By Dr. Harold McClure, New York City

On May 21 Finland’s Supreme Administrative Court issued its decision Case No. KHO:2021:66, which rejected an attempt by the Finnish tax authority to increase the intercompany interest rates charged by a Finnish financing affiliate to its Russian operating affiliate.

The key issue was whether the intercompany interest rate should be based on the group credit rating or the standalone credit rating of the Russian affiliate.

Currency of denomination

The Finnish financing affiliate had a series of third-party loans denominated in Euros with the interest rates set with a loan margin equal to 0.5 percent. This affiliate extended back-to-back loans to the Russian affiliate denominated in rubles with a loan margin near 0.55 percent. The logic of the intercompany loan margin was that the Russian affiliate’s credit rating should be seen as the group credit rating with the small increase in the loan margin covering the financing affiliate’s administrative expenses.

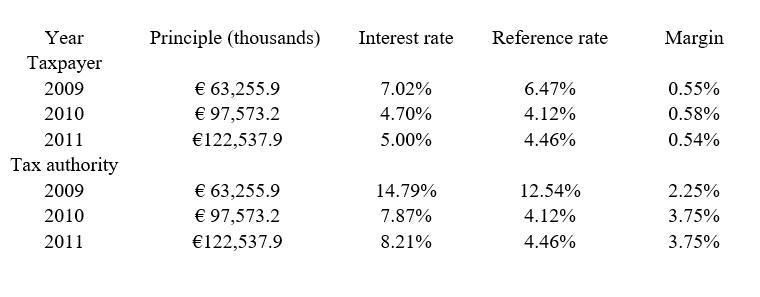

The following table summarizes the taxpayer’s position as well as the tax authority’s position. The initial loan amount was just over €63 million in 2009, rising to over €122 million by 2011.

The intercompany interest rate was set at a Russian reference rate plus the intercompany loan margin based on the group credit rating.

The tax authority argued for higher loan margins based on a standalone credit rating and using loan margin data derived from the Thomson Reuters DealScan database. This database provides loan margin data on floating rate loans based mainly on US LIBOR rates but also some Euro LIBOR rates.

While the reference rates used by the tax authority for 2010 and 2011 were the same as the reference rates used by the taxpayer, the reference rate for 2009 was considerably higher than the reference rate used by the taxpayer.

The following table provides monthly data on Russia’s 3-month interbank rate as provided by the OECD. Over the 2009 to 2011 period, this rate averaged 7.9 percent. This interest rate was very high at the beginning of 2009 but fell below 10 percent during the latter months of 2009. This rate also fluctuated around 5 percent during 2010 and 2011.

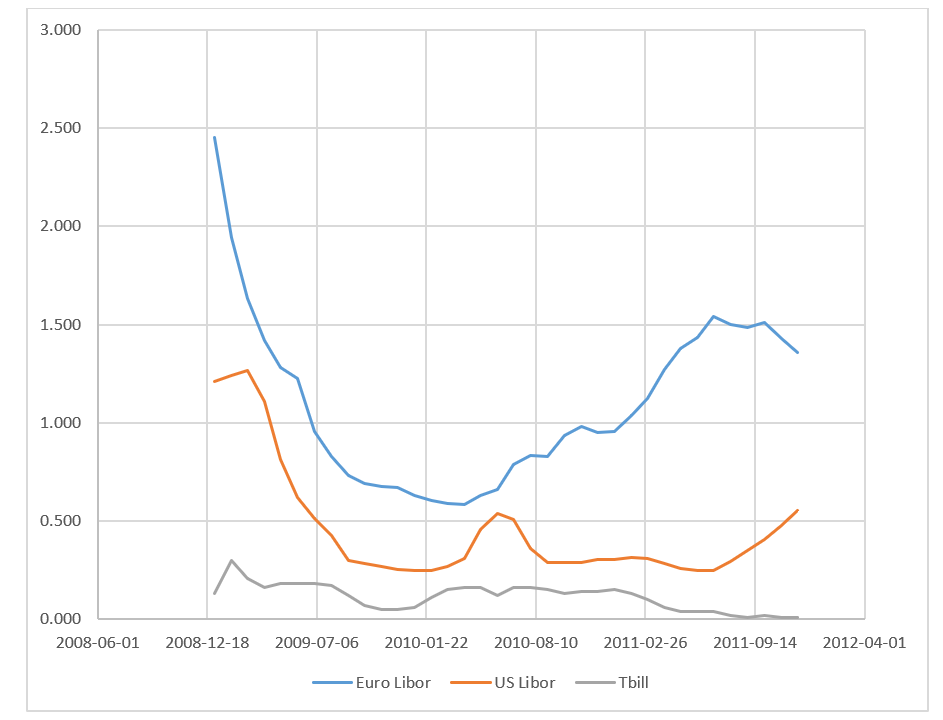

A second graph shows monthly data on the 3-month US LIBOR rate as well as the LIBOR rate denominated in Euros. The US LIBOR rate average 0.46 percent during this period, while the LIBOR rate denominated in Euros averaged 1.1 percent. The higher interest rates for Russia’s 3-month interbank rate reflected Russia’s higher inflation rate and the implication for the expected devaluation of the ruble.

The key issue is what is the appropriate credit rating and its implications for the credit spread.

Loan margins are based on interbank rates and not government bond rates. The appropriate credit spread therefore should be seen as the sum of the loan margin and the spread between the interbank rate and the yield on the corresponding government bond interest rate.

The second graph shows the interest rate on 3-month US Treasury bills for the period. The TED spread is the difference between the 3-month US LIBOR rates and the 3-month US Treasury bill rate. The TED spread was near 1 percent during early 2009 but rapidly declined averaging 0.35 percent over the 2009 to 2011 period. The credit spread is the sum of the loan margin and the TED spread. If the appropriate loan margin was 0.55 percent, the implied credit spread was 0.9 percent.

The tax authority’s position on the credit rating

The tax authority convinced the Administrative Court that intercompany loan margin should be raised to levels almost as high as what Chevron Australia tried to assert in its unsuccessful attempt to defend a higher intercompany interest rate.

The Supreme Administrative Court summarized the earlier decision’s discussion of how the Finnish tax authorities used various credit rating models from Moody’s, including the credit cycle adjusted credit cycle adjustment model and a financial statement only model.

The credit cycle adjustment model yielded a higher level of credit risk by incorporating market information during a period that was known for credit risk issues. Even though the taxpayer contended that this model overestimated the credit risk incurred by the borrowing affiliate, the Administrative Court accepted the tax authority’s position.

The Supreme Administrative Court, however, accepted the tax authority’s position that the group rating should be used. Its decision noted that the taxpayer was using an approach consistent with a February 2, 2009, decision by the Helsinki Administrative Court.

This decision also noted a November 2010 decision by the Supreme Administrative Court in KHO 2010:73.

This case involved a Finnish affiliate that refinanced €38 million in debt using an intercompany loan from its Swedish parent in 2005. The intercompany interest rate was 9.5 percent. The Finnish tax authority, however, noted that the multinational paid third-party lenders interest rates of only 3.25 percent.

During this period, the one-year government bond rate was 2.25 percent. If the multinational’s group credit rating was A, a credit spread of only 1 percent would have been required by third party lenders.

Three-month LIBOR rates for both Euro and US dollar

The November 2010 decision by the Supreme Administrative Court in KHO 2010:73 allowed the Finnish tax authority to insist on the use of the group credit rating when evaluating intercompany loans extended to a Finnish borrowing affiliate by a foreign parent.

This recent decision holds the taxpayer was also warranted in using the group credit rating for an intercompany loan from a Finnish financing affiliate to a Russian borrowing affiliate.

The Finnish tax authority derived a high loan margin using a synthetic credit rating using the standalone principle. Its approach was rejected by the Supreme Administrative Court.

Had the Finnish tax authority succeeded in its aggressive attempt to raise the intercompany interest rate, this multinational would have faced double taxation if the Russian tax authorities believed that the Russian borrowing affiliate was granted a lower credit rating based on the implicit support standard.

Be the first to comment