By Clive Jie-A-Joen, Counsel, and Monique van Herksen, Partner, Simmons & Simmons LLP, Amsterdam

The Dutch Revenue Service’s 2020 annual report on international tax rulings published 15 June provides preliminary insight into experiences with advance pricing agreements (APAs) and other international tax rulings in the first full year of the revised Dutch ruling practice.

The report, which the Dutch Revenue Service issues annually on rulings dealing with international transactions, includes information on granted, rejected and withdrawn APAs, advance tax rulings, innovation box and other rulings with an international character.

The 2020 report includes the first full year of data under the new rules and procedures of the revised Dutch ruling practice that are effective as of 1 July 2019. This article largely focuses on the APAs that were issued.

Revised Dutch ruling practice

The revised Dutch ruling practice took effect on 1 July 2019 and applies to rulings with an “international character.” This includes APAs, which serve to provide advance certainty on the determination of an arm’s length remuneration or a method for determining an arm’s length remuneration for international controlled transactions and dealings. It also includes advance tax rulings, which consist of an agreement with the Dutch Tax Authorities on the taxing rights and obligations resulting from the application of Dutch tax laws and regulations in a taxpayer-specific situation.

The revised Dutch ruling practice introduced updated measures on transparency, stricter requirements to qualify for rulings and additional reviews embedded in the process of issuing rulings to assure that rulings are only issued in situations that can withstand parliamentary and international scrutiny.

The revisions are targeted to safeguard and increase the quality and robustness of the Dutch ruling practice for companies with so-called “real” activities in the Netherlands. An anonymized summary is published of each granted ruling. Ruling requests that did not result in a ruling are also summarized and published.

There is a stricter substance standard for taxpayers who request a ruling with an international character than before. A ruling will only be granted to a taxpayer that is part of a multinational enterprise group that carries out commercial operating activities in the Netherlands (i.e., has economic nexus with the Netherlands). In addition, the commercial operating activities must be performed for the risk and account of the requesting taxpayer for which there is adequate staff available at the group level that are operating in the Netherlands. The activities must furthermore fit the functional profile of the taxpayer within the group.

No ruling will be granted if the taxpayer’s sole or key motive for the transaction or structure is to save Dutch or foreign taxes. Rulings will also not be available in case of transactions with entities established in countries that are on the EU list of non-cooperative jurisdictions for tax purposes or with entities that are established in jurisdictions that qualify as low tax jurisdictions.

All ruling requests must be reviewed twice: a new “International Fiscal Certainty College” was formed with centralized authority to sign off on rulings that are subject to a two-signature requirement. The new process serves to assist with securing better quality rulings and policy consistency.

Ruling practice developments in 2019

As was already expected, the revised Dutch ruling practice led to a significant decrease in the number of ruling requests from 619 in the first half of 2019 (i.e., 1 January 2019 – 30 June 2019) to 298 in the second half of 2019 (i.e., 1 July 2019 – 31 December 2019). The number of rulings granted was respectively 682 and 116 in the first half and second half of 2019. Some of the rulings granted in the first half of 2019 were obviously requested in 2018.

The significant decrease in the second half may have resulted from a rush to obtain tax rulings before the revised ruling practice with more strict rules became effective on 1 July 2019. In addition, the use of open norms in the new ruling regime, such as the term ‘economic nexus’ and ‘tax savings’, are credited for creating uncertainty regarding whether a ruling can be obtained in certain cases, since 1 July 2019.

Key figures from the 2020 annual report

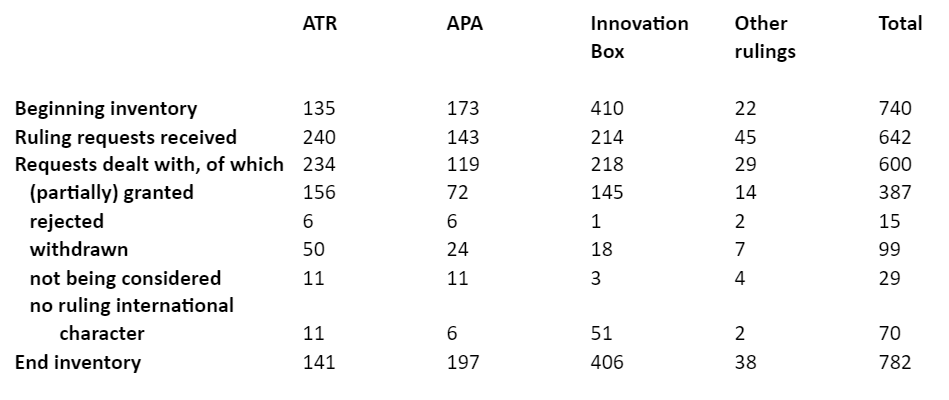

The below table presents the key figures for 2020.

“Innovation Box” rulings regard requests for application of a fiscal stimulus regime that was introduced in 2007 and allows companies in the Netherlands to have profits derived from (qualifying) intellectual property to be taxed at an effective 9% rate, instead of the regular corporate income tax rate of 15%–25%.

The table indicates that 642 ruling requests were received in 2020, which was proportionally an increase in the number of ruling requests as compared to the second half of 2019 (i.e., 298) but a decrease as compared to the first half of 2019 (i.e., 619).

It follows from the statistics that a significant number of the requests did not lead to a ruling (i.e., 143 ruling requests were rejected, withdrawn or not considered). A possible explanation for that is that in 2020 experience was still being gained with respect to the interpretation of the open norms of the revised Dutch tax ruling practice, including aspects such as ‘economic nexus’ and ’tax savings’.

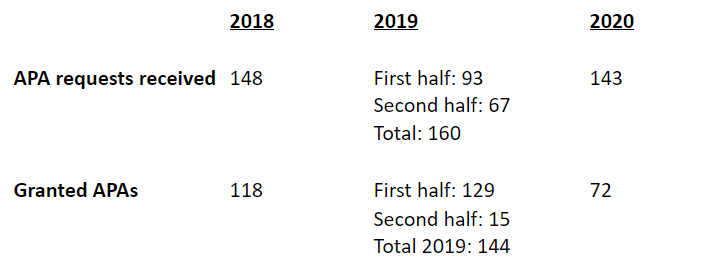

Focusing on APAs, the below table presents the number of APA requests received and granted in 2018, 2019 and 2020.

While the number of APA requests in 2020 seems to be about the same level (or a bit lower) as that in 2019, the number of granted APAs decreased significantly in 2020 as compared to the previous years.

It is too early to say that these statistics can be considered illustrative or indicative for the future, however. The year 2020 was a highly distinct year for many businesses because of the COVID-19 pandemic. While the pandemic led to logistical challenges (for example, ruling-related consultations mostly took place online), it also caused taxpayers to reconsider locking themselves into advance certainty as the future was so highly unpredictable.

In over 95% of the cases, anonymized summaries of the granted rulings were published on the website of the Dutch tax authorities, leading to significant transparency.

The annual report confirms that template-based information on cross-border rulings (and APAs) were exchanged with foreign tax authorities in European and OECD countries in 2020 consistent with the transparency procedures that became effective in 2017 and 2016 respectively, as a result of the EU Directive on Administrative Cooperation in the field of taxation 2011/16/EU and OECD BEPS Action 5.

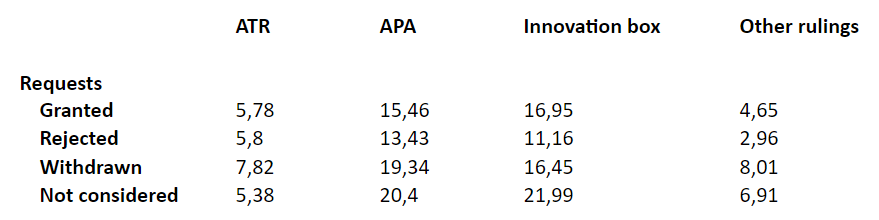

Gross lead time / turnaround time 2020 (denoted in months)

The below table presents the turnaround time of the various rulings in 2020 denoted in months (including waiting time), referenced as “gross turnaround time” in the annual report (in reports prior to 2018 a so-called “chess-clock” principle was used, which excluded waiting times).

The reported information indicates that the gross turnaround time was longer in 2020 as compared to the second half of 2019, except for advance tax rulings.

Types of APAs granted in 2020

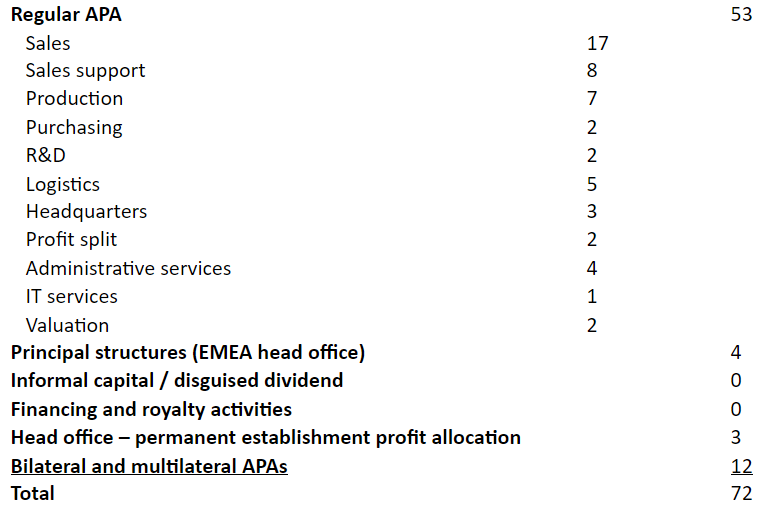

The table below presents the types of APAs granted in 2020. By far the most APAs were granted for sales activities. No APAs were granted for intermediary financing and royalty activities in the context of financial service entities in the Netherlands in 2020.

While the OECD guidance on financial transactions was formally published in February 2020, there were no APAs concluded for intra-group financial transactions (e.g., loans, cash pooling, financial guarantees and captive insurance).

The challenge encountered in practice with obtaining an APA for an intra-group loan is that an assessment must be made of the debt-equity ratio of the taxpayer based on the arm’s length principle prior to pricing the loan. In the Netherlands, there is a history of Supreme Court decisions with respect to non-arm’s length loans that do not apply the arm’s length principle, however.

This peculiarity largely reduces the interest of taxpayers in obtaining an APA for intercompany financial transactions and makes it more complex for the tax authorities to insist on application of the arm’s length principle. That may contribute towards the absence of APAs on financial transactions.

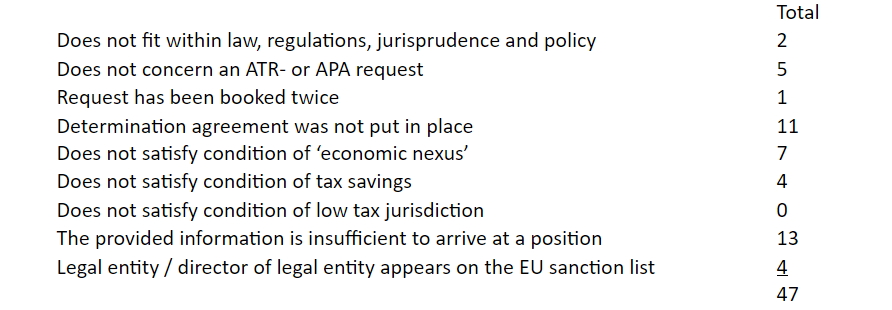

Reasons for rejected APA requests

The below table presents the reasons based on which 47 rulings were rejected, withdrawn, not considered or deemed to be not of an international character. Two main reasons for rejecting an APA request were that the determination agreement reflecting the agreement reached (if any) was eventually not put in place and that the information provided was insufficient to arrive at an agreed position.

Anonymized summaries of APA requests dealt with in 2020

Under the 2019 revised Dutch ruling practice, an anonymized summary must be published of each ruling request irrespective of whether this request will result in a ruling. In 2020, an anonymized summary was published for 113 of the 119 APA requests. The other six APA requests were deemed to not be ruling requests with an international character, and therefore not considered subject to the anonymous summary requirement.

The anonymized summary lists the following information: cause of ruling request, facts, legal framework, considerations and conclusions. It usually ends up being about one to three pages long.

A review of the anonymized summaries provides further insights into the functioning of the revised Dutch tax ruling practice and the reasons why certain requests were withdrawn or not considered.

In the bulk of the granted APAs, the transactional net margin method was the transfer pricing method used to determine an arm’s length remuneration. The summaries of the 2020 APAs usually present the interquartile range of results of the identified comparables. In practice, the median of the results (or close to the median) is the margin that is most often applied in the eventual APA determination agreement. The summaries reviewed do not disclose the actually agreed (median) margin, however, they only provide the interquartile range.

In several of the APA summaries, the transactional net margin method is substantiated as being the most appropriate method by stating (with a consistent text) that an analysis of operating margins provides a reliable outcome as compared to a method based on gross margins, since the latter is dependent on cost classification, which information is unavailable for the independent comparable parties. In addition, a comparable uncontrolled price could not be identified. Furthermore, it is explained that one of the related parties to the controlled transaction is regarded as the tested party as it is the least complex party.

Apparently, for two out of the 53 granted regular APAs, the profit split method was applied.

Two granted APAs concern a valuation for which the discounted cash flow method was applied. One of these APAs regards European trademarks in which the parties agreed on a price adjustment clause.

Economic nexus

Rulings with an international character will only be granted if taxpayers have (sufficient) economic nexus with the Netherlands. This being an open norm, it is not clear what ‘economic nexus’ precisely means. The following example was provided by the Dutch State Secretary of Finance in a letter to Dutch Parliament (dated 23 April 2019) to illustrate (the absence of sufficient) ‘economic nexus’:

A large internationally operating group with a finance department abroad with 75 FTE also has part of its function in the Netherlands consisting of 2 FTE. All financial flows run through the Netherlands, reducing foreign withholding tax. The ratio of the number of employees abroad as compared to the Netherlands in combination with the fact that all financial flows run through the Netherlands means that there is insufficient ‘economic nexus’ for a ruling. In addition, it is plausible (due to the low nexus) that the financial flows are included in the Dutch accounts in order to avoid foreign withholding tax.

The Annual Report provides that when assessing if there is sufficient economic nexus, the relationship between the functions performed in the Netherlands, assets in the Netherlands or activities carried out in the Netherlands, as compared to comparable factors for the group abroad, may (inter alia) be considered.

In that context, it will be considered whether a relevant reflection of the activities is provided, both quantitatively and above all qualitatively. For example, if a Dutch entity manages a certain number of assets, it can be considered what number of such assets the multinational group manages outside of the Netherlands and whether the functionality in the Netherlands is reasonably proportional to comparable functionality performed outside of the Netherlands.

Example #7 of the document “Examples of access / no access to ruling of an international character” makes it clear that the hiring of staff from inside or outside the group may be taken into account when assessing whether there is an economic nexus, provided that that staff carries out their work in the Netherlands.

The question has been raised as to whether the hiring of staff includes the outsourcing of work to (unaffiliated) service providers established in the Netherlands. The outsourcing of services can be taken into account only to the extent that there is control by the people present at the taxable entity in the Netherlands. It depends on the specific circumstances when this is the case and to what extent it is the case.

With respect to financing activities of companies whose financial flows are included in the Dutch accounts, the annual report remarks that there is sufficient economic nexus if there are relevant functions in the Netherlands to manage the financing risks. Joint control, as described in the OECD guidelines, will also lead to sufficient economic nexus. If the functionality in the Netherlands is not sufficient, these will be considered mere support functions. In that case, there is insufficient economic nexus with regard to the financing activities and no advance certainty can be provided.

Transfer of intangibles

While transfers of intangibles may seem to be the ultimate area for which advance certainty can be beneficial, it is important to note that no APA will be available in cases of transfers of intangibles from a jurisdiction where the value increase (step-up in basis) of the intangible will not be taxed at the moment of the transfer out of the country or if no relevant functions are being performed in relation to the intangible in that location. This is because no tax certainty will be provided in cases where mismatches in taxation occur.

An APA is also not available when intangibles are being transferred to the Netherlands from a “CV-BV” structure. Obtaining an APA is possible, however, if it regards the (level of) remuneration for activities conducted in the Netherlands in relation to intangibles that are transferred from a CV-BV structure to a foreign jurisdiction.

Ruling practice in relation to business climate

The annual report provides in relevant part that the contact point for potential foreign investors has signaled that taxation appears to play a less decisive role in the choice to locate business activities in the Netherlands than it has in the past. This undoubtedly will be welcome news for the Dutch State Secretary of Finance, considering that the Netherlands has been criticized for being a tax haven and is trying hard to shake that image.

However, obtaining advance certainty on the fiscal consequences of legitimate investments is still seen as an important (and attractive) part of the Dutch business climate given the relevant (inter)national developments and uncertainty on this aspect. An accessible (Dutch) tax authority that provides clear guidance and certainty on the fiscal implications of investments in the Netherlands is perceived as positive by foreign investors.

Concluding remarks

The Dutch tax authorities will continue to accommodate taxpayers with tax certainty and support the Dutch investment climate, provided there is sufficient economic nexus with The Netherlands as regards the activities or structure for which an advance determination is requested. However, structures that mainly serve to avoid or reduce (Dutch or foreign) taxation will not be eligible for advance tax certainty.

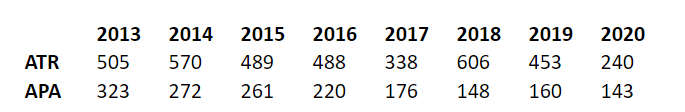

The revised ruling practice will likely continue to impact the number of rulings that will be requested and issued going forward. In recent years, a decline in ruling requests can be observed – witness the below table on received advance tax ruling and APA requests, which will probably continue.

The mandatory exchange of rulings to EU Member States and currently unfavorable impression that rulings are having in the public eye certainly will have contributed to the reduced requests for rulings as well.

If the Dutch State Secretary of Finance wants to continue to offer advance certainty – while assuring that the revised rules and strict thresholds are met and that the quality of rulings that are issued meets the current standards of transparency and scrutiny in the global tax world – further investment in time and resources at the level of the advance tax ruling and APA teams will simply be unavoidable.

—Clive Jie-A-Joen is Counsel and Monique van Herksen is Partner at Simmons & Simmons LLP, Amsterdam.

Be the first to comment