By Dr. J. Harold McClure, New York City

As briefly discussed in Amgen’s most recent 10-Q filing and an August 3 earnings report, the IRS has proposed very large transfer pricing adjustments for the period 2010–2015 with respect to the intercompany pricing between the biopharmaceutical company’s US parent and its Puerto Rican manufacturing affiliate. Amgen also filed a related tax court petition on July 21, which has not been made publicly available yet.

The issues in Amgen’s case seem likely to mirror those in Medtronic’s recent transfer pricing dispute with the IRS. The issue in that litigation was what the appropriate royalty rate was for the Puerto Rican manufacturing affiliate to pay to the US parent. The Amgen controversy similarly seems to center on what Amgen’s Puerto Rican manufacturing affiliate should pay in terms of intercompany royalties.

Amgen also has a Dutch manufacturing affiliate that produces products for its European distribution affiliates. This Dutch affiliate may be in a cost sharing arrangement, but this intercompany pricing issues is not the subject of the current controversy.

A simple model of Amgen’s possible transfer pricing structure roughly based on its financials illustrates the potential similarities between the Amgen dispute and the Medtronic litigation. While Medtronic is a medical device manufacturer, Amgen is a biopharmaceutical multinational whose main products are Enbrel, Neulasta, Aranesp, and Epogen.

Our model makes several assumptions. First, worldwide sales equal $20 billion per year with 75 percent of these sales being in the US and the other 25 percent being in Europe. Second, production costs equal 20 percent of sales with the Puerto Rican affiliate providing products for US sales and the Dutch affiliate providing products for European sales. Finally, selling costs equal 25 percent of sales, and ongoing research and development (R&D) costs equal 25 percent of sales.

Worldwide profits equal 30 percent of sales or $6 billion per year. The allocation of profits between the US parent, the Puerto Rican affiliate, the Dutch affiliate, and the European distribution affiliates depends on the transfer pricing policies.

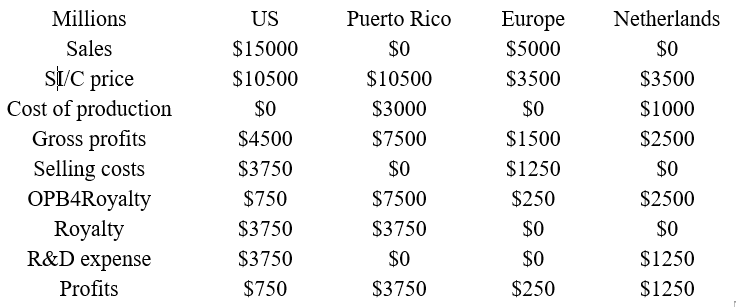

Table 1 presents the actual intercompany pricing policy and includes additional assumptions. First, the transfer pricing for products paid by the European distribution affiliates to the Dutch manufacturing affiliate equals 70 percent of sales, which is also the transfer pricing for products for the US parent as distributor paid to the Puerto Rican affiliate. Second, the Dutch affiliate as cost sharing partner incurs $1.25 billion of the R&D expenses with the US parent bearing the other $3.75 billion of the R&D expenses. Third, the Puerto Rican affiliate does not incur R&D expenses but pays intercompany royalties to the US parent for the use of intangible assets.

Table 1: Financial model for Amgen’s transfer pricing

The intercompany price (I/C price) paid by the distribution affiliates to the manufacturing affiliates leaves the distribution affiliates with a gross margin equal to 30 percent. Since selling costs equal 25 percent of sales, this intercompany pricing policy leaves the distribution affiliates with a 5 percent operating margin, which represents the routine return for distribution.

The routine return for manufacturing can reasonably be seen as production costs plus 20 percent, which represents 5 percent of end user sales. Under the actual intercompany pricing policies, the manufacturing affiliate retains profits that are 25 percent of sales. In other words, the Dutch affiliate and the Puerto Rican affiliates receive residual profits equal to 20 percent of sales but for different reasons.

Operating profits before royalties or R&D (OPB4Royalty) represent 55 percent of sales. Residual profits, therefore, represent 45 percent of sales before any consideration of ongoing R&D expenses. The Dutch affiliate retains all the residual profits created by European operations, which may be arm’s length if the Dutch affiliate owns the European rights to the intangible assets under the cost-sharing arrangement. Table 1 assumes that the Dutch affiliate has already paid the US parent for any pre-existing intangible assets.

The Puerto Rican affiliate does not pay any R&D expenses as it does not own the product intangibles for operations in North America. The Puerto Rican affiliate pays the US parent intercompany royalties equal to 25 percent of sales for the use of these product intangibles. Since residual profits before consideration of R&D expenses is 45 percent of sales, the Puerto Rican affiliate retains residual profits equal to 20 percent of US sales or $3 billion per year.

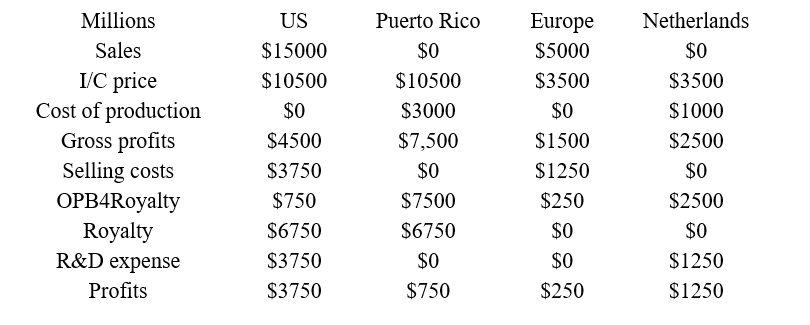

Table 2 presents what may be the IRS position, which is that the intercompany royalty rate should be raised from 25 percent of sales to 45 percent of sales. This increase represents $3 billion per year as additional US income. The income for the Puerto Rican affiliate would be reduced from $3.75 billion per year to $750 million per year. In other words, the Puerto Rican affiliate would retain only the routine return to contract manufacturing. This logic was the IRS position in the Medtronic litigation, where the IRS used the comparable profits method (CPM) to determine the appropriate intercompany royalty.

I critiqued this IRS position in “Medtronic’s Intercompany Royalty Rate: Bad CUT or Misleading CPM?” (Journal of International Taxation, February 2019):

The usual application of CPM is a flawed application of profits-based approaches, as it ignores the essence of licensee risk-taking in the presence of highly valuable intangible assets. With that said, the IRS is certainly correct to raise the profit-potential issue when the expected profitability in a controlled transaction is substantially higher than the profitability in the third-party transactions that taxpayers offer as alleged CUTs. But it is precisely in these situations when ignoring the role of licensee risk-taking leads to absurdly high results for the intercompany royalty rate.

The residual profits generated by Amgen’s intangible assets are also very high. As such, a similar criticism could be applied to any application of CPM in this Amgen controversy.

Table 2: IRS application of the comparable profits method

Medtronic tried to argue for a modest intercompany royalty rate on the basis of an alleged comparable uncontrolled transaction (CUT), which was severely criticized by the Eighth Circuit Court of Appeals. It is unclear whether Amgen will argue for a lower intercompany royalty rate based on its own application of the CUT approach.

If Amgen does present third party agreements to justify its lower intercompany royalty rates, several questions should be considered. The primary question is whether Amgen’s use of the CUT approach is more credible with the Medtronic application of CUT. Even if a credible application of the CUT approach is presented, questions with respect to comparability differences must be explored.

Amgen’s fact pattern could potentially differ from that of Medtronic especially since the issue in this controversy will be over the economics of the biopharmaceutical sector rather than the medical device sector. Hopefully we will learn more about the positions of the IRS and Amgen when this Tax Court petition becomes publicly available.

Be the first to comment