by Jian-Cheng Ku, Tim Mulder, and Rhys Bane, DLA Piper, Amsterdam

The Dutch tax consolidation regime violates EU concepts of freedom of establishment and is thus contrary to EU law, the Advocate General of the Court of Justice of the European Union (CJEU) said, in an opinion delivered October 25, 2017.

In joined cases, X BV (Case C-398/16) and X NV (Case C-399/16) Advocate General Campos Sánchez-Bordona states that the per-element approach, as adopted by the CJEU in the Groupe Steria (Case C-386/14), should be applied to the Dutch fiscal consolidation regime because, to do otherwise, would lead to different treatment of taxpayers that have a resident subsidiary as opposed to Dutch taxpayers that have a non-resident subsidiary.

Just after the Advocate General delivered his opinion, the Dutch State Secretary of Finance announced emergency reparatory legislation which would have retrospective effect to the time and date of publication, being October 25, 2017, at 11:00, a.m (CET).

The cases relate to the application of the Dutch interest deduction limitation rule to prevent base erosion and the non-deductibility of currency losses on a participation in a non-Dutch/EU subsidiary under the Dutch participation exemption.

CJEU Groupe Steria case

In Groupe Steria, the CJEU decided that the French group taxation regime could be considered an infringement of the freedom of establishment.

Under the French rule, a full tax exemption on dividend income is granted only if such income is received from a company belonging to the same tax-integrated group (i.e., fiscal unity).

Since French parent companies cannot form a fiscal unity with their foreign subsidiary companies under French tax law, the full tax exemption is unavailable for dividends from subsidiaries established in other Member States. This is an unjustifiable restriction to the freedom of establishment, the court said.

Interest deduction limitation

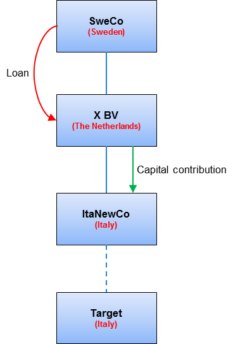

In X BV versus the State Secretary of Finance, X BV is part of a Swedish group and holds shares in an Italian company. To acquire the shares in the Italian company, X BV incorporated another Italian company (ItaNewCo), to which it contributed capital. The contribution was financed by means of a loan to X BV attracted from its Swedish parent company.

The Dutch interest deduction limitation rule, (Article 10a, Dutch Corporate Income Tax Act 1969 (CITA)) denies the deduction of interest paid by Dutch corporate taxpayers to a related party where the relevant debt is connected with a capital contribution in a subsidiary.

For a visual representation, see the figure below.

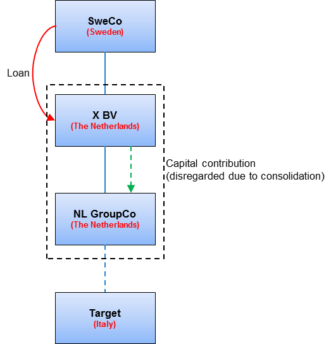

The tax treatment would have been different if ItaNewCo would have been established in the Netherlands and was part of a Dutch consolidated tax group.

Hence, the capital contribution would not have been recognized for tax purposes as a result of the consolidation and as such the interest would have been deductible. Since, generally, only Dutch resident companies can be part of a consolidated tax group this would create a difference in taxation that would be an infringement of the freedom of establishment.

For a visual representation, see the figure below.

To resolve, AG proposes that the CJEU to rule that the denial of the deduction of interest in the case of X BV versus the State Secretary of Finance constitutes an infringement of the freedom of establishment, leading to the application of the per-element approach as the ECJ ruled in the Groupe Steria case.

Currency losses on participations

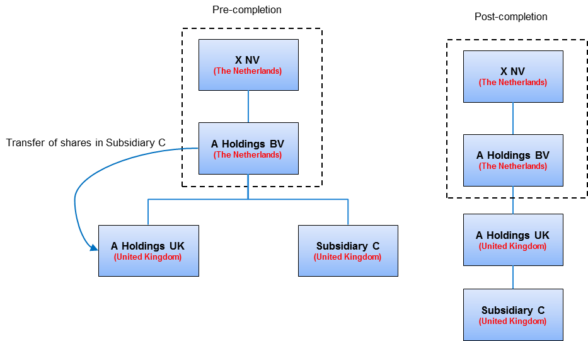

In X NV versus State Secretary of Finance, X NV belongs to a group of companies that applies the Dutch fiscal consolidation regime.

A Holdings BV, a subsidiary of X NV, holds all the shares in a UK participation: A Holdings UK.

In November 2008, A Holdings BV transferred all its shares in A Holdings UK to its UK subsidiary C. Furthermore, X NV sought to deduct losses resulting from the fluctuations of the exchange rate in its corporate income tax returns for the fiscal years 2008 and 2009.

The deduction was denied pursuant to Article 13(1) CITA.

For a visual representation, see the figure below.

In the post-completion figure the currency losses on the shares in subsidiary C would be deductible if A Holdings UK could be included in the fiscal unity, whereas the currency losses would not be deductible when the participation exemption applies, which is the case in the post-completion figure.

In the case of X NV versus the State Secretary of Finance, the Advocate General is of the opinion that in the case the difference in treatment of the currency loss in the value of the shares held by the parent company in the non-resident subsidiary, when the non-resident subsidiary cannot form a part of the fiscal unity, does not limit the freedom of establishment for the same reason as in the 2015 decision in X AB v. Skatteverket (C-686/13).

Potential impact of AG’s opinion

If the CJEU were to follow this opinion, the per-element approach would be applicable to the Dutch fiscal consolidation regime, which would lead to the possibility for taxpayers to cherry-pick advantages provided by the consolidation regime, thereby excluding the disadvantages of the regime.

In practice, this per-element approach would have consequences for the application of the anti-base erosion rules (Article 10a CITA), the participation exemption (Article 13 CITA, more specifically paragraphs 9 up to and including 15 and 17 CITA), the interest deduction limitation for excessive participation interest (Article 13l CITA) and the loss setoff in case of a change of shareholders (Article 20a CITA).

If the CJEU would follow the opinion of the AG, at the very least, the interest that was previously non-deductible due to the application of Article 10a CITA, would be deductible.

Announced reparatory legislation

Dutch State Secretary of Finance emergency legislation includes proposed changes to anti-abuse rules that would be affected by the ‘per-element approach’ in the CITA and the Dividend Withholding Tax Act of 1965 (“DWTA”).

The following CITA provisions would be modified to be applied as if the consolidation regime was not applicable to the group of taxpayers: Articles 10a (anti-profit shifting), 13 paragraph 9 up to and including 15 and 17 (participation exemption), 13l (interest deduction limitation for excessive participation interest) and 20a (loss setoff in case of a change of shareholders).

For the DWTA, Article 11, paragraph 4 (rebate for the redistribution of dividends for taxpayers applying the consolidation regime) would be removed.

The Dutch Association of Tax Advisers has published its commentary on the proposed changes in legislation, noting that it contains a large quantity of overkill and may have an impact on the Netherlands its attractive business climate.

–Jian-Cheng Ku is a Tax Adviser with DLA Piper, Amsterdam. He advises on international tax law and transfer pricing with a particular focus on international tax planning, M&A and private equity transactions, corporate reorganisations, and planning and design of transfer pricing policies.

-Tim Mulder is a Tax Adviser with DLA Piper, Amsterdam. Tim advises on Dutch and international tax aspects relating to international tax planning, M&A transactions, corporate restructurings, private equity and investment fund transactions.

-Rhys Bane is a Legal Assistant with DLA Piper, Amsterdam. Rhys Bane studies Tax Law at Leiden University. His focus lies on international tax planning, M&A, corporate restructurings and tax policy & legislation.

Be the first to comment