By Julie Martin, MNE Tax

The 130+ countries that make up the “Inclusive Framework on BEPS” still aim to reach consensus by the end of 2020 on updated rules for taxing multinational groups; however, disagreement has emerged regarding whether the “pillar one” reallocation of taxing rights should apply to all multinationals or to only digital multinationals, Pascal Saint-Amans, Director, OECD Centre for Tax Policy and Administration said April 5.

Speaking during a webcast, Saint-Amans and other OECD tax officials also provided an update of OECD Centre for Tax Policy and Administration plans for new transfer pricing, digital platform, and cryptocurrency guidance.

Here are some highlights of today’s discussion:

- Saint-Amans said that although one or two countries support a one year delay the global tax negotiations, he expects that the Inclusive Framework countries will reach agreement on both pillar one and pillar two at their early October meeting. A July Inclusive Framework meeting in Berlin was canceled due to the COVID-19 crisis, he noted. Saint-Amans added, though, that he wouldn’t be surprised if international agreement on pillar one becomes a “staged process,” with some elements of the agreement delayed until 2021.

- Saint-Amans noted there is an “emerging view” among countries that the pillar one amount A reallocation of taxing rights should be limited to digital companies, though the US and China remain opposed to such ring-fencing.

- He said the pandemic has created a risk of proliferation of unilateral digital taxes and trade conflicts, making agreement on pillar one even more important.

- He also noted that the increased pressure on public finances from the COVID-19 crisis has heightened countries’ interest in pillar two rules for a minimum tax on multinational group profits.

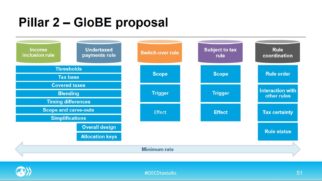

- The OECD Committee on Fiscal Affairs (CFA) working parties have prepared detailed technical notes on the “building blocks” of pillar one and pillar two, as reflected in the following two charts. It is expected that the technical work will be shared with the public for comment this summer.

(click on image to expand)

- Saint-Amans said he hoped the OECD’s impact assessment of the digital taxation proposals can be released to the public by the end of the summer; some countries continue to oppose public release. The impact assessment will be updated to reflect the economic effects of the COVID-19 crisis, he said.

Transfer pricing & COVID-19, country-by-country reporting

- Saint-Amans said also that OECD CFA’s working party #6, responsible for transfer pricing matters, is preparing guidance on transfer pricing issues that result from the COVID-19 pandemic. Unlike the OECD’s work on the effect of COVID-19 on tax treaties, which was drafted by the OECD Secretariat, the objective is for the transfer pricing work to be a consensus document that will be binding on countries. The COVID-19 transfer pricing guidance will likely be completed after year-end. Stakeholder input on what should be covered in this guidance is welcome and should be sent to [email protected]. (For MNE Tax’s analysis of transfer pricing issues arising from COVID-19, visit this link).

- Saint-Amans said that one example out of many transfer pricing issues under consideration is how to treat an MNE that has low-risk distributors in a number of countries but has massive losses as a result of the COVID-19 pandemic. The country of residence “may not be that keen on seeing you keeping profits abroad in your low-risk distributor,” Saint-Amans said.

- The planned 2020 review of Action 13 country-by-country is continuing, reported Achim Pross, OECD Head of the International Co-operation and Tax Administration Division. The OECD’s public consultation has been rescheduled as a virtual meeting to be held on May 12-13.

Digital platforms/cryptocurrency

- Pross also said that OECD hopes to release “before summer” draft model rules for digital platforms. The model rules would require reporting in the platform’s country of residence and then that information would be exchanged with other countries. Uniform rules in this area would be good for taxpayers, tax administrations, and digital platforms, alike, he said. Pross said that the stakeholder feedback on the OECD’s consultation on digital platforms had been helpful.

-

Pross also said that the OECD is working in the cryptocurrency and stablecoin space. “Work is proceeding at a fast pace” on a project to ensure that there is tax transparency in this sector, Pross said. Saint-Amans said the OECD has promised deliverables on this topic to the G20 by year-end.

You can watch a replay of today’s webcast here:

Be the first to comment