By Noopur Trivedi and Jitesh Golani

The past two months have witnessed historic international tax cooperation with 133 jurisdictions agreeing to implement the two-pillar solution set forth in the 1 July OECD/G20 Inclusive Framework statement. As the statement manifests, the tax world can expect the final global minimum tax under “Pillar Two,” including the global anti-base erosion (GloBE) proposal, to be similar to the proposal in the OECD’s October 2020 blueprint.

While there is no dearth of academic literature on a host of intricate rules under the GloBE proposal, not much is discussed around the effect these rules can have when implemented in a typical multinational enterprise (MNE) structure. With the Pillar Two final package knocking on the doors, it is an opportune time to decipher the rules through a stylized case study and discover what has not yet met the eye!

Quick review of the GloBE rules

The GloBE rules apply to MNE groups with consolidated revenues over a EUR 750 million (approximately USD 880 million) threshold as determined under the OECD’s base erosion and profit shifting (BEPS) Action 13 (country-by-country reporting).

As the fundamental objective of the GloBE policy is to stop the race to the bottom amongst tax jurisdictions, the application of the rules begins with the computation of the jurisdictional effective tax rate of the constituent entities. The jurisdictional effective tax rate is compared with the agreed GloBE tax rate (currently a minimum of 15 percent).

The rules for identifying constituent entities and their corresponding jurisdictions are majorly aligned with the country-by-country reporting rules. The entities considered for preparing consolidated financial statements for financial reporting purposes (including those ignored due to size/materiality) are considered constituent entities of the MNE group. Further, a permanent establishment is considered a separate constituent entity in the jurisdiction where it is located, provided it prepares separate financial statements for financial reporting, regulatory, tax reporting, or internal management control purposes.

Additionally, for determining the jurisdiction of certain unique entities/arrangements, the GloBE rules postulate specific guidance. Tax transparent and reverse hybrid entities are tagged to the “stateless” jurisdiction if they are not subject to tax in either the owner’s or the entity’s jurisdiction. Hybrid entities are considered a constituent entity located in the jurisdiction where they are treated as a tax resident.

If the jurisdictional effective tax rate is below the GloBE tax rate, the twin-fold rules of the income inclusion rule and the undertaxed payments rule enter the show for levy and collection of the top-up tax.

The income inclusion rule follows the top-down approach and gives the right to collect the top-up tax to the jurisdiction at the top of the MNE group, which has adopted the income inclusion rule. If the top-most jurisdiction has not adopted the income inclusion rule, the right to collect the top-up tax passes on to the immediately below intermediate parent jurisdiction that has adopted the income inclusion rule. The top-up tax payable under the income inclusion rule is limited to the ownership percentage of the respective parent.

An exception to the top-down approach is the “split-ownership” rule which applies where persons outside the MNE group hold the significant shareholding (20 percent or more) in a constituent entity. The split-ownership rule pushes the obligation to apply the income inclusion rule to the partially owned intermediate parent whose jurisdiction has adopted the income inclusion rule. Further, an intermediate parent shall not apply the income inclusion rule if all its equity interests are held directly/indirectly by another constituent entity whose jurisdiction has applied the income inclusion rule. The split-ownership rule avoids any competitive advantage and other distortion when the ultimate parent entity does not wholly own an intermediate parent entity through which the low-taxed entity is held.

The undertaxed payments rule intends to serve the hybrid purpose of being a backstop to the income inclusion rule and addressing base erosion through deductible intra-group payments. If a constituent entity is not controlled directly/indirectly by another constituent entity whose jurisdiction has adopted the income inclusion rule, then the low-taxed profits of such constituent entity shall be allocated under the undertaxed payments rule in a two-step process. First, allocation is made to the undertaxed payment rule taxpayer as per any direct deductible payments made by such taxpayer to the low-taxed constituent entity. Second, allocation is made to the undertaxed payment rule taxpayer in proportion to the total net intra-group expenditure incurred by all undertaxed payment rule taxpayers.

A stylized case study

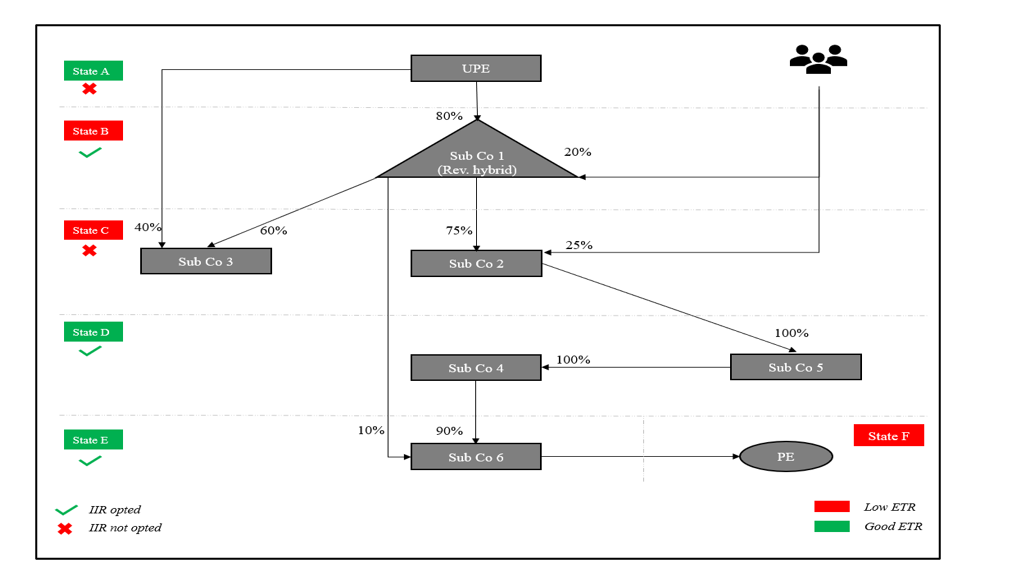

The below hypothetical structure is of an in-scope MNE group based out of State A, which adopts the income inclusion rule.

Sub Co 1 is a low-taxed reverse hybrid entity whose jurisdiction adopts the income inclusion rule. Further, the minority shareholders outside the MNE group hold 20 percent of the shares.

Sub Co 2 and Sub Co 3 are low-taxed entities whose jurisdiction does not adopt the income inclusion rule. Further, the minority shareholders outside the MNE group hold 25 percent of the shares.

Sub Co 4 and Sub Co 5 are located in State D, which applies the income inclusion rule and is a high-tax jurisdiction.

Sub Co 6 is incorporated in State E, a high tax jurisdiction that adopts the income inclusion rule.

Sub Co 6 has a permanent establishment in State F, which is a low tax jurisdiction. The permanent establishment prepares separate financial statements in State F for tax and regulatory purposes.

MNE group structure

Questions on application of GloBE rules in case study

Question 1: For jurisdictional effective tax rate computation, the GloBE rules assign the income and taxes of Sub Co 1 and the permanent establishment of Sub Co 6 to which jurisdictions?

Question 2: For which low-taxed constituent entities would the income inclusion rule apply? Of all the entities where the income inclusion rule applies, which would fall under the top-down approach? For the low-taxed profits of the permanent establishment, which parent entity would be liable to the income inclusion rule as per the split-ownership rule?

Question 3: Would the undertaxed payments rule apply on top-up tax to the extent of 40 percent owned by the ultimate parent entity in Sub Co 3?

Question 4: Does any mechanism currently exist through which top-up tax to the extent of 25 percent held by the minority shareholders in Sub Co 2 would be allocated under the income inclusion rule?

Answer 1: Jurisdiction assignments

Sub Co 1 is a reverse hybrid entity, i.e., it is not a taxable entity in State B, but State A considers it a taxable entity and does not tax its owners for Sub Co 1’s income. The GloBE rules assign such entities to the “stateless” jurisdiction.

Considering that the permanent establishment prepares separate financial statements, it would be a constituent entity separate from Sub Co 6, and for effective tax rate computation, its jurisdiction would be State F.

Answer 2: Income inclusion rule

Regarding Sub Co 1, the ultimate parent entity’s jurisdiction does not apply the income inclusion rule. Thus, the income inclusion rule would not apply to the low-taxed profits of Sub Co 1. Instead, the top-up taxes would be allocated under the undertaxed payments rule as per the two-step process.

Regarding Sub Co 2 and Sub Co 3, the income inclusion rule would apply considering that the jurisdiction of the immediate parent entity (i.e., Sub Co 1) applies the income inclusion rule. The allocation of top-up tax under the income inclusion rule would be limited to the ownership of Sub Co 1 in the respective entities. While Sub Co 1 is tagged to the stateless jurisdiction for effective tax rate computation, State B would be eligible to get the income inclusion rule for the low-taxed profits of Sub Co 1’s subsidiaries (despite being a low-tax jurisdiction!).

With respect to permanent establishment, the income inclusion rule would apply since at least one of its parent entities is located in a jurisdiction adopting the income inclusion rule.

Answer 2: Top-down approach

The top-down approach is the default rule, except when minority shareholding from outside the group is 20 percent or more in a constituent entity below the ultimate parent entity. In the extant case, for all the low-taxed constituent entities where the income inclusion rule is applicable, the minority shareholding from outside the group is 20 percent or more. Thus, the top-down approach will not apply by default, and thus, the split-ownership rule will take over.

For Sub Co 3, it may seem that the top-down approach is being applied as the top-most jurisdiction (after the ultimate parent entity) adopting the income inclusion rule, i.e., State B, collects the top-up tax under the income inclusion rule. However, even if State A adopts the income inclusion rule, the outcome would not change due to the split-ownership rule.

Answer 2: Partially owned intermediate parent

Regarding the partially owned intermediate parent entity for the low-taxed permanent establishment profits – as per the split-ownership rule, a partially owned parent entity shall not apply the income inclusion rule if all its equity interests are held directly or indirectly by the constituent entities required to apply the income inclusion rule.

In the case study: Sub Co 6 and Sub Co 4 shall not be the partially owned intermediate parent since all their equity shares are directly held by a constituent entity, whose jurisdiction adopts the income inclusion rule. Sub Co 2 cannot be the partially owned intermediate parent as its jurisdiction does not adopt the income inclusion rule.

Sub Co 5 shall be the partially owned intermediate parent in the instant case since it is located in State D, which adopts the income inclusion rule, and all of its shares are not held directly/indirectly by a constituent entity whose jurisdiction adopts the income inclusion rule. Accordingly, Sub Co 5 shall apply the income inclusion rule per the split-ownership rule on its 90 percent shareholding in Sub Co 6.

Sub Co 1 shall not be the partially owned intermediate parent due to minority shareholding in Sub Co 2. However, on its 10 percent shareholding in Sub Co 6, no other constituent entity can apply the income inclusion rule under the split-ownership rule. Based on the rationale of the top-down approach, the top-up tax of balance 10 percent shareholding is allocable to the jurisdiction of Sub Co 1.

Answer 3: Undertaxed payments rule

If non-controlling parent entities, whose jurisdictions adopt the income inclusion rule, hold shares in a low-taxed constituent entity, all its top-up tax gets allocated partly under the income inclusion rule and partly under the undertaxed payments rule. However, in the extant case, the controlling parent entity of Sub Co 3, i.e., Sub Co 1, is located in a jurisdiction applying the income inclusion rule. Thus, the undertaxed payments rule would not apply to 40 percent of the ultimate parent entity shareholding. The Pillar Two blueprint highlights this anomaly, and a special rule to address this situation would be a part of the final package.

Answer 4: Collecting top-up tax on minority shareholding

The split-ownership rule does not apply to the income of a low-taxed constituent entity that the minority shareholders directly own. Currently, there is no mechanism to collect the top-up tax on 25 percent minority shareholding in Sub Co 2. Again, the blueprint highlights this lacuna, which the final package should resolve.

Conclusion

The case study barely scratches the surface of the complexities that could exist on Pillar Two’s practical implementation. Navigating the maze of GloBE rules may be nothing short of a Rocky Road for corporates (including those in Dublin!).

— Noopur Trivedi and Jitesh Golani are international tax professionals-cum-researchers, based in India.

The views and opinions expressed are personal. The authors graciously invite comments from readers at [email protected] to discuss and debate this intriguing international tax reform.

Finance for a project

We offer Genuine LOAN, BG &SBLC for sale and lease with strong financial backing from top rated banks across the globe with good track records of proven ability and express delivery.

WE ALSO OFFER MT103 AUTO CASH TRANSFER

Interested agents, brokers, investors and individual proposing local & international projects funding should contact us for directives. We will be glad to share our working procedures with you upon request.

Email: [email protected]

Skype-live:.cid.ce6288f74ce1a8f8

Lucas