By Jian-Cheng Ku & Jeroen Swart, DLA Piper Nederland N.V.

As an advocate of the initiatives to discourage tax base erosion and profit shifting, the Netherlands government has chosen to modify almost all of its bilateral tax treaties by the Multilateral Convention to Implement Tax Treaty Related Measures to Prevent Base Erosion and Profit Shifting (Multilateral Instrument), with only limited reservations.

The Dutch House of Representatives has now affirmed this choice, passing a bill on February 12 ratifying the multilateral instrument, with some amendments.

The bill is now subject to the Dutch Senate’s review. After this final approval, the ratification of the Multilateral Instrument will only need to be deposited with the OECD to enter into effect.

Dutch House of Representatives Amendments

Along with the passage of the bill, the Dutch House of Representatives approved an amendment to make a reservation to Article 12 of the Multilateral Instrument, which targets the artificial avoidance of permanent establishment (PE) status.

In short, this provision would have led to PEs being recognized earlier in commissionaire arrangements by expanding the scope of a PE to persons playing a principal role in concluding contracts.

The House of Representatives fears that potential mismatches in the allocation of profits cannot be resolved in the absence of any effective method of dispute resolution. This could result in double taxation.

The reservation to Article 12 is obviously warmly welcomed by Dutch taxpayers with commissionaire structures. However, it is important to note that this reservation will be revisited by the end of 2020.

Principal purpose test

The Multilateral Instrument contains several provisions that may have a significant impact on the tax structure of multinationals.

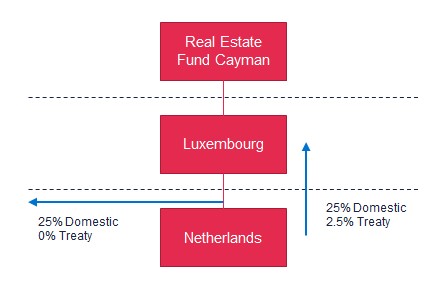

The principal purpose test of the Multilateral Instrument is expected to have the most impact. Please find a simplified illustrative example below.

In this case, assuming that Real Estate Fund Cayman (i.e., located in a country that did not conclude a tax treaty with the Netherlands) does not conduct economic business activities in the Netherlands (materiële onderneming), capital gains and dividend income derived from the Dutch entity are subject to 25% Dutch corporate income tax based on the Dutch foreign taxpayer rule (rate will be reduced to 20.5% in 2021).

However, based on the bilateral tax treaty between the Netherlands and Luxembourg, the Netherlands does not have taxing rights to capital gains and the Dutch tax on dividend distributions is reduced to 2.5%.

However, if a Luxembourg company is interposed with the principal purpose of obtaining tax treaty benefits, having regard to all relevant facts and circumstances, tax treaty benefits will be denied. Absent sufficient substance in Luxembourg, this result is expected.

There are more complex structures implemented which rely on the extensive Dutch treaty network. However, a technical analysis of the principal purpose test exceeds the scope of this article. We advise all multinationals to carefully review their structure to determine the impact of the principal purpose test.

Dual residency

Another provision that may impact multinational structures is the dual resident provision included in Article 4 of the Multilateral Instrument.

Currently, almost all bilateral tax treaties concluded by the Netherlands determine the tax residency of an entity by its place of effective management. Article 4 of the Multilateral Instrument will effectively change this to the place mutual agreed upon by the contracting jurisdictions.

Relevant factors in determining the tax residency are, inter alia, the place of effective management, the place of incorporation, and any other relevant factors. The key determining factor is unfortunately unclear, which leads to uncertainty for taxpayers.

Furthermore, as taxpayers are, in principle, not able to claim treaty benefits until both contracting jurisdictions agree on the tax residency, double taxation may arise.

As a positive note, many other jurisdictions which signed the Multilateral Instrument did not opt for the dual residency provision. As we do not often see dual resident entities with those other jurisdictions that opted for the dual residency provision, we feel that the impact of this provision may be limited (for now).

Permanent Establishment

Finally, we would like to highlight the lowered threshold for permanent establishments. Albeit that the Netherlands made a reservation to one of the provisions which lowers the threshold for permanent establishments, the Multilateral Instrument has other provisions which could also lead to a permanent establishment being recognized earlier.

The main provisions in the Multilateral Instrument lowering the threshold for permanent establishments are listed below:

|

Article 12 – Artificial Avoidance of Permanent Establishment Status through Commissionaire Arrangements and Similar Strategies |

|

As explained in this article, expands the scope of a permanent establishment to persons playing a principal role in concluding contracts |

|

Article 13 – Artificial Avoidance of Permanent Establishment Status through the Specific Activity Exemptions |

|

Provides several options for modifications to permanent establishment. The Netherlands has chosen for option A: limit the availability of the permanent establishment exemption to circumstances where the activity is of a preparatory or auxiliary character. Article 13 also contains an anti-fragmentation rule. |

|

Article 14 – Splitting-up of Contracts |

|

Preventing the splitting of activities to avoid the qualification of a permanent establishment. |

|

Article 15 – Definition of a Person Closely Related to an Enterprise |

|

Defines a closely related person for Articles 12-14. |

Next Steps

It is expected that the Netherlands will deposit the ratification of the Multilateral Instrument before July 1, 2020. If this holds true, the Multilateral Instrument as a whole will enter into effect as of April 1, 2019.

We recommend all multinational entities to review the impact of the Multilateral Instrument on their tax structure. This should be done as soon as possible, but in any case before January 1, 2020.

Be the first to comment