by Dr. Paloma Schwarz Martínez

The Luxembourg government on August 4 released draft legislation for its new intellectual property (IP) tax regime to take effect fiscal year 2018.

Since 2008 Luxembourg has offered a tax incentive consisting of an 80 percent exemption from corporate income tax for qualifying income and capital gains derived from certain types of intellectual property, such as software copyrights, patents, trademarks, service marks, domain names, designs, and models.

Moreover, from 1 January 2009, a 100 percent exemption from net wealth tax (NWT) had been applied to qualifying IP rights.

Following agreement on a modified nexus approach for IP regimes at both the OECD and the EU level, Luxembourg decided to abolish its IP box regime as of 1 July 2016 because the tax incentive did not require a direct connection between research and development (R&D) expenditures, IP assets, and the qualifying income.

As was the case in the previous regime, under the new plan, eligible income from qualifying IP assets will benefit from an 80% exemption from Luxembourg income tax and a full exemption from Luxembourg Net Wealth Tax.

Eligible assets

The proposed regime, introduced by Luxembourg’s Finance Minister as bill n° 7163, would benefit income derived from the following IP assets:

- Patents

- Utility models

- Certain supplementary protection certificates

- Copyrighted software

- Plant breeder’s rights

- Orphan drug designations

The assets must have been created, developed, or further improved after 31 December 2007.

Moreover, unlike to the previous regime, trademarks and designs will no longer be eligible for the tax incentive.

Eligible income

Qualifying income includes royalties, capital gains, and embedded IP income. Expenses for the year and, if applicable, prior tax losses in relation to eligible IP assets must be deducted to determine the net amount eligible for the exemption.

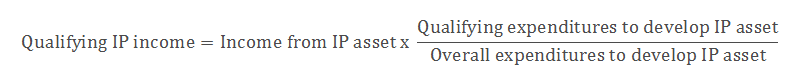

The proportion of income, which may benefit from the 80% exemption must be the same as the proportion of qualifying expenditures to overall expenditures.

Therefore, the qualifying IP income must be calculated as follows:

Qualifying expenditures

Qualifying expenditures include R&D expenditures incurred by the taxpayer and directly related to eligible IP assets.

This does not include acquisition costs, financing costs, and building costs. It should also be noted that outsourcing costs for R&D are eligible as long as these activities are not carried out by related parties.

The new regime provides for the opportunity to apply a 30% uplift to expenditures including qualifying expenditures to remain competitive and to ensure that the new regime does not penalise taxpayers excessively for acquiring IP or outsourcing R&D activities to related parties.

Overall expenditures are the sum of all expenditures that would count as qualifying expenditures if they were undertaken by the taxpayer itself (including acquisition costs).

Outlook

Unlike the previous regime, trademarks, designs, and domain names will no longer be eligible for the tax incentive. At the same time, the Luxembourg government has decided to extent the scope of eligible income. Embedded IP income is no longer limited to self-developed patents.

Taxpayers will have to carry out directly an R&D activity (or source it out to an unrelated party) to benefit from the new regime.

The sole acquisition of a qualifying IP right is no longer sufficient to benefit from the IP regime. The R&D activity does not have to be carried out within Luxembourg (otherwise it would be contrary to the EU fundamental freedoms). It is therefore debatable to what extent the IP box will contribute to more R&D in Luxembourg.

Therefore, to remain competitive, it would be desirable if Luxembourg would also introduce R&D input incentives such as tax credits and super deductions.