By Emmanouela Kolovetsiou-Baliafa, Associate, KG Law Firm, Greece

The Greek government has retroactively reduced the corporate income tax rate, suspended the imposition of the special solidarity contribution (SSC), and introduced other support measures through Law 4799/2021, published in the Official Gazette on May 18.

Reduction of corporate income tax rate

The corporate income tax rate is retroactively reduced from 24% to 22% for tax year 2021 and onwards. Credit institutions (banks) remain subject to a corporate income tax rate of 29%, provided that the provisions of deferred taxation apply (Article 27A of the Income Tax Act).

Reduction of income tax prepayment rate

The income tax prepayment rate for individuals conducting business activity is reduced from 100% to 55% of the tax due for tax year 2021 and onwards.

Similarly, the corporate income tax prepayment rate for legal persons and legal entities is reduced from 100% to 80% of the tax due for tax year 2021 and onwards. For tax year 2020, the corporate income tax prepayment rate is reduced to 70%.

The income tax prepayment rate for Greek banking institutions and branches of foreign banks operating in Greece remains at 100% for tax years 2020 onwards.

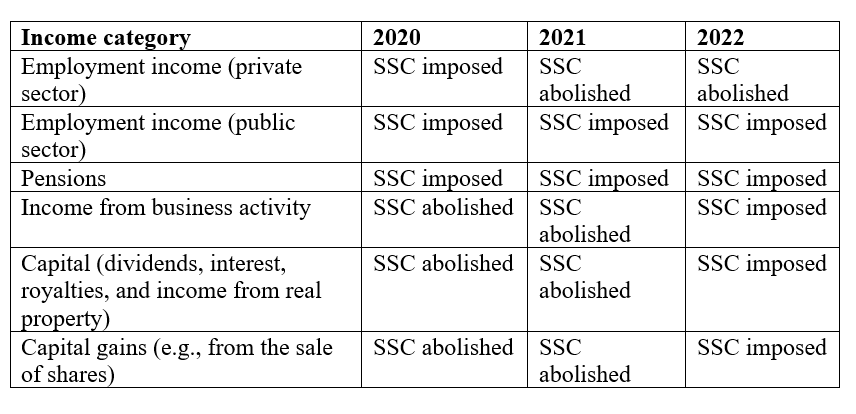

Suspension of the imposition of SSC

The imposition of the SSC is suspended for specific categories of income for tax years 2021 and 2022. The table below reflects the income categories to which the SSC is/will be imposed or abolished for fiscal years 2020, 2021, and 2022.

Sales tax on stock exchange transactions

The rules regarding the sales tax on stock exchange transactions are amended (0.2% on the shares’ sale value), on the basis that the “Hellenic Central Securities Depository” (AthexCSD) is licensed as a central securities depository (CSD) as of April 4.

Particularly, pursuant to the new provisions, the context of application of the sales tax is clarified.

Moreover, the new law introduces certain provisions regarding the process for the collection and attribution of the tax and redefines the persons liable to pay and remit the sales tax. It also extends the payment deadline.

In addition, in cases of non-compliance with the filing obligations, the new law provides for the imposition of certain administrative sanctions (i.e., penalties and default interest) on the AthexCSD or the intermediaries (as appropriate).

Suspension of rental payments due in May 2021

According to the provisions of the new law the rental payments due in May 2021 are totally suspended for businesses that ceased their operation due to the state mandate, as well as for those affected by the COVID-19 pandemic.

A ministerial decision is expected to provide the NACE codes of businesses that are eligible for this measure. However, such rental suspension does not apply to businesses that already are eligible for the 40% reduction in rental payments based on their active NACE code as announced in previous ministerial decisions.

Be the first to comment