by Wiebe Dijkstra and Klaas Versteeg

On 19 May, the Dutch Ministry of Finance issued for public consultation on the internet a draft bill for the revision of the Dutch innovation box regime. The main purpose of the draft bill is to bring the Dutch innovation box regime in line with the final report on action 5 of the OECD base erosion profit shifting (BEPS) project. If the draft bill is adopted in its current form, some profits will no longer be eligible for the Netherlands’ lower innovation box tax rate, and some intangibles will no longer qualify for the regime.

Background

The Dutch innovation regime was introduced in 2007 and amended in 2010 to create a more attractive research and development (R&D) environment in the Netherlands. Profits derived from intangibles that qualify for the innovation box regime are taxed at an effective rate of 5% insofar those benefits exceed the production costs of the intangibles. The regime represents a significant reduction of the tax rate, considering that the normal Dutch corporate income tax rate is 25%.

The OECD’s final report, published in October 2015, adopted the “modified nexus approach” as proposed by Germany and the UK in November 2014. The European Union Code of Conduct Group for Business Taxation endorsed the modified nexus approach in November 2014. The Code of Conduct Group agreed that all patent box regimes within the European Union that are not compatible with the modified nexus approach should be changed in line with the compromise.

During an ECOFIN meeting in December 2014, the Netherlands fully supported the objective to end aggressive tax planning and to put a stop to innovation/patent boxes that encourage profit shifting. In February 2016, the Dutch State Secretary of Finance published the impact assessment of the Dutch innovation box regime and announced his intention to present a draft bill in September 2016. The impact assessment showed that the use of the innovation box regime increased dramatically in the Netherlands, from a total tax benefit of EUR 52 million in 2008 to EUR 697 in 2012. The report also showed that, at a minimum, more than 10% of the taxpayers using the innovation box did not create the intangible assets in the Netherlands.

New innovation box proposal

It is proposed that all intangible assets developed after 30 June would be governed by the new regime with respect to financial years beginning on or after 1 January 2017. A grandfathering rule is proposed, providing that qualifying intangible assets created before 30 June continue to benefit from the current regime until 1 July 2021. Further, patented intangible assets or breeder’s rights developed by the taxpayer before 1 January 2017 will be considered as qualifying intangibles under the new regime, even if the proposed additional requirement under ii below is not satisfied. These will continue to qualify for the innovation box without a time limitation.

The main proposed changes to the innovation box regime are the following:

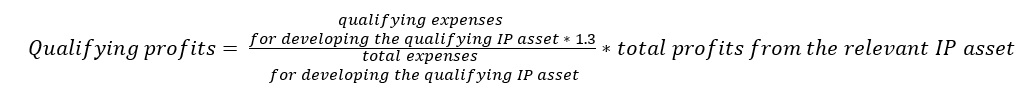

i. Reinforcing and modification of the nexus approach: Although the State Secretary of Finance takes the view that the current regime already provides for substance requirements that are on average stricter than many other regimes, an additional nexus requirement is proposed implementing the mathematical approach set out in the OECD report. Under this approach, the qualifying profits that benefit from the regime will be calculated as follows:

The key difference between qualifying expenses in the numerator and the total expenses in the denominator are outsourcing expenses for contract R&D activities performed by related entities. Expenses for contract R&D activities performed by third parties do form qualifying expenses.

The aim of the 30% up-lift for qualifying expenses is that taxpayers that outsource only a small part of R&D activities to group companies are not faced with restrictions on application of the regime. The OECD final report allows states to introduce a 30% up-lift for qualifying expenses within the nexus approach. The draft bill suggests using the full 30% up-lift.

ii. The criteria for access to the regime: The revised criteria for qualifying intangible assets differ for small and large taxpayers. Large taxpayers are taxpayers with a five-year average turnover resulting from innovative assets of more than EUR 7.5 million and a total five-year average turnover of more than EUR 50 million. To qualify for the innovation box regime, both categories of taxpayers must have obtained a R&D certificate (referred to as WBSO verklaring) for the development of the relevant intangible asset. For large taxpayers an additional condition applies. Only a patent, exclusive license, software program, plant breeder’s right, and pharmaceutical certification can qualify for the innovation box regime. This is a significant change all intangible assets developed by (large or small) taxpayers qualify if either the WBSO subsidy is granted or if the large taxpayer has the patent or similar rights of the IP assets.

iii. Determination of profits: If the taxpayer has multiple intangible assets, the assessment of whether the assets qualify for the innovation box regime is performed for each intangible asset separately. A specific rule applies to interrelated intangible assets that cannot be assessed individually.

iv. Continuing development of intangible assets: The draft bill clarifies that if the taxpayer continues the R&D of an acquired existing intangible asset that was produced by another person, the regime can only be applied insofar these continued R&D activities result in a new intangible asset.

v. Administrative requirements: The draft bill introduces a special documentation requirement for taxpayers using the innovation box regime. The taxpayer must maintain all relevant information for determining the allocation of income to the innovation box regime. This documentation requirement already exists, but is now clarified.

Finally, the OECD report and the draft bill do not introduce detailed rules to calculate the profits attributable to the qualifying intangible assets. The calculation of the benefits should be determined on a case-by-case basis. Different economic approached are used such as the ‘paring method’ and the ‘per asset method.’ This is in line with current practice.

If the draft bill is adopted in its current form, certain profits will no longer be eligible for the lower tax rate resulting from the innovation box regime, and certain intangibles will no longer be covered by the innovation box regime. Interested stakeholders can submit their input or proposed amendments to the draft bill until 19 June.

Be the first to comment