percent to 4.78 percent. When LIBOR exceeded 3 percent, the interest expense on this debt exceeded $300 million per year. ‘

While these interest rates are high, the lenders were commercial banks, export credit agencies, international financial institutions, and the Multilateral Investment Guarantee Agency (MIGA). MIGA is a member of the World Bank Group that promotes investment in developing nations by providing political and risk insurance. The Oyu Tolgoi mining affiliate pays MIGA premium equal to 1.4 percent for any insured loan.

The Centre for Research on Multinational Corporations issued a 2018 report entitled “Mining Taxes” that discussed the various financing issues involved in the operation of the Oyu Tolgoi mine.

This report noted a $3 billion intercompany loan from Turquoise Hill Resources to Erdenes Oyu Tolgoi, which is the entity that holds the 34 percent equity interest owned by the Mongolia government.

This report claims that the intercompany interest rate is LIBOR plus a 6.5 percent loan margin. While the 2016 40-F filing for Turquoise Hill Resources notes this $3 billion intercompany loan as a related party receivable, the recorded financing income represents only 3 percent of the stated principle.

These intercompany payments represent finance income for Turquoise Hill Resources, which partially offsets the intercompany interest expenses.

Pricing of copper and gold

The consolidated financials for Turquoise Hill Resources over 2014–2020 indicated modest operating profits based on historical prices for copper and gold, but these operating profits were less than interest expenses.

Whether the Mongolian mining affiliate would retain sufficient operating profits to cover these substantial interest expenses over the long-run depends both on the transfer pricing paid to the mining affiliate and the future prices for copper and gold.

Turquoise Hill Resource’s copper and gold revenue declined from their 2014 levels. It is unclear whether this decline was from lower production or lower prices paid to Turquoise Hill Resources by its customers.

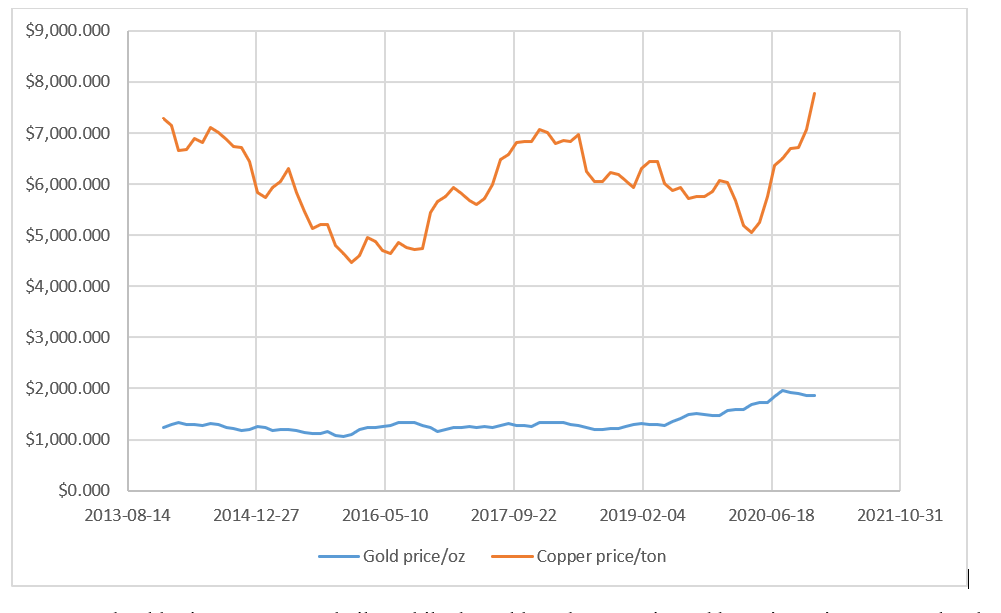

Our figure shows the global price for both commodities as reported by the International Monetary Fund.

Gold prices have recently soared. Copper prices exceeded $7000 per ton in early 2014 but declined to less than $4500 per ton in early 2016 before recovering to $7000 per ton in early 2018. After another decline, copper prices have recently experienced another boom.

Gold prices fluctuated between $1050 per ounce and $1350 per ounce from early 2014 to May 2019. Since then, gold prices have risen, reaching almost $2000 per ounce in August 2020.

The 40-F for Turquoise Hill Resources does not disclose who its customers were. If any of its sales were to Rio Tinto, then the arm’s length nature of these transactions should be evaluated.

Even if the prices paid to Turquoise Hill Resources were market prices, the intercompany pricing between the Mongolian mining affiliate and any selling affiliate should also be evaluated.

Even if the prices paid to Turquoise Hill Resources were market prices, the intercompany pricing between the Mongolian mining affiliate and any selling affiliate should also be evaluated.

The reported selling expenses relative to total revenue for Turquoise Hill Resources have been less than 1.5 percent. As such, a selling affiliate with a gross margin in excess of 2 percent could be seen as paying the mining affiliate an intercompany price below the arm’s length standard.

Copper and Gold Prices – January 2014 to December 2020

Copper and gold prices are very volatile. While the gold market experienced booming prices, recent developments have seen this boom partially retreat. Copper prices have, in contrast, began escalating in the last few months.

Whether the Oyu Togloi mining affiliate eventually records significant taxable income in Mongolia depends in part on the resolution of the transfer pricing issues being raised as well as the future prices for the commodities that it will produce.

Be the first to comment