By Rubeena Dina, Partner at Global Tax Services, UAE, and Director at GTS Africa, Mauritius, and Aniruddha Saha, transfer pricing specialist at GTS Africa

Tax authorities globally are introducing electronic invoicing (e-invoicing) requirements to overcome challenges with the traditional invoice system, which is fraught with issues of non-compliance, inefficiencies, errors, or even fraud in some cases. With a focus on the Middle East and Africa, this article reviews the trend towards e-invoicing and implications for transfer pricing.

E-invoices

Every business in carrying out its day-to-day operations issues and receives thousands of invoices for purchase and sale of goods. An invoice is a time-stamped commercial document that itemizes and records a transaction between a buyer and a seller. Types of invoices may include a paper receipt, a bill of sale, debit note credit note, sales invoice, or online electronic record. Based on these invoices, value-added tax (VAT) – or as known in some countries a goods and services tax (GST) – is calculated for businesses. Tax authorities are informed of these invoices only at the time when businesses file their VAT returns which is always at a much later date from the actual date of invoice generation, and this can adversely affect their cash flow.

An electronic invoice (e-invoice) is an invoice that is issued, transmitted, received, processed, and stored electronically using specific document formats. The generation of e-invoices is digital throughout the entire document life cycle, from issuance to archiving, through a process of authentication on a specified reporting platform implemented by the tax administrations.

For businesses, e-invoicing will have to be integrated in the existing enterprise resource planning (ERP) system, which would involve a certain amount of modification.

Evolution of VAT/GST and transfer pricing in the Middle East and Africa

Across the Middle East and Africa, we have witnessed several taxes-reform measures, and, for the purpose of this article, we are focusing on transfer pricing, VAT, and e-invoicing.

VAT was introduced and reformed in Saudi Arabia, the United Arab Emirates (UAE), Bahrain, Jordan, and Oman following the 2017 signature of the VAT Framework Treaty of the Gulf Cooperation Council (GCC). The more recent development is the introduction of e-invoicing. Saudi Arabia is close to the end of its first implementation phase and is due to have a fully implemented system by 1 January 2023. It is believed that the UAE and other GCC countries could be working on a similar initiative.

While VAT or GST has long been in existence across African jurisdictions, e-invoicing implementation is now gaining traction across the continent. From January 1, 2021, businesses in Uganda are required to use EFRIS (the Electronic Fiscal Receipting and Invoicing System) to report electronic invoices and sales receipts to the Uganda Revenue Authority. Egypt has introduced e-invoicing from November 15, 2020, in a first trial phase for a selection of large businesses, and this will eventually be extended to all VAT registered businesses. In Kenya, electronic tax invoice was rolled out from August 1, 2021, and all VAT-registered taxpayers are required to comply with the electronic tax invoice regulations within 12 months from the date of the rollout.

Transfer prices refer to the terms and conditions which “associated enterprises” agree for transactions that occur between them. According to the Organisation for Economic Co-operation and Development (OECD) transfer pricing guidelines, enterprises are associated if (a) an enterprise participates directly or indirectly in the management, control, or capital of another enterprise or (b) the same persons participate directly or indirectly in the management, control, or capital of two enterprises.

The purpose of transfer pricing regulations is to ensure that all transactions between associated enterprises are priced on an arm’s length basis, i.e., prices that would be charged between independent companies. This is to ensure that profits are not shifted via such transactions from one company to another related company which would result in an unfair tax advantage. The OECD transfer pricing guidelines heavily influence the shape of transfer pricing regulations in many countries.

Transfer pricing regulations were introduced in Saudi Arabia and Qatar effective 2018. Jordan published regulations on 7 June 2021 which came into force from 7 July 2021, and the first filing requirement is expected in 2022. Transfer pricing regulations have also been updated in Egypt with the introduction of mandatory filing in 2018, and, in 2020, penalties for non-compliance with documentation requirements were introduced in the tax laws.

Interaction between VAT and transfer pricing

In the case of transactions between associated enterprises, the value of such transactions needs to be determined using a similar principle under the VAT and transfer pricing rules. The concept of market valuation is used to assess the VAT taxable basis of transactions between associated parties. Tax authorities can substitute the transaction value agreed between associated parties with the market value if the pricing of the transactions is not deemed at fair market value. The concept of fair market value resembles the arm’s length principle under transfer pricing.

E-invoicing and transfer pricing

Whilst e-invoicing rules do not impact the application of the arm’s length principle, taxpayers need to consider the transparency aspect of related party e-invoicing as real-time information will be provided to tax authorities which potentially could be used to monitor the transfer pricing position of taxpayers.

In many cases, multinational entities are required to adjust either costs or sale prices at the year-end to achieve the target transfer pricing position, which complies with the transfer pricing policies of the group. One common situation that gives rise to the requirement to make a year-end adjustment is where the target transfer pricing is based on a forecast, and there are significant differences between the forecast and the actual results. Any subsequent change to transaction values that are effectuated in the form of debit/credit notes or supplementary invoices will have an impact on the VAT liability of a taxpayer.

For instance, in the case of a contract manufacturer, the transfer pricing policy could be to earn an arm’s length target operating cost plus for the functions performed, assets utilized, and risks assumed by that entity. This target mark-up would be achieved by setting the transfer price for the goods sold by that entity based on forecasts of operating costs. If actual operating costs differ significantly from the forecasts, there will be a need for the taxpayer to make an upward or downward adjustment to the transfer price to achieve the target operating markup at the end of the financial year.

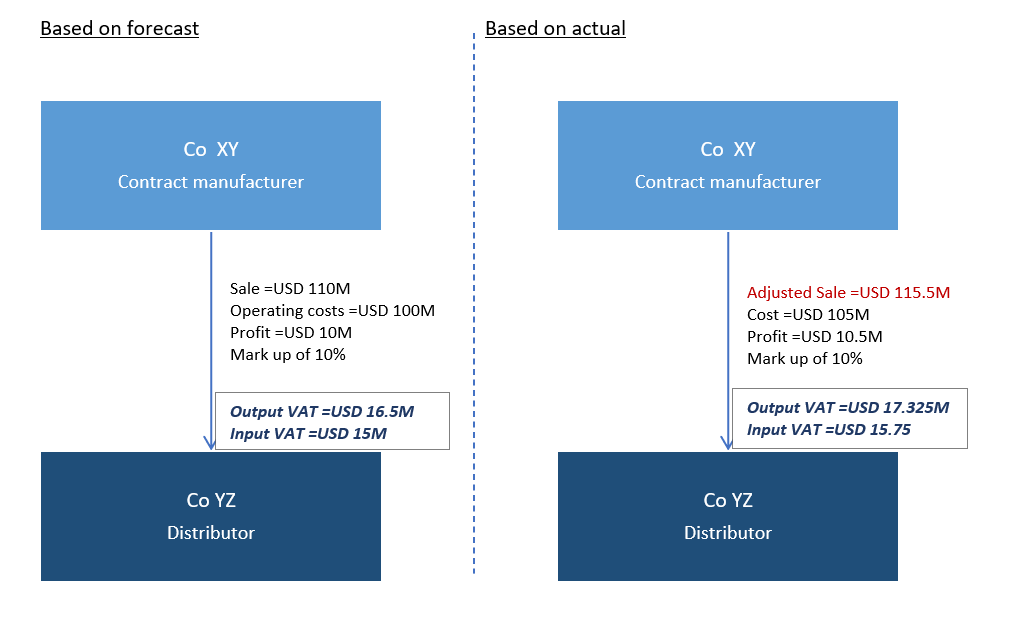

This is illustrated in a simplified example below. Company XY, a contract manufacturer, needs to earn a target profit on operating costs of 10% as per the transfer pricing policy. It sells its products to associated distributor Co YZ. The transfer price of USD 110 million is calculated based on forecast operating costs of USD 100 million.

During the year, Company XY incurs additional operating profit of USD 5 million so that its operating costs rise to USD 105 million. To maintain the target profit on operating costs in line with the transfer pricing policy, Co XY needs to adjust its sale price.

VAT at the standard rate applies at the rate of 15% on the value of transactions, and we assume, for simplicity, that all revenues and costs are subject to VAT at the standard rate.

In this example, the adjustment in the transfer price will be effectuated by supplementary invoices being raised of USD 5.5 million (USD 115.5 – USD 110 million), resulting in an increase in output VAT of USD 825,000.

The e-invoicing system should provide the flexibility for such adjustments to be performed. The use of appropriate technology to provide timely information to tax departments is a critical part of such processes and system design.

Given that transfer pricing adjustments usually relate to transactions that span over a period of time, it may be difficult to trace the transfer pricing adjustments to specific transactions which might attract different VAT rates, e.g., some transactions might be standard rates, others zero-rated, exempt or out of scope. There might be the requirement to develop methodologies that allow businesses to make VAT adjustments to the value of their supplies by apportioning the transfer pricing adjustments using proxies.

Operational transfer pricing

Operational transfer pricing refers to the implementation and execution of transfer pricing policies on a daily basis to ensure that these are accurately reflected in the financial statement of entities. Accordingly, operational transfer pricing is a tool that is used to gather timely, accurate, and most recent information or data points that are used to implement the transfer pricing policy, which finally becomes part of the financial records and ultimately the financial statements of the company. Further, this information is also used for various purposes including transfer pricing reporting, tax reporting, tax return, and VAT calculation.

As the data points used for operational transfer pricing may also be used for VAT calculation, in such a scenario, an interconnecting platform is required to be integrated between operational transfer pricing data points and an e-invoicing system. Accordingly, e-invoicing systems should be carefully designed and implemented to reflect the accurate transfer pricing policy adopted by the taxpayer.

Different types of transfer pricing models are used by multinational enterprises, and these include cost plus mark-up (for service providers or manufacturers), return on sales (for distributors), return on assets (for capital intensive industries), transaction profit split (for highly integrated operations). In a cost-plus model, any change in the definition of operating cost items for the business, which is predefined in the intercompany agreement and the IT system, will need to be taken care of both from an operational transfer pricing perspective and for VAT calculation in parallel. If operational transfer pricing data points and the e-invoicing system are not properly aligned, there is a risk of inconsistent information being potentially presented to the tax authorities.

Potential risks and complications for taxpayers

With real-time invoice reporting to tax authorities and the quantum of information that would be made available to the tax authorities, there could be a risk of ambiguity in data interpretation. Although there is no universal format for e-invoices, some of the data points to be included may include fields like type of goods or services traded, price, date, mode of payment, interest, or miscellaneous charges, if any, and business relationship between the entities. In the early stages post-implementation, tax administrators will find themselves with a vast amount of data, which they might not previously have had easy access to and are not used to interpreting. In many of the Middle East and African countries where e-invoicing is being implemented, transfer pricing capabilities are being further developed, and until the full capabilities are reached, multinationals might have many queries from tax authorities.

The transactional net margin method (TNMM) is a widely used method to prove arm’s length. There could be increasing risk, for multinationals, of challenges brought by tax authorities with regards to the suitability of TNMM in view of the availability of detailed information of goods and services traded which would become available via the e-invoicing platform. Tax authorities might want to see more comparable third parties’ prices used in proving arm’s length.

There is no global standard for e-invoices and hence different countries are implementing e-invoicing regimes in different ways. Countries like Singapore, Hong Kong, and Australia operate an open e-invoicing framework whereby the software systems of businesses can interact seamlessly, and tax authorities verify the transactions after completion. Other countries like Russia, Chile, Mexico, and Egypt use the clearance model which requires approval of transactions by tax authorities pre-issuance. The second planned phase of implementation in Saudi Arabia suggests a move towards a clearance-based model, and it is expected that other countries in the Gulf region will explore this model.

As well as having to deal with a growing number of tax generation rules in different countries, multinationals would need to understand each country’s technical, data and field structure requirements. From an intercompany financial management perspective, e-invoices may create a set of invoicing hurdles that can impact intercompany processes for conglomerates.

Conclusion

E-invoicing systems should provide the flexibility for transfer pricing adjustments to be performed. The system should be designed to enable the identification of relevant sources of information flow and links with tax reporting, regulatory requirements and with the internal processes that would ultimately lead to an appropriate transfer pricing policy to be adhered to by the related parties.

While there are undoubtedly long-term cost savings to be gained from e-invoicing, the concern for most businesses is implementation costs. These expenses are recurring if countries implement differing requirements and multinationals will be impacted when undertaking group transactions.

A holistic approach is recommended during the implementation of an e-invoicing platform where direct and indirect tax teams work together to ensure a tax ecosystem that generates consistent information.

Very valuable views expressed. Indeed both the tax authorities and taxpayers , through their representatives, should engage more to smoothen implementation of e-invoicing.

Hi Paul

Thank you for your comment. Indeed, there are some Tax Administrators who work with industry groups on the implementation of such initiatives or as we are finding across Africa, there is increasing cooperation and exchange of know-how between the different authorities. As the platform for e-invoicing interacts with taxpayers, engagement with them, as you pointed out, is very important.

Very valuable information,in 2022 e invoicing in mandatory in uae?

Thanks for the article on E-invoicing and interaction with transfer pricing: a Middle East and African perspective.Looking forward for more articles like this.