By Ksenija Cipek, Assistant Director General for Tax Legislation and International Cooperation, Ministry of Finance, Croatia

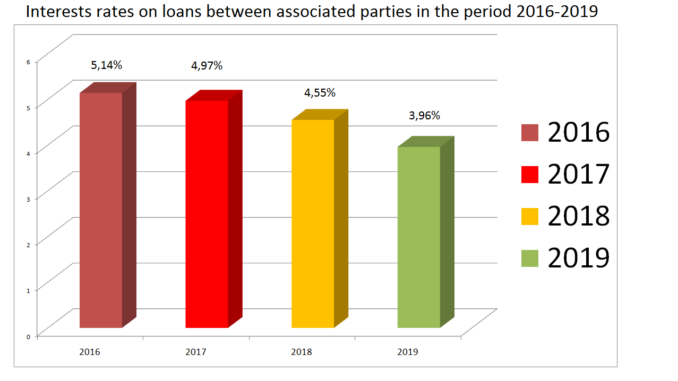

Croatia’s Minister of Finance has announced the 2019 interest rate for loans between associated parties. The interest rate is 3.96%, according to the decision of the Croatian National Bank, published in National Gazette 118/2018 on December 27, 2018.

To determine interest expenditure on loans received from an associated party, the interest can be no greater than the interest that would have been realised between non-associated parties at the time of loan approval.

As a result of the interest rates announced for 2019, the following applies to loans between associated parties:

- if a higher interest rate than the prescribed 3.96% arm’s length interest rate is applied, the difference between the applied interest rate and the prescribed interest rate is considered tax non-deductible for profit tax purposes.

- if a lower interest rate is applied, the difference between the applied interest rate and the prescribed 3.96% interest rate is considered taxable for profit tax purposes (increasing tax base).

The following table shows changes to the interest rate on loans between associated parties in Croatia since 2016:

The Croatian Minister of Finance’s obligation to determine and publish interest rates for loans between associated parties was established during the third round of Croatian tax reform which brought a number of new or amended regulations into force in 2019.

These rules (OJ L 193, 19.7.2016) aim to implement interest limitation rules in accordance with EU Council Directive (EU) 2016/1164 of 12 July 2016.

Under this law, the interest rate is determined as the arithmetic mean of the average interest rates on the status of loans granted for a period longer than one year to non-financial companies issued by the Croatian National Bank in the current calendar year.

Croatia tax base

According to Croatia’s profit tax law, the tax base is the profit that is assessed pursuant to accounting regulations as the difference between revenue and expenditures before the profit tax calculation, increased and reduced pursuant to the provisions of the act.

The tax base is increased by interest that is not a tax deductible expenditure as per the provisions of the law.

There is different treatment of interest for associated parties, residents, and non-residents. Residents are defined as legal and natural persons whose registered office is registered in the commercial or other registry or record in Croatia, or whose actual business management and supervision location is in Croatia. Residents are also entrepreneurs, namely, natural persons with a permanent residence or habitual residence in Croatia, whose activity is inscribed in a registry or record. A non-resident is a person not fulfilling one of the previous conditions. Associated parties are parties wherein one party participates directly or indirectly in the management, supervision, or capital of the other party or both parties participate directly or indirectly in management, supervision or capital of the company.

Interest determined through transfer pricing methods

Except for the aforementioned, a taxpayer may determine interest according to the conditions and using method provided for transfer pricing on the condition that this method is applied for all agreements.

If agreed prices or other conditions between associated parties in their business relations are different than prices or other conditions that would be agreed between non-associated parties, all profit that would be realised if the taxpayer was a relationship of non-associated parties shall be included in the tax base of associated parties.

In determining and assessing whether business relations between associated parties correspond to market prices, one of the following methods may be used:

- comparable uncontrolled price method

- commercial prices methods

- gross profit on costs

- profit split

- Net gain method

Business relations between associated parties shall be approved only if the taxpayer possesses and, at the demand of the tax administration, provides data and information on associated parties and business relations with these parties about the methods used for determining comparable market prices and the reasons for choosing those concrete methods.

In this way, using the appropriate method for transfer pricing, interest can be determined by associated parties that are residents if one of the associated parties has a privileged tax status, that is, pays profit tax with rates that are lower than the prescribed rate, or if the associated party is exempt from paying profit tax or has the right to transfer tax losses from previous tax periods to the current taxation period.

Shareholder interest and company members’ loans

Interest that is not tax deductible expense includes interest on loans accepted from shareholders or company members that hold at least 25% of the stock or capital shares or voting rights in the taxpayer, if at any time during the taxation period these loans exceed four times the amount of the share that shareholder or company member in capital or voting right, determined in relation to the amount and loan period during the taxation period, except for interest for loans by financial organizations. These interest rates do not include interest on loans received from a shareholder or member of a company that is a bank or other financial organization but include interest on a financial organization that is established to finance a group of associated parties or a person who does not offer loans or loans in the financial market.

Loans of shareholders or company members shall also mean loans by third parties vouched for by the shareholder or company member, and loans from associated parties.

The amount of the shareholder’s or company member’s share in the loan user’s capital is determined for the taxation period as the average capital paid, profit kept and reserves on the last day of every month of the taxation period.

In the case that on income from interest is paid personal income tax, the interest does not increase the profit tax base.

Interest limitation rule

A taxpayer that has tax deductible expense may establish overdue borrowing costs incurred in the tax period only up to 30% profit before interest, taxes, and depreciation (EBITDA) or 3.000.000,00 EUR if such amount is higher.

A taxpayer is considered to have exceeded borrowing costs when the borrowing costs exceed the taxable interest income or other economically identical taxable income.

Borrowing costs include interest expenses on all forms of debt, other costs economically equivalent to interest, and expenses incurred in connection with the raising of finance as defined in national law, including, without being limited to, payments under profit participating loans, imputed interest on instruments such as convertible bonds and zero coupon bonds, amounts under alternative financing arrangements, such as Islamic finance, the finance cost element of finance lease payments, capitalised interest included in the balance sheet value of a related asset, or the amortisation of capitalised interest, amounts measured by reference to a funding return under transfer pricing rules where applicable, notional interest amounts under derivative instruments or hedging arrangements related to an entity’s borrowings, certain foreign exchange gains and losses on borrowings and instruments connected with the raising of finance, guarantee fees for financing arrangements, arrangement fees and similar costs related to the borrowing of funds.

EBITDA calculations only take into account taxable revenues, and before tax, add to the profit the tax deductible depreciation costs and the total borrowing costs. Interest limitations rule shall not apply to ·

- an independent taxpayer, i.e. a non-part of the consolidated group for accounting purposes, who has no associated party within or a permanent establishment, and does not receive or disallow loans to its members or shareholders

- a taxpayer who is a financial company

Financial companies are defined as any of the following entities: credit institutions, investment company, AIFM, UCITS, insurance company, a reinsurance company, an institution for occupational retirement, pension institution, AIF, central counterparty, central securities depository, etc., according to the special regulation.

A taxpayer may exclude exceeding borrowing costs incurred on loans used to fund a long-term public infrastructure project where the project operator, borrowing costs, assets and income are all in the EU. Long-term public infrastructure projects are projects to provide, upgrade, operate and/or maintain a large-scale asset that is considered in the general domestic public interest.

A taxpayer may exceed the overdue borrowing costs in the taxable period for the following three tax periods, but in each tax period to the amount determined by profit tax law. For amounts exceeding overdue borrowing costs that exceed the prescribed amount, the taxpayer shall increase the tax base.

Be the first to comment