By Gonzalo Escalante, Tax Partner, Zegarra Aguilar Abogados, and Tax Law lecturer, Universidad Católica San Pablo

On October 27, María del Carmen Alva Prieto, the prime minister of Peru (whose position still has to be confirmed by Congress) sent to the Peruvian Congress a legislative project (583/2021-PE) that seeks to increase the presumed income applicable to nonresident entities and their branches or other permanent establishments.

Through this document, the executive power has requested that Congress approve its faculty to legislate on several tax matters.

Among other matters, it requests the faculty to modify the income tax law to increase the presumed income rates that apply to non-resident entities and branches or other permanent establishments located in Peru. As the legislative project explains, the increase regards the presumed income rates regulated in article 48 of the income tax law.

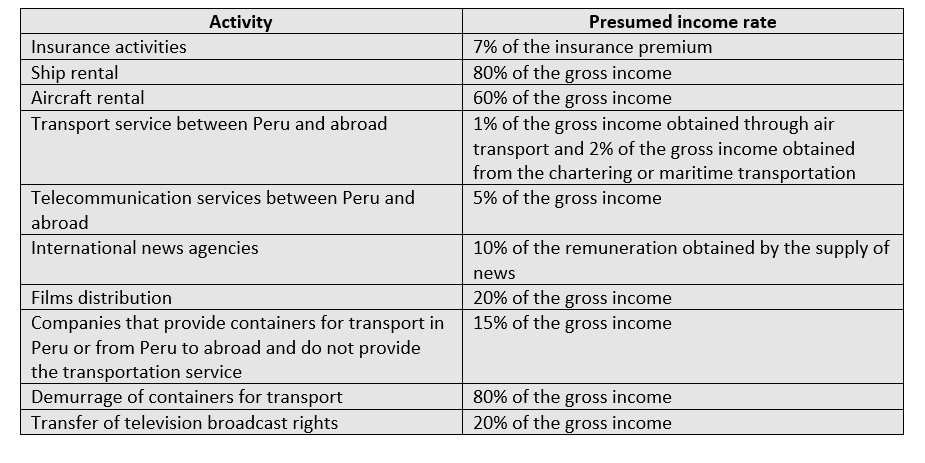

The “presumed income” under this article includes several sources, including those listed in the following table.

It is important to consider that the presumed income rates cannot be adjusted. Therefore, the rate that is legally established for such activities will not be subject to any change, no matter what the taxpayer argues.

The legislative project does not specify which presumed income rates will be increased if Congress approves the request. Nevertheless, it is reasonable to consider that, since one of the objectives of the regulation is to have higher tax revenues, all the activities, or at least most of them, would likely see an increase in the corresponding presumption rate.

The reason offered for such increases is that other countries in the region have higher tax rates for nonresidents than the one in Peru, which currently is 30%.

The legislative project also considers that it is necessary to include new activities as subject to withholding tax on the Peruvian income obtained. The modification, if the project is approved, would consider the extraction and commercialization of hydro-biological resources, such as tuna.

It is up to Congress to decide whether to approve the legislative project. For the relevant changes to the income tax law to come into force in 2022, the executive power would have to enact the corresponding legislative decree before the end of the current year.

—Gonzalo Escalante is a Tax Partner at Zegarra Aguilar Abogados and a Tax Law lecturer at Universidad Católica San Pablo.

Be the first to comment