By Thomas Schänzle (Partner), Dr. Christian Port (Partner), Florian Gimmler (Partner), Justus Eisenbeiß (Associate), Christian Witthus (Associate), Kevin Prashil Brusa (Economist), Baker McKenzie Rechtsanwaltsgesellschaft mbH von Rechtsanwälten und Steuerberatern, Frankfurt, and Rabea Lingier (Senior Associate), Baker McKenzie Rechtsanwaltsgesellschaft mbH von Rechtsanwälten und Steuerberatern, Düsseldorf

German tax law has undergone significant changes in 2021, with some of the most important changes resulting from the Withholding Tax Relief Modernization Act (AbzStEntModG), which was promulgated on June 8 and came into force on June 9. In addition to changing the procedure for withholding tax refunds and withholding tax exemption certificates, the Act completely revised the German anti-treaty shopping provision and made comprehensive revisions to the transfer pricing provisions.

The Withholding Tax Relief Modernization Act also introduced new rules on the use of losses in legal restructurings, on tax certificates for capital gains tax, and on the exchange of information on tax arrangements using the capital markets.

This article focuses on the far-reaching practical implications of the amendments to the German anti-treaty-shopping provision and the German transfer pricing rules.

Background on German anti-treaty-shopping provision

The German anti-treaty-shopping provision aims at denying the refund of, or the exemption from, German withholding tax to non-resident taxpayers under the applicable Double Tax Treaty (DTT) or under the applicable European Union Directive (Directive) if the payment recipient has been interposed into the structure for the purpose of obtaining a tax benefit, which would otherwise not have been available.

The rule applies primarily to dividend distributions (effective withholding tax rate of 26.375%) and royalty payments (effective withholding tax rate of 15.825%) made by resident taxpayers to non-resident recipients. However, it also applies to royalty payments between non-resident taxpayers for rights that are recorded in a German public book or registry (so-called “extraterritorial taxation of register cases”).

To understand the relevance of the provision, it is important to know that under German law, the payer’s obligation to withhold and remit taxes on corresponding payments exists regardless of whether the recipient is entitled to the benefits of a DTT or a directive. The payer must withhold, report and remit the withholding tax to the German tax authorities regardless of the DTT or Directive unless the payee has received a so-called withholding tax exemption certificate from the German Federal Central Tax Office prior to the payment, confirming that the payer may refrain from withholding tax. However, such withholding tax exemption certificate will only be issued to the payee if the payee’s entitlement to the benefits of the applicable DTT or Directive is not excluded or limited by the German anti-treaty shopping provision.

If the payee does not have a valid exemption certificate from the Federal Central Tax Office at the time of payment, the payer must withhold, report, and remit the tax to the Federal Central Tax Office, and the payee must apply for a subsequent refund. In such refund procedure, the eligibility for a refund depends again on whether the anti-treaty shopping provision precludes the refund.

The new law’s critical amendments to the anti-treaty-shopping provision come against the backdrop of jurisprudence of the European Court of Justice, which held the former versions of the provision to be incompatible with the freedom of establishment (Article 49 TFEU) as well as the Parent-Subsidiary Directive (C-504/16 Deister Holding and C-613/16 Juhler Holding on the provision applicable until 2012; C-440/17 GS on the version applicable for 2012 onwards). A circular issued by the Federal Ministry of Finance (IV B 3 – S 2411/07/10016-14) sought to mitigate the conflict with European Union law by mandating a modified (limited) application of the provision for intra-European Union dividend distributions subject to the Parent-Subsidiary Directive. Whether the now revised anti-treaty shopping provision will achieve the legislature’s proclaimed goal of resolving the conflict with EU law remains doubtful, however.

Revised anti-treaty-shopping provision

Under the new version of the German anti-treaty shopping provision, a foreign corporation shall have no entitlement to relief from German withholding tax insofar as two tests are satisfied. The “Shareholder Test” aka “Look-Through Approach” considers whether persons that have an interest in the foreign corporation or are beneficiaries under its articles of association, foundation or other constitution would not have the same legal entitlement to relief if they received the income directly. The “Income Test“) evaluates whether the source of income has any material connection with an economic activity of this corporation, association of persons or estate.

The earning of the income, its forwarding to associated parties or beneficiary persons as well as an activity, insofar as it is carried out with a business operation which is not appropriately set up for the business purpose, shall not be deemed to be an economic activity. The German anti-treaty shopping provision shall not apply insofar as the corporation, association of persons or estate proves that none of the principal purposes of its involvement is the attainment of a tax advantage (PPT Escape), or if substantial and regular trading takes place with its main class of shares on a recognized stock exchange (ListCo Escape).

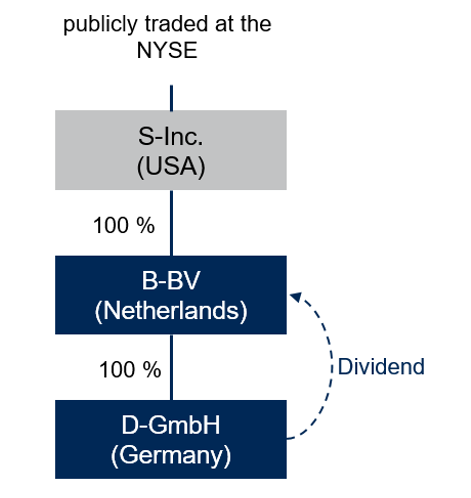

The new anti-treaty shopping provision essentially asks whether the foreign corporation’s direct and indirect shareholder(s) would hypothetically have the same legal entitlement to withholding tax relief if they were the direct recipient of the payment (Shareholder Test or Look-Through-Approach). This constitutes a significant restriction of the personal withholding tax relief eligibility test with great practical implication, as the former version of the anti-treaty shopping provision merely demanded a hypothetical relief claim equal in the amount. The effect can be illustrated by the following example:

In the above example, B-BV would generally be eligible to full relief from German withholding tax under the Parent-Subsidiary Directive. The former version of the German anti-treaty shopping provision would not have restricted or limited B-BV’s entitlement to relief under the Parent-Subsidiary Directive. There is no treaty-shopping situation because the S-Inc. would have been entitled to the same relief (0%) from German withholding tax if it had received the distribution directly. The fact that S-Inc.’s entitlement to relief would have been based on the Germany-US treaty did not matter under the former version of the German anti-treaty shopping provision. Moreover, S-Inc. is a listed stock corporation and, therefore, is per se entitled to DTT benefits under the ListCo Escape.

The outcome is different under the new version of the German anti-treaty shopping provision. The new version requires that the shareholder’s relief claim must have the same legal basis as the applicant’s relief claim. This requirement is not fulfilled in the above example since the applicant’s relief claim is based on the Parent-Subsidiary Directive whereas the parent’s relief claim is based on the Germany-US treaty. Accordingly, the new version of the German anti-treaty shopping provision is, in principle, applicable to the above fact pattern and B-BV will either need to pass the Income Test or the principal purpose test. In summary, the look-through approach is now essentially limited to cases where the applicant and its shareholders reside in the same jurisdiction or where the applicant and the shareholder of the applicant can both claim relief under a Directive.

If the Shareholder Test is “blocked,” the foreign corporation will be entitled to relief from German withholding tax to the extent that the source of income, which generates the income subject to German withholding tax, has a material connection with an economic activity of this corporation, association of persons or estate (Income Test). The Income Test, therefore, requires that the foreign corporation conducts an own economic activity to which the respective source of income has a material link. Merely forwarding income or an activity lacking sufficient business infrastructure does not constitute an economic activity. The same is likely true for passive holding activities. The requirement of a material link between the commercial activity and the income source constitutes a further tightening of the anti-treaty-shopping provision.

If the foreign corporation fails to pass the Income Test, withholding tax relief might still be granted under the PPT Escape. The PPT Escape requires the taxpayer to demonstrate that none of the principal purposes for the interposition of the foreign corporation was to acquire a tax advantage. The test considers all German or foreign tax advantages and takes into account all non-tax reasons including those stemming from group relations. From the taxpayer’s point of view, the PPT Escape is associated with risks and uncertainties. In particular, it is not clear how strictly the German tax authorities will apply the principal purpose test in the future.

Due to the comprehensive tightening of the German anti-treaty shopping provision, German tax advisors are likely to recommend even more frequently in the future to place the German company directly under the top-tier parent company, in particular, if the top-tier parent company is a listed stock corporation. This is because the German anti-treaty shopping provision does not apply to non-resident taxpayers whose principal class of shares are regularly traded on a recognized stock exchange (so-called ListCo Exception). Accordingly, these taxpayers are per se entitled to the benefits of their DTT and or the applicable Directive regardless of whether they are engaged in an own economic activity or whether one of the principal purposes for their interposition was to acquire a tax advantage.

Finally, it should be noted that the new version of the German anti-treaty-shopping provision shall apply in addition to the anti-abuse provisions of the applicable DTT (e.g., the limitation on benefits in Article 28 US/Germany DTT) according to the explanatory statement of the German legislator. This contradicts the previous case law of the Federal Fiscal Court on the former version of the German anti-treaty shopping provision. This is because the Federal Fiscal Court ruled that the former version of the German anti-treaty shopping provision should not apply if the applicable DTT contains a special and conclusive anti-treaty shopping clause, which should then take precedence over the national anti-treaty shopping provision.

Practical and formal considerations of anti-treaty shopping changes

The new version of the German anti-treaty shopping provision is applicable to all payments made from June 9 onwards and to all payments made up and until June 9 if the application of the new version of the German anti-treaty shopping provision is more advantageous to the taxpayer in comparison to the former version. Accordingly, for payments received by June 9, taxpayers may elect to base their claim for withholding tax relief on the former version of the German anti-treaty shopping provision (which permits the look-through approach to a significantly broader extent) or on the new version of the German anti-treaty shopping provision (which incorporates the PPT Escape).

In the future, however, i.e., as of June 9, only the new version of the German anti-treaty shopping provision will apply. The new anti-treaty shopping provision drastically increases the hurdles for taxpayers. The significant restriction of the Shareholder Test or Look-Through Approach de facto leads to a shift in the focus of the examination to the more comprehensive and more difficult Income Test, on the one hand, and the newly introduced and inherently subjective PPT Escape, on the other hand. The result is that both the complexity of the exercise and the uncertainty of the outcome is significantly increased. Multinationals are therefore advised to review their existing structures for compliance with the new version of the German anti-treaty shopping provision and to carefully consider the requirements of the new provision when structuring new arrangements.

Practical and formal considerations of anti-treaty shopping changes

The new version of the German anti-treaty shopping provision is applicable to all payments made from June 9 onwards and to all payments made up and until June 9 if the application of the new version of the German anti-treaty shopping provision is more advantageous to the taxpayer in comparison to the former version. Accordingly, for payments received by June 9, taxpayers may elect to base their claim for withholding tax relief on the former version of the German anti-treaty shopping provision (which permits the look-through approach to a significantly broader extent) or on the new version of the German anti-treaty shopping provision (which incorporates the PPT Escape).

In the future, however, i.e., as of June 9, only the new version of the German anti-treaty shopping provision will apply. The new anti-treaty shopping provision drastically increases the hurdles for taxpayers. The significant restriction of the Shareholder Test or Look-Through Approach de facto leads to a shift in the focus of the examination to the more comprehensive and more difficult Income Test, on the one hand, and the newly introduced and inherently subjective PPT Escape, on the other hand. The result is that both the complexity of the exercise and the uncertainty of the outcome is significantly increased. Multinationals are therefore advised to review their existing structures for compliance with the new version of the German anti-treaty shopping provision and to carefully consider the requirements of the new provision when structuring new arrangements.

Key changes regarding German transfer pricing rules

The Withholding Tax Relief Modernization Act comprehensively revised the transfer pricing adjustment rule contained in Section 1 of the German Foreign Tax Act. It also introduced a separate rule on price adjustment clauses in a new Section 1a of the German Foreign Tax Act. It should be noted that both previous and revised version of Section 1, as well as the new Section 1a of the German Foreign Tax Act, constitute unilateral corrective legislation, which only apply if a deviation from the arm´s length principle is observed to the detriment of the German tax base.

The underlying intention of the legislator with the recent amendment was to align German transfer pricing rules with the OECD Transfer Pricing Guidelines 2017 as well as to adapt the rules to the results of the OECD-BEPS project, notably BEPS Action items 8 to 10. According to the legislative explanatory note, the rules aim at ensuring a fair allocation of taxation rights between the countries in which multinational companies operate. In terms of timing, these new transfer pricing rules are to be applied for the first time for income and corporate income tax purposes for the fiscal year 2022. As such, the previous wording of Section 1 of the German Foreign Tax Act remains applicable for assessment periods until and including 2021.

In addition, the German Ministry of Finance reacted promptly to the new legislation by issuing a new transfer pricing circular dated July 14, 2021, setting out the administrative principles for transfer pricing adjustments pursuant to Section 1 of the Foreign Tax Act (the New TP Principles). These new administrative principles consolidate the administrative view and the interpretation adopted by the German tax administration of the German transfer pricing rules. Further, the New TP Principles also refer to the German Administrative Principles Procedures 2020 of December 3, 2020, issued by the German Ministry of Finance, which contain, in particular, details on the taxpayer’s duty to cooperate with regard to cross-border transactions and any estimations that can be performed by the German tax authorities resulting from potential non-compliance with the rules. In brief, failure to comply with the cooperation and documentation requirements may result, pursuant to Section 162 of the German Fiscal Code, in an estimation of income and/or penalties. The new administrative principles significantly strengthen the position of the German tax authorities. In addition, an increasingly aggressive approach can be observed in tax field audits. A sharp increase in the number of disputes is expected due to the new regulations.

The following will highlight the key changes introduced with respect to transfer pricing through the Withholding Tax Relief Modernization Act.

Introduction of a best method rule

In its previous version, Section 1 (3) of the German Foreign Tax Act stipulated the priority of the so-called “standard methods,” namely the comparable uncontrolled price method (CUP), the resale price method, and the cost plus method, if fully comparable third-party data was available. If only limited comparable third-party data was available, all methods – i.e., standard methods and transactional profit methods, namely transactional net margin method (TNMM) and profit split method – were equally applicable. Further to the implementation of the Withholding Tax Relief Modernization Act, this hierarchy of methods has been abolished. Instead, a best method rule has been introduced and the most appropriate transfer pricing method is now to be applied, in line with the OECD Transfer Pricing Guidelines 2017.

If neither fully nor partly comparable arm’s length prices can be determined, the hypothetical arm’s length test is maintained in the new law. While the principle of the hypothetical arm’s length test has generally remained unchanged, some wording in the law has been adjusted. In the previous version of the law, the arm’s length range under the hypothetical arm’s length test is derived from the maximum price acceptable for the payer (buyer) and the minimum price to be charged by the payee (seller) based on a functional analysis and considering profit potential and function and risk adequate capitalization interest rates. Once a range between maximum and minimum prices has been established (the so-called “area of agreement”), the price that is most likely to be at arm’s-length should be identified and applied. If no such price can be determined, the median value between the maximum and minimum price should be taken.

As a result of the Withholding Tax Relief Modernization Act, the provisions concerning the hypothetical arm’s length test were shortened and restructured. Section 1 (3) of the revised German Foreign Tax Act now requires that it solely be carried out based on economically recognized valuation methods from the perspective of both the provider and the recipient in a transaction.

In juxtaposition to the previous version of the law, the revised law does not explicitly refer to certain factors that need to be taken into account when determining the area of agreement under the hypothetical arm’s length test, such as a functional analysis, the profit potential and function and risk adequate capitalization interest rates. In addition, the previous version of the law required the price to apply that is most likely to be at arm’s-length, and only to the extent that no such price can be determined, the median value should have been used. However, although the application of the median value was the exception to the general rule in determining an arm’s length price pursuant to the law, the exception (i.e., use of the median value) was typically applied in practice.

The new version of the law now prescribes the application of the median value as a general rule, with the exception being that the taxpayer needs to credibly demonstrate that another price within the determined range complies with the arm’s length principle. Interestingly, the revised law does not refer to the price that is most likely to meet the arm’s length principle but solely refers to a price within the determined area of agreement that complies with the arm’s length principle. As such, the wording is formulated more openly compared to the previous version, while practical implications on how to adopt the hypothetical arm’s length test seem to be limited.

Determination of transfer prices ex-ante

Generally, the arm’s length character of transfer prices can be analyzed in form of an ex-ante price setting approach (i.e., whether the transfer price at the moment of agreement to the transaction was at arm’s length) or ex-post based on an outcome testing approach (i.e., whether the result of the transaction was at arm’s length from an ex-post perspective). While members of the German tax authorities (in line with the OECD) have expressed their preference for a price-setting approach in the past and such approach has often been discussed in tax audits, both approaches were in practice generally accepted and frequently applied by both taxpayers and tax authorities.

The new Section 1 (3) of the German Foreign Tax Act now explicitly provides that the circumstances at the time of the agreement underlying the transaction are decisive. This refers amongst others to the contractual terms and conditions of a transaction, the functional and risk profile of the parties involved in the transaction, the economic circumstances of the parties involved and the general economic market conditions, as well as the business strategies pursued by the parties of the transaction. Moreover, the amendments introduced by the Withholding Tax Relief Modernization Act place emphasis on the economic approach and provide general rules for the determination and examination of transfer prices more in line with international practice.

This tightening of the law includes a clear postulation towards an ex-ante price-setting approach, which might lead to complications in practice as sufficient and qualified comparable data are not always available at the moment of the agreement of a transaction and third parties might also negotiate under uncertainty. It is therefore important for the taxpayer to consider the economic circumstances of a transaction for tax purposes and document the transfer prices contemporary.

Determination of interquartile range

A new Section 1 (3a) of the German Foreign Tax Act was introduced by the Withholding Tax Relief Modernization Act that provides details on the ranges of arm’s length data and their narrowing. Essentially, the previous practice that a price range is narrowed in the event of limited comparability remains unchanged. However, according to the previous legal framework, there was no indication of how this narrowing was to be carried out.

Pursuant to the new law, if the values themselves do not provide any indications to the narrowing of the determined range of results, the interquartile range method is to be applied. If the transfer price used by the taxpayer falls outside the (full or narrowed) range, an adjustment to the median is made, unless the taxpayer can credibly demonstrate that a different result (within the range) is more in line with the arm’s length principle.

In summary, this means that the determination of an interquartile range, which has already been common practice in Germany and used in the case of limited comparability, is now covered by German law.

Changes to transfer of functions rules

The rules on transfer of functions have been streamlined and combined in the new Section 1 (3b) of the German Foreign Tax Act. In case of a transfer of a function including the respective opportunities and risks as well as the transferred assets or other benefits (previously and other benefits), a so-called transfer package approach based on the hypothetical arm’s length test must regularly be applied if no comparable data is in place. This means that a total price must be determined for the so-called transfer package as a whole (the function to be transferred including the transferred assets).

In the previous version of the law, there have been exceptions (escape clauses), so that in certain cases no complex transfer package valuation has to be carried out, but individual transfer prices for transferred assets can be applied. These exceptions have been limited to only one escape clause under the new Section 1 (3b) of the German Foreign Tax Act. Taxpayers do not have to apply a transfer package approach if they can credibly demonstrate that no significant intangible assets or other benefits are part of the transfer of functions. This applies for cases in which the transferee solely performs the transferred function for the transferor and is remunerated based on the cost plus method.

The abolition of escape clauses in combination with the slight change in wording regarding the definition of a transfer of function is expected to lead to further cases falling under the regulations regarding transfer of functions, increased compliance effort and additional scrutiny by tax authorities.

Implementation of the DEMPE concept

A completely new regulation was created with Section 1 (3c) of the German Foreign Tax Act providing details on transfer pricing in the case of the transfer and assignment of intangible assets.

This is the first time that the term “intangible asset” has been legally defined in accordance with the OECD Transfer Pricing Guidelines for German transfer pricing purposes. Likewise, the DEMPE concept (Development, Enhancement, Maintenance, Protection, Exploitation) from the OECD’s BEPS action plan is now legally anchored in German tax law. The exercise and control of functions in connection with the development or creation, enhancement, maintenance, protection or exploitation of the intangible asset must be remunerated at arm’s length.

As a consequence, each party contributing to the intellectual property (IP) should be remunerated based on its functional profile in relation to the IP. That means that the residual profit should not necessarily be allocated to the legal or economic owner of the IP, but to the parties contributing to the IP in form of the DEMPE functions. Therefore, an independent functional and risk analysis needs to be performed within the framework of the DEMPE concept. The mere financing function in the development or the creation, preservation or protection of an intangible asset does not in itself entitle to a share of the residual profit from the use of the intangible asset. Rather, it should only receive an arm´s length remuneration for the pure financing function, which typically would consist in a service fee or (low) return on funds invested).

While the alignment with the OECD guidelines can be seen as favorable in terms of international comparability and consistency, current transfer pricing models in relation to intangibles likely need to be reviewed (and revised) based on the new legislation.

Changes to price adjustment clauses

The new Section 1a of the German Foreign Tax Act includes modifications to the price adjustment clause that should align the German regulations with the price adjustment clause as stipulated by the OECD.

Under the previous version of the German law, the price adjustment clause solely applied in the context of the hypothetical arm’s length test in cases of a transfer of functions. According to the new Section 1a of the German Foreign Tax Act, the price adjustment clause is now intended to apply to all transactions involving significant intangible assets or benefits. If the actual subsequent profit development deviates significantly from the profit expectation on which the transfer pricing was based, it can rebuttably be assumed that there were uncertainties with regard to the transfer price determination at the time the transaction was concluded and that independent third parties would have agreed on an appropriate price adjustment clause. A significant deviation exists if the arm’s length price calculated based on the actual profit realized deviates from the transfer price applied by more than 20 percent. The observation period for any transfer pricing adjustments has been shortened from previously ten to seven years after the conclusion of the transaction.

If a price adjustment clause has not been contractually agreed, German tax authorities will in the future have the right to make an adjustment in the eighth year after the transaction in the event of a significant deviation, unless one of three newly formulated exceptions applies that are described in the following.

No adjustment is to be made if, firstly, the taxpayer can either credibly demonstrate that the deviation in profit development is based on unforeseeable circumstances, or, secondly, the taxpayer can demonstrate that it has adequately taken into account all economically relevant uncertainties in its initial pricing, or, thirdly, a sales- or profit-based remuneration (under a license agreement) has been implemented.

Whether the objective to align the new German regulation with the OECD guidance has been achieved remains questionable. In particular, the OECD applies a price adjustment clause only for so-called hard-to-value intangibles and not for any significant intangible asset as provided for in the German law. While German tax authorities might see all significant intangibles also as constituting hard-to-value intangibles, this position is doubtful. At the same time, the OECD proposes only a five-year adjustment period, which, however, only starts from the time when the intangible asset generates income from independent third parties for the first time. This may, under certain circumstances, significantly extend the period under consideration.

Intercompany financing

Special rules on intercompany financing relationships (loans, cash pooling, hedging, guarantees) were originally envisaged in the draft bill for a law to implement the European Union Anti-Tax Avoidance Directive (ATAD) that was published on December 10, 2019, and a revised draft bill on March 24, 2020. According to the draft bills, financing entities (at least for inbound cases) are seen as routine service providers subject to a routine remuneration, typically on a cost plus basis. Moreover, besides a debt capacity and benefit test for the borrower (i.e., the ability to repay the debt), the draft included stricter regulations in relation to the characterization of intercompany financing as debt and a clear tendency towards the group rating instead of the stand-alone rating for determining arm’s length interest rates.

However, the majority of the transfer pricing proposals were no longer included in the ATAD draft bill of November 17, 2020. Instead, they were included in the draft bill of the Withholding Tax Relief Modernization Act of January 20, 2021, however, with some modifications compared to the previous ATAD draft. In particular, the new provisions on intra-group financial transactions were no longer included in the draft bill of the Withholding Tax Relief Modernization Act dated January 20, 2021.

Essentially, the envisaged draft provisions on intercompany financing relationships were finally not adopted by parliament and did not find their way into the Withholding Tax Relief Modernization Act. Nonetheless, the German tax authorities frequently use the criteria / tests contained in the initial ATAD draft bill, such as the debt capacity and benefit test for the borrower, as arguments when analysing intercompany financial transactions. This is also underlined in the New TP Principles. Even though these special rules have not been implemented, from the perspective of the German tax authorities, these criteria / tests are merely a concretization of the arm’s length principle that has applied to date and thus, still apply irrespective of any implementation of these special rules into the law.

New legal basis for the advance pricing agreement (APA) procedure

The Withholding Tax Relief Modernization Act has also introduced a new provision on the advance pricing agreement (APA) procedure in Section 89a of the German Fiscal Code. According to the legislative explanatory note to the law, the intention is to clarify Germany’s desire to engage in APA procedures and to prove that legal certainty is given a very high priority.

The new provision shall apply to all APA requests received by the competent authority after June 8. Until then, the legal basis for APAs was solely a mutual agreement provision comparable to Article 25 of the OECD Model Tax Convention (OECD-MTC) in the applicable double tax agreement in conjunction with German administrative guidelines (circular issued by the Ministry of Finance dated October 5, 2006). Largely, Section 89a of the German Federal Fiscal Code codifies previous practice, however, taxpayers should be aware of subtle changes, some of which might weaken their position.

In line with previous practice, an APA request requires an effective double tax treaty between the Federal Republic of Germany and the other state involved in the matter at hand which must contain a mutual agreement clause. The applicant must be covered under the respective double tax treaty. Furthermore, a successful APA request requires the applicant to show that there is both a risk of double taxation and a likelihood that double taxation can be avoided through the APA procedure and a consistent treaty interpretation can be reached with the competent authority of the other contracting state.

Deviating from previous practice, German tax authorities now have more discretionary power to deny APA requests. On a positive note, however, Germany is now willing to extent the scope of advance mutual agreement procedures beyond cross-border profit allocation cases to all cross-border situations, provided that the procedural requirements for an application are met.

Further subtle changes that might impact taxpayers affect the time period covered by an APA. An APA procedure shall only be granted for a precisely defined set of facts which have not yet materialized at the time the application is filed and for a specific period of validity (to a maximum of five years). However, retroactive effect on previous years, i.e., a roll-back, might be possible for recurring transactions. It is unclear how German tax authorities will handle new APA applications considering the new legal requirements, especially questionable if roll-backs will be granted in line with previous practice or if roll-backs will be handled restrictively.

Another notable change is that Section 89a of the German Fiscal Code stipulates that an APA ceases to be effective not only if the conditions of validity are not observed but also if the other contracting state does not comply with the agreement or if regulations which the APA relies on are changed.

As a result of the new law, there has also been an increase in fees for APAs. In transfer pricing cases, the fee for an initial application is now EUR 30,000 (instead of the previous EUR 20,000), while the fee for renewal applications remains at EUR 15,000. Interestingly, a separate fee for modification requests has been abolished and is thus, no longer available (previously EUR 10,000).

Outlook on the German transfer pricing landscape

The revised Section 1 and introduction of a new Section 1a in the German Foreign Tax Act by the Withholding Tax Relief Modernization Act is the most significant change to German transfer pricing legislation in the past decade. The new regulation aligns German transfer pricing rules with the OECD guidelines and outcomes of the BEPS project. This can be considered a positive development, as it not only provides a clearer structure to Section 1 of the German Foreign Tax Act, but also harmonizes transfer pricing regulations with other countries that also follow the OECD transfer pricing guidelines.

While some of the new rules rather clarify existing practice (e.g., with respect to the status of law of the interquartile range), other changes are likely to have a significant impact on transfer pricing models of multinational firms (e.g., the introduction of the DEMPE concept for intangibles, or changes in the regulations regarding transfer of functions in combination with the revised price adjustment clause).

The German Ministry of Finance also reacted promptly to the new legislation by issuing a new circular dated July 14, setting out the administrative principles for transfer pricing adjustments pursuant to Section 1 of the Foreign Tax Act. The New TP Principles consolidate the administrative view and the interpretation adopted by the German tax administration of the German transfer pricing rules. In particular, these new principles apply, from the perspective of the German tax administration, retroactively to all open cases and must therefore be directly observed both when determining transfer prices and when preparing transfer pricing documentation. In this respect, it is interesting to note that the New TP Principles already make reference to the new legislation as amended by the Withholding Tax Relief Modernization Act, which, however, only have effect as of tax assessment period 2022. The New TP Principles bind the German tax authorities, but neither the German tax courts nor the taxpayer. However, they demonstrate the position taken by the tax authorities, e.g., in the course of a tax field audit. Overall, the New TP Principles have exacerbated the transfer pricing regime in Germany and will likely lead to further scrutiny from the German tax authorities and additional challenges for taxpayers in defending their transfer price setup.

Due to the revised legislation in combination with two new circulars by the Federal Ministry of Finance, which reflect a major change in the German transfer pricing landscape, implications on transfer pricing models of multinational firms and increased scrutiny by German tax authorities can be expected.

Be the first to comment