by Daniel Garabedian and Steven Peeters

Update 2/7/2017: the incentive has been adopted with changes. For coverage, see: link.

The Belgian government is expected to introduce a new innovation income deduction regime this year to replace its patent income deduction regime, considered inconsistent with the modified nexus approach as provided for in the final report under Action 5 of the OECD/G20 base erosion profit shifting (BEPS) plan.

While a draft of the new innovation income deduction has not yet been introduced in the Belgian Parliament, the outlines thereof are generally known within the Belgian tax community. This succinct note sets out the core features of the new regime, slated to become effective retroactively from 1 July. It can, of course, not be excluded that the design of the innovation income deduction regime would be amended during the legislative process.

The new Belgium innovation income deduction regime is expected to include the following features. The previous patent income deduction regime has meanwhile been abolished with effect as of 1 July, with a grandfathering for existing situations until 30 June 2021.

Qualifying IP rights

While, undeniably, the new regime is more restrictive than the existing patent income deduction, as it is tied to the requirements of the modified nexus approach prescribed by the BEPS project, the new regime also significantly expands the incentives for research and development (R&D) in Belgium where that is possible within the boundaries of the modified nexus approach.

Belgium’s beneficial regime would no longer be restricted to patents and supplementary protection certificates, but would also cover copyrighted software and breeder’s rights.

All intangibles related to marketing remain excluded. The extended scope of application justifies the name change from “patent income deduction” to “innovation income deduction.”

Calculation of tax benefit

The deductible amount would be 90% of the net R&D income arising from the qualifying IP assets, restricted in line with the modified nexus approach.

In a nutshell, the modified nexus approach aims at linking the R&D tax benefit with the substance of the entity enjoying that benefit. It uses the R&D expenses incurred by the relevant entity as a yardstick to measure the substance of that entity.

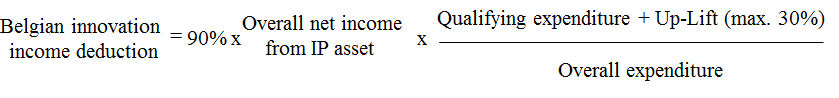

Consequently, the Belgium innovation income deduction is calculated according to the following formula, in line with the approach agreed upon in Action 5 of the BEPS Project:

The “overall net income” from an IP asset refers to the net income generated by the relevant entity, and not the gross income, as is the case in the patent income deduction. The income includes royalties, IP income embedded in the sale price for products, process innovation income, and certain damages and capital gains.

The “qualifying expenditure” includes all expenses directly related to the IP asset that are made by the relevant group entity itself or that are outsourced to non-related parties.

The “overall expenditure” is the “qualifying expenditure” increased by the acquisition costs of the IP asset and any costs related to outsourcing to related parties. To avoid excessive penalization of entities that acquire R&D assets or outsource R&D activities to related parties, an uplift of 30% of the qualifying expenditure is allowed, it being understood that the uplifted qualifying expenditure may never exceed the overall expenditure.

For a detailed explanation of the different parameters included in the formula, reference should be made to the final report in BEPS Action 5, which the new Belgium regime has implemented.

In principle, this formula must be applied on an IP-asset-by-IP-asset basis. When this approach turns out to be impossible from a practical perspective, it may be applied to each product or service or for each group of products or services. In any event, significant tracking and tracing of the income and expenses relating to IP assets will be required. In this respect, the deduction is conditional upon the satisfaction of stringent documentary requirements.

The formula set out above thus links the tax advantage with the R&D activity of an entity. Under the patent income deduction regime, no such formula was applied; rather, it was required that the qualifying IP assets was either partly or fully developed in a R&D center of the company, or acquired from a third party and improved in a R&D center of the company (except for small and medium-sized companies).

Startup phase, transferability to subsequent tax years

Under the previous regime, income was only eligible as from the moment that the relevant patent or supplementary protection certificate was obtained. The new regime would also apply to income generated prior to obtaining the IP protection. During the preparatory phase, the tax benefit would be structured as a temporary and conditional tax exemption which becomes final once the IP protection has been obtained.

The patent income deduction is restricted to the taxable year itself, and any carry-over is prohibited. It is expected that the Belgium innovation income deduction will allow the transfer of excess deductions to subsequent taxable years.

Advance decisions

Legal certainty regarding the application of the Belgium innovation income deduction regime – in strict compliance with its legal framework – may be obtained by requesting an advance decision from the Belgian tax authorities.

Additionally, Belgium is expected to use the possibility provided for in the final report in BEPS Action 5 to consider the calculation method for the innovation income deduction as a rebuttable presumption. In certain exceptional circumstances, it would be possible to obtain an advance decision allowing a deviation from the fraction set out above if it does not provide an accurate reflection of the R&D activity of a certain entity. Such exceptions will be subject to strict monitoring and international exchange of information.

Belgium innovation income deduction regime in context

The Belgian federal government is currently preparing a fundamental reform of the corporate income tax regime, which aims at reducing the nominal corporate income tax rate to 20% combined with a simplification of the calculation of the corporate income tax base. Based on the information currently available, it would not be envisaged to amend the new Belgium innovation income deduction in the framework of this reform.

However, the European Commission 25 October proposal for a Council Directive on a Common Corporate Tax Base included no similar innovation income deduction. On the contrary, the proposal provides for a so-called “super-deduction” of R&D expenses in addition to the ordinary deduction thereof, for an amount of 25%, 50%, or 100% of the incurred expenses under certain conditions (cf. article 9.3 of the proposed directive).

Although the EU Commission approach also links the tax advantage to R&D activity, it is remarkable that the tax advantage is structured as a “super-deduction” of expenses and not as a deduction based on the (net) R&D income.

Be the first to comment