By Dr. Harold McClure, New York City

Vincent Kiezebrink and Jasper van Teeffelen accuse Qiagen of base erosion through the use of intercompany loans issued by a German affiliate to an affiliate in Malta in their October 2020 publication “Profiting from a pandemic how COVID-19 test kit producer Qiagen receives public money but avoids taxes.”

The authors assert that the intercompany interest deductions should be disallowed in their entity. This assertion would be valid only if the financing were deemed to be equity contributions and not debt. We shall assume the validity of the intercompany loan and explore the alternative issue of whether the intercompany interest rates were excessive or arm’s length.

The authors write:

[W]e investigate how Qiagen set up two intercompany loan structures through Luxembourg and Malta in order to generate tax credits in the Netherlands. In 2011 and 2014, Qiagen’s Dutch parent company, Qiagen NV, made two large capital contributions into a Qiagen subsidiary in Malta (€253 million and €138.4 million respectively … Qiagen Luxembourg took the two interest-free loans it received from Malta and on the same day loaned them onwards to Qiagen’s German holding company, Qiagen Deutschland Holding GmbH, (henceforth ‘Qiagen Germany’) but with added interest (6% and 4.54% respectively). The German subsidiary immediately loaned the sums back to the Qiagen parent company in the Netherlands. Both loan sums therefore ended up back with Qiagen NV in the Netherlands: a financial merrygo-round of debt and interest.

Their discussion suggests that these intercompany loans are actually equity contributions where any intercompany interest deductions in either Germany or the Netherlands should be disallowed.

The OECD’s Transfer Pricing Guidance on Financial Transactions, released February 10, 2020, begins with an extensive discussion entitled “determination of whether a purported loan should be regarded as a loan.”

According to this guidance, whether the Dutch and German tax authorities could characterize the financing noted by Kiezebrink and Teeffelen as equity rather than debt depends on the particular facts as well as local tax law.

The OECD guidance would have the legal analysis consider the accurate delineation of the transaction.

Our focus will be on the pricing of these intercompany loans, noting that the intercompany interest rates may be in excess of the arm’s length standard.

Evaluating whether an intercompany interest rate is arm’s length

A standard model for evaluating whether an intercompany interest rate is arm’s-length can be seen to have two components — the intercompany contract and the credit rating of the related party borrower.

Properly articulated intercompany contracts stipulate the date of the loan, the currency of denomination, the term of the loan, and the interest rate.

The first three items allow the analyst to determine the market interest rate of the corresponding government bond. This intercompany interest rate minus the market interest rate of the corresponding government bond can be seen as the credit spread implied by the intercompany loan contract.

Kiezebrink and Teeffelen provide the key terms of the two loans, which we detail in the following table.

Terms of the two intercompany loans

|

Date |

Amount |

Term |

Interest rate |

|

6/29/2011 |

€253.0 |

9 years |

6.00% |

|

10/1/2014 |

€138.4 |

9 years |

4.54% |

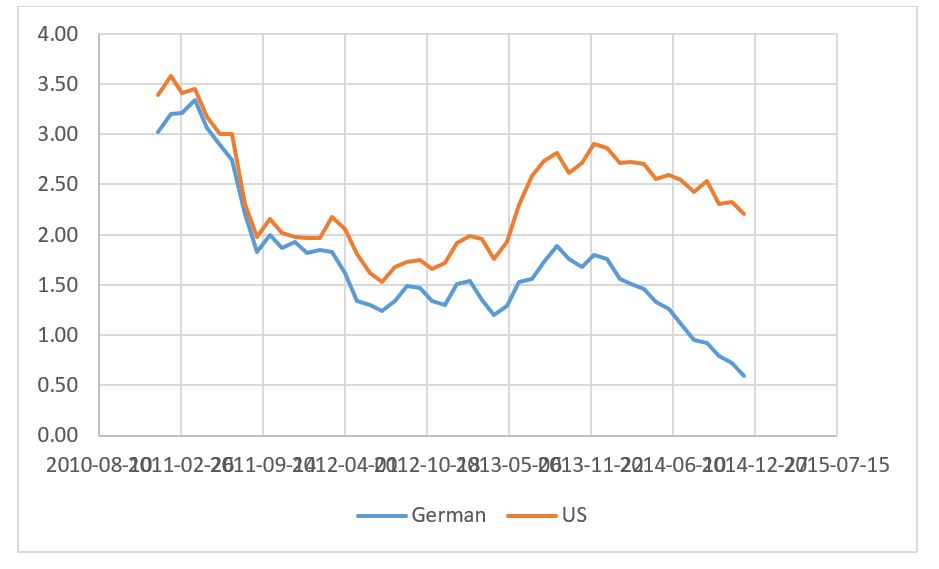

The following graph shows the interest rate on 10-year German government bond rates from January 2011 to December 2014.

During the period for the first intercompany loan, this interest rate was less than 3 percent. During the period for the second intercompany loan, this interest rate was less than 1 percent. As such, the implied credit spreads for both intercompany loans were over 3 percent.

It is not clear whether Qiagen had commissioned a transfer pricing analysis to justify its intercompany interest rates.

Our graph also shows the interest rate on 10-year US government bonds for the same period.

As we note below, the 20-F filing for Qiagen provides useful information on its third-party borrowings denominated in US dollars.

Note while interest rates were similar in both nations for 2011, interest rates on German government bonds fell relative to interest rates on US government bonds during the 2012 to 2014 period.

Interest rate on 10-year German and US government bonds: January 2011 to December 2014

The OECD guidance notes that market information can be used to determine an appropriate credit spread once a reliable estimate of the borrower’s credit rating can be determined:

Once the actual transaction has been accurately delineated, arm’s length interest rates can be sought based on consideration of the credit rating of the borrower or the rating of the specific issuance taking into account all of the terms and conditions of the loan and comparability factors.

While one can justify high credit spreads on the basis of estimates of the standalone credit rating for an affiliate, the role of the overall group credit rating for the multinational is also noted in the OECD guidance.

Given that the borrowing affiliate was either Qiagen’s Dutch or German affiliate, information on the interest rate paid by the parent corporation on third party loans could provide that justification.

The 20-F filings for Qiagen, for example, note the following borrowings on October 16, 2012:

In October 2012, we completed a private placement through the issuance of new senior unsecured notes at a total amount of $400.0 million with a weighted average interest rate of 3.66% (settled on October 16, 2012). The notes were issued in three series: (1) $73.0 million 7-year term due in 2019 (3.19%); (2) $300.0 million 10-year term due in 2022 (3.75%); and (3) $27.0 million 12-year term due in 2024 (3.90%).

Interest rates on 10-year US government bonds at the time were approximately 2.25 percent, whereas interest rates on 10-year German government bonds were only 1.5 percent.

The 3.75 percent interest rate on 10-year corporate bonds denominated in US dollars suggests a credit spread of only 1.5 percent. At the time, interest rates on 7-year US government bonds were approximately 1.7 percent, which also suggests a credit spread equal to 1.5 percent.

These market credit spreads for Qiagen were consistent with a group credit rating of BBB. Any justification for the credit spreads implied by the intercompany loans discussed by Kiezebrink and Teeffelen would have to assert credit spreads of BB or worse.

While Qiagen may have commissioned an analysis to support the intercompany interest rates, the tax authorities could certainly challenge any such analysis.

Be the first to comment