By Jian-Cheng Ku, Gabriël van Gelder, & Mehdi el Manouzi, DLA Piper, Amsterdam

A member of the Dutch political party “Groenlinks” has proposed to introduce an exit tax to the Dutch dividend withholding tax.

If enacted, this controversial proposal would apply to all Dutch resident companies undertaking certain cross-border reorganizations as of September 18, 2020.

Here we discuss this legislative proposal and flag areas that MNEs active in the Netherlands need to consider.

Background of the proposal

To have a proper understanding of the motivation for this Dutch member parliament’s bill, it is key to place the legislative proposal in the right context.

In 2017, the Dutch government announced its intention to abolish the dividend withholding tax as of 2019.

The announcement led to political arguments between the government and the opposition. Outside Parliament, there was strong public discontent with the proposal to abolish the dividend withholding tax as the government failed to substantiate its proposal with strong economic arguments on why the benefits outweighed the costs.

The Dutch government tried to justify the abolishment of the dividend withholding tax by stressing the improvement of the business climate and keeping the Netherlands attractive for existing and new headquarters of (listed) MNEs.

For completeness’ sake, we point out that the abolishment of the dividend withholding tax had been on the wish list of Dutch MNEs listed on the Dutch stock exchange (Euronext Amsterdam) for many years.

The reason for the proposal is that in some cases, the levy of dividend withholding tax for (portfolio) investors is a final tax levy (i.e., no possibility of a (full) tax credit in the investor’s state), which puts pressure on the stock price of Dutch companies.

The battle for dual-headed Anglo-Dutch companies

Another reason why the Dutch government advocated for the abolishment of the dividend withholding tax is to assure that certain MNEs with a dual-headed structure in the UK and the Netherlands would choose the Netherlands over the UK as their sole headquarters.

Although, the Netherlands has a very attractive corporate law and tax system which makes it a favourable jurisdiction to headquarter an MNE, the levy of dividend withholding tax is a disadvantage with respect to non-corporate portfolio shareholders.

On the other hand, the departure of the UK from the European Union, with the lack of certainty that a (favourable) withdrawal deal will be reached, is a strong disadvantage to the UK.

Despite intense efforts of the government to defend the abolishment of the dividend withholding tax, the government withdrew its plans due to the severe public pressure. Alternative measures were instead announced to improve the business climate (e.g., a lower corporate income tax rate).

When it became clear that abolishing the Dutch dividend withholding tax was not feasible, one dual-headquartered Dutch MNE announced that it would unify its dual-head structure by relocating its headquarter into one London-based HQ structure.

In response to the announcement that the concerning MNE was planning to pick the UK over the Netherlands, an opposition member of Parliament submitted a legislative proposal to introduce a final settlement for Dutch dividend withholding tax purposes aimed at certain companies that relocate their headquarter from the Netherlands to certain jurisdictions (see next section for the details).

Legislative proposal in short

The proposal introduces a conditional exit tax for Dutch dividend withholding tax purposes.

The exit tax only applies for certain cross-border reorganizations to jurisdictions that are considered a “qualifying state”.

Cross-border reorganizations

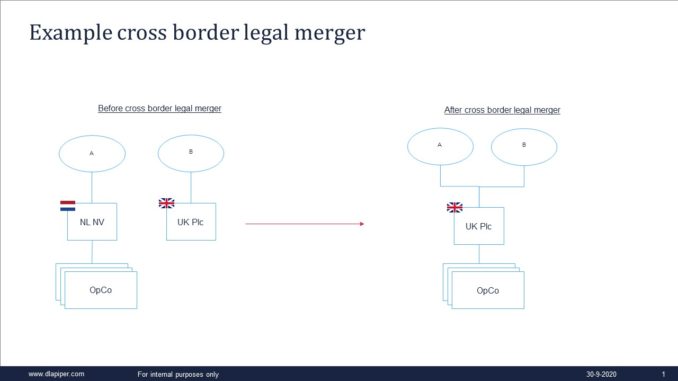

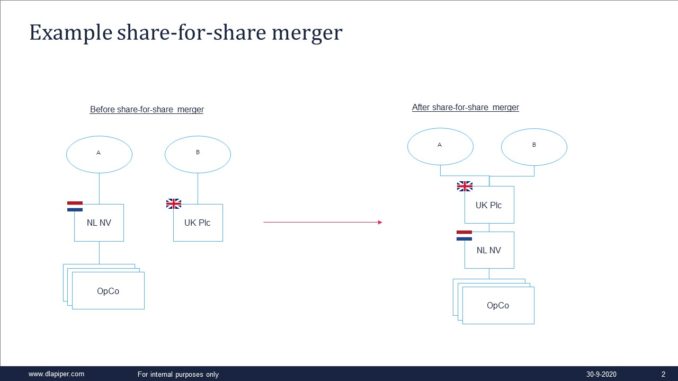

The legislative proposal is aimed at companies performing cross-border reorganizations to a qualifying state, namely cross-border mergers, demergers, share mergers, or relocations of the registered office (i.e., transfer of the place of effective management of the company).

Qualifying state

For purposes of the legislative proposal, a qualifying state is a state without a dividend withholding tax that is comparable with the Dutch dividend withholding tax (e.g., the UK) or a state that allows a step-up for dividend withholding tax purposes to the fair market value.

Taxable base

According to the legislative proposal, meeting the conditions (i.e., a cross-border reorganization to a qualifying state), results in a deemed distribution of all the available profits of the company, including non-realized profits (e.g., non-realized capital gains in assets).

Date of entry into force

Initially, the legislative proposal had a retrospective effective to the date the proposal was first published, July 10, 2020.

However, the initiator of the legislative proposal expanded the scope of the proposal on September 18, 2020, and, as such, the date of entry was extended to that date.

Deferral of payments

According to the legislative proposal, companies can file a request for deferral of payment of the dividend withholding tax due. However, the deferral is terminated insofar actual dividend distributions occur after the cross-border reorganization.

Amendments initial proposal

Initially, the proposed exit tax only applied to companies that are part of a group with a consolidated group net revenue in the preceding year of at least EUR 750 million. However, on September 18, the initiator of the bill announced two amendments, including expanding the scope of the legislative proposal.

First, the scope is no longer limited to companies part of a group with net revenue of EUR 750 million. Therefore, in principle, all entities in the Netherlands (irrespective of the turnover) are within the scope of this legislative proposal. Secondly, the retroactive effect has changed to September 18, 2020 (and no longer July 10, 2020).

Expansion deemed tax residency

In addition, the legislative proposal contains an additional measure extending the incorporation fiction.

The extension entails that a foreign taxable company which has been tax resident in the Netherlands for at least two calendar years will, after the transfer or migration to another jurisdiction, be deemed to remain a Dutch tax resident for ten calendar years for dividend withholding tax purposes.

Currently, only an incorporation fiction (i.e., infinite) applies to companies incorporated under Dutch civil law.

Step-up for cross border migration to the Netherlands

The legislative proposal also introduces a step-up in the taxable base for Dutch dividend withholding tax purposes in situations that a non-Dutch tax resident company becomes liable for dividend withholding tax purposes as a result of its place of effective management or due to a cross border reorganization.

In short, the step-up results in no Dutch dividend withholding tax due on the amount of available (unrealized) profits of that company prior to becoming subject to dividend withholding tax.

The step-up in the taxable base does not apply insofar as value is attributable to shares in a Dutch company (anti-abuse rule).

Heated debate in Parliament awaits

The next phase of the parliamentary procedure is that the Council of State (Raad van State), an advisory body to the Dutch government and Parliament, is consulted. The bill will then be debated by Parliament.

The Council of State provides the government with independent advice on (in principle) all bills introduced in Parliament.

Council of State sends its official report on the bill to the initiator of the bill. The Parliamentary discussion starts when the initiator submits the report of the Council of State to Parliament.

As of today, the initiator has refused to publish the report.

It is said that the initiator is holding the report back due to the strong negative legal advice from the Council of State.

The legislative proposal is controversial as it breaches with EU law and international tax treaties (see the next section).

We expect that the Parliamentary debate will take place later this year.

Breach of EU law and tax treaties

The legislative proposal has been fiercely criticized as it is considered in breach with European law and international (tax) treaties.

The breach with EU law is based on multiple grounds.

First, EU law prohibits discrimination of cross-border situations in comparison to domestic situations.

Considering the exit tax only applies with respect to cross-border reorganizations and not for domestic reorganizations, cross-border reorganizations are disadvantaged.

Second, the exit tax is at odds with the EU merger directive that regulates that EU member states need to allow companies to restructure their business within the EU without triggering adverse tax consequences.

Third, the levy of dividend withholding tax on the basis of deemed fictitious payments is in breach of double tax treaties concluded by the Netherlands.

Finally, Dutch tax law allows the retroactive effect of legislation only in certain limited cases, and the legislative proposal at hand does not meet these requirements.

The report of the Council of State is anxiously awaited by the Dutch tax practice and is expected to be released shortly.

What does this possibly mean for your company?

At first glance, the legislative proposal is perceived as troublesome.

This has mainly to do with the eye-catching headlines that the legislative proposal has created. However, studying the legislative proposal in further detail, the impact on MNEs seems limited.

This because the number of qualifying states (i.e., states without a comparable dividend withholding tax or a step-up for migration companies) is limited.

Although the legislative proposal received international press coverage, the impact is limited to a small number of MNEs which have their (listed) HQ in the Netherlands.

MNEs having a Dutch entity which is held by a group company residing in a jurisdiction that has a tax treaty concluded with the Netherlands, should generally qualify for the domestic dividend withholding tax exemption. The domestic dividend withholding tax exemption is a full exemption on dividend distributions and is based on the overarching Dutch tax (treaty) principle that intra-group dividends should be taxed on an exclusive resident state basis and therefore exempt from dividend withholding tax.

In practice tax relief on dividends is also assured by the wide Dutch tax treaty network (almost 100 treaties) which is based on the idea that intra-group dividends should be taxed at the level of the shareholder and consequently no tax should be withheld at the level of the source state. Therefore, in most MNE situations, the legislative proposal has effectively no impact.

It remains uncertain if the legislative proposal will receive a qualifying majority in Parliament.

Nevertheless, MNEs are strongly advised to take this legislative proposal into account when considering cross-border reorganizations (e.g., legal mergers, demergers, or share mergers).

Furthermore, MNEs need to be aware that an (unwillingly) transfer of the place of effective management of a Dutch company to a qualifying jurisdiction may trigger the exit tax.

Therefore, monitoring, among others, the fulfillment of the Dutch substance requirements and place of effective management, is of even greater importance given this pending legislative proposal.

Be the first to comment