By Dr. J. Harold McClure, New York City

The Inland Revenue Authority of Singapore (IRAS) released the sixth edition of its e-tax transfer pricing guidance on August 10. This guidance extended its coverage of intercompany financing, providing a few interesting examples, which this discussion illustrates with market data.

Paragraph 15.46 discusses intercompany loan guarantees in light of implicit support. The example states:

The parent company of an MNE group maintains an AA credit rating on the strength of the group’s consolidated balance sheet. Company X is a member of the MNE group and has a stand-alone credit rating of BBB. Company X obtains a loan from an independent lender. The independent lender is willing to lend at interest rate based on an A credit rating without any formal guarantee because of Company X’s membership in the MNE group. If the parent company guarantees the loan, the independent lender is willing to lend at interest rate based on the parent company’s AA credit rating.

Consider a Singapore subsidiary of a US parent corporation. The Singapore subsidiary borrows 100 million Singapore dollars on February 14, 2018, for 10 years with a fixed interest rate of 3 percent. The Monetary Authority of Singapore notes that the 10-year government bond rate on that date equals 2.25 percent. The 0.75 percent difference represents the credit spread for AA corporate debt.

A standalone borrower with a credit rating would have likely paid an interest rate of 3.75 percent since credit spreads for borrowers with a BBB credit rating would be near 1.5 percent. The US IRS might view the appropriate credit spread in this case to be 0.75 percent.

The IRAS guidance, however, notes:

The enhancement of Company X’s credit standing from BBB to A is attributable to the implicit support derived purely from passive association in the MNE group for which the parent company need not be compensated.

The enhancement of Company X’s credit standing from A to AA is attributable to a deliberate concerted action, namely the provision of the guarantee by the parent company. As such, Company X is required to pay an arm’s length guarantee fee to the parent company reflecting the benefit of raising Company X’s credit standing from A to AA.

If the credit spread for borrowers with A credit ratings would be 1 percent, the Singapore subsidiary would have been able to borrow at an interest rate of 3.25 percent. The IRAS approach, which emphasizes the role of implicit support, would suggest an intercompany guarantee fee of only 0.25 percent.

Paragraph 15.49 discusses the role of re-financing long-term loans. The first example assumes 10-year fixed interest rate loans with the first loan being issued on February 1, 2008, and the next loan being issued on February 1, 2018. The intercompany interest rate for the first loan was 8 percent. The guidance notes that the new intercompany loan would be based on market rates in early 2018.

The example does not specify which currency the intercompany interest rate was denominated in.

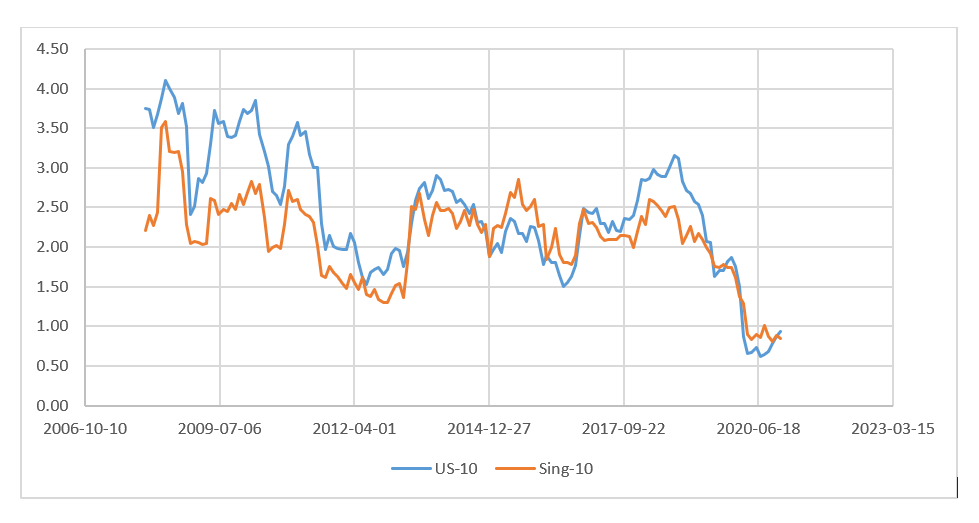

The following chart shows the evolution of 10-year government bond rates for both Singapore government bonds and US government bonds from January 2008 to December 2020 where monthly averages are presented for convenience. Singapore government bond rates were generally lower than US government bond rates in early 2008. Over the next 10 years, both government bond rates fluctuated with US government bond rates being lower in early 2018 than they were in early 2008. Singapore government bond rates in early 2018 were similar to the low government bond rates in 2008.

Ten-year Singapore government bond and US government bond rates: 2008 to 2020

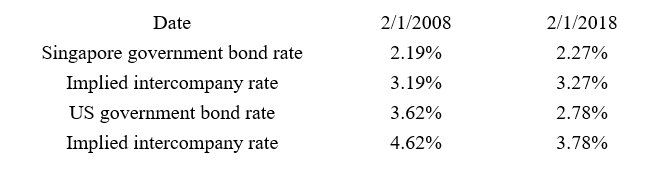

The following table represents the government bond rate for both nations for both February 1, 2008, and February 1, 2018. Even if the first intercompany loan were denominated in US dollars, the 8 percent intercompany interest rate would be quite high unless an analysis could support a credit spread near 4.4 percent. If the intercompany loan were from a US parent to a Singapore subsidiary, the IRAS could argue that the 8 percent intercompany interest rate on the first loan was excessive.

Alternative intercompany interest rates

Following the intercompany guarantee example, suppose that the IRAS successfully argued that the credit rating for the Singapore borrowing affiliate was A so that the appropriate credit spread should be only 1 percent. The arm’s length interest rate also depends on the currency of denomination. If the intercompany loans were denominated in Singapore dollars, the arm’s length interest rate would be only 3.19 percent on the intercompany rate for the earlier loan. Upon refinancing, the intercompany interest for the loan issued on February 1, 2018, would be 3.27% since Singapore government bond rates were slightly higher than they were 10 years earlier.

Interest rates on 10-year US government bonds on February 1, 2008, were 3.62 percent. If the appropriate credit spread were 1 percent, then the arm’s length interest rate would be 4.62 percent on the earlier intercompany loan. For the new intercompany loan issued on February 1, 2018, the arm’s length interest rate would be only 3.78 percent since US government interest rates fell relative to 10 years earlier.

A defense of the original 8 percent intercompany interest rate would require a convincing argument that the Singapore borrowing affiliate’s credit rating would be quite poor even if the intercompany loan were denominated in US dollars. Since government bond rates have been quite low for many nations since 2008, the defense of high intercompany interest rates has become difficult especially if tax authorities base the analysis of credit spreads on implicit support.

Micron Technology may represent an interesting real-world example since its Singapore affiliate represents its largest Asian manufacturing operations with three fabrication facilities, a test and assembly facility, and a technology center. Micron Technology incurred significant amounts of corporate debt on June 12, 2019, at an interest rate equal to 4.66 percent for the portion of the debt that represented 10-year corporate bonds. Its group credit rating was BBB- and the credit spread on this debt was 2.5 percent since the interest rate on 10-year government bonds was 2.15 percent.

Let’s assume that Micron Technology extended a 10-year fixed interest rate intercompany loan denominated in Singapore dollars to its Singapore affiliate on June 19, 2019. On that date, the interest rate on 10-year Singapore government bonds was 2.01 percent. The appropriate intercompany interest rate depends on the appropriate credit rating and the implied credit spread. The IRS might argue for a 5.5 percent interest rate on the premise that the standalone credit rating is BB- implying a credit spread equal to 3.5 percent. The IRAS could alternatively argue for a 4.5 percent intercompany interest rate based on the credit spread enjoyed by Micron Technology’s group credit rating. An intermediate view based on implicit support would likely support a BB credit rating and a 3 percent credit spread. Hopefully, double taxation could be avoided with the two tax authorities ultimately agreeing to a 5 percent intercompany interest rate.

Be the first to comment