by Wiebe Dijkstra and Peter Spijker

The Netherlands government, on 20 September, presented its 2017 Budget including its Tax Plan 2017, proposing significant changes to the taxation of multinational businesses, international investors, and investment funds.

Included in Tax Plan 2017 and related legislative proposals (the “Bill”) are measures that would change the dividend withholding tax exemption, the Netherlands innovation box, the anti-base erosion and acquisition debt interest deduction limitations, and the rules on refunds of Dutch dividend withholding tax.

Also proposed is a reduction in the amount of corporate income subject to tax at the Netherlands’ highest rate, changes to the VAT rules for building sites and non-performing loans, and modifications to the wage tax rules applicable to supervisory board members.

In addition, a letter from the Secretary of Finance to Dutch Parliament was released alongside the 2017 Budget proposals. The letter recommends proposed changes to the Dutch dividend withholding tax position of cooperatives from 1 January 2018 (the “Letter”).

Below we will give a concise overview of the impact of the Bill and Letter on international business.

Interest deduction, anti-base erosion and acquisition debt

The Bill amends two existing interest deduction limitations: (i) the anti- base erosion provision and (ii) the interest deduction limitation for acquisition holdings.

The anti-base erosion provision contains an interest deduction limitation in the case of interest payments to a related party that are connected with certain tainted transactions. The definition of related parties will be amended to include groups acting in concert. Based on this new definition, companies that are part of a group of companies that act in concert and hold a minimum total combined interest of one third in a Dutch company will each qualify as related party.

The expanded definition primarily aims to combat private equity structures where a general partner manages multiple funds. Each such fund may qualify as a related entity of the Dutch company if the general partner has, amongst others, certain control over (the investment in) the Dutch company, and also if such fund individually holds an interest of less than one third. In these types of structures, the interest deductibility of shareholder loans should be re-evaluated.

The second proposed amended interest deduction limitation is the interest deduction limitation for acquisition debt. This provision disallows the deduction of interest expenses relating to (deemed) excessively leveraged acquisitions if the target is subsequently included in a fiscal unity for corporate income tax purposes or merged with the acquiring company.

Whether acquisition debt is excessive is determined based on a loan-to-purchase price ratio. In the year of the acquisition, a maximum loan-to-purchase price ratio of 60 percent is allowed; this maximum percentage is reduced by 5 percentage points annually over the course of seven years, down to 25 percent in year eight and subsequent years.

The Bill closes certain loopholes in this provision. The first amendment aims to counter debt-push down transactions where the acquisition debt is assumed by the target company. Previously, these transactions prevented application of the interest deduction limitation. The second amendment aims to counter intragroup transactions that would result in reseting the annual allowed reduction back to 60% of the acquisition price.

Third, the proposed rules include a disallowance of the grandfathering rules introduced in 2012 for existing debt when the acquisition holding is included in a new Dutch fiscal unity headed by a different parent company. The proposed rules may lead to the disallowance of the deduction of interest paid by a Dutch company whereas under the current rules, such interest would be deductible. This may have an impact on the interest deductibility in existing structures.

Dutch innovation box

The Bill also contains changes to the innovation box regime, including the introduction of the ‘modified nexus’ approach. These changes were the subject of a public consultation that commenced last May.

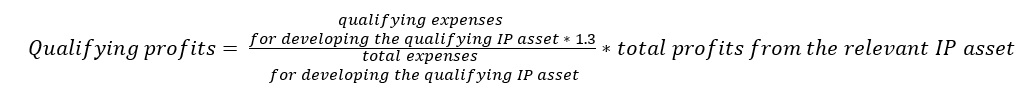

The modified nexus approach calculates the qualifying benefit under the innovation box regime as follows:

The difference between qualifying expenses in the numerator and the total expenses in the denominator are (i) outsourcing expenses for contractual R&D activities performed by related entities and (ii) IP acquisition costs. These costs therefore limit the benefits of the innovation box regime. R&D activities performed by third parties, group companies in a fiscal unity or a permanent establishment of the taxpayer are qualifying expenses. For a more detailed overview of the modified nexus approach, please see our update of 15 June.

The proposed legislation also introduces of new criteria for access to the regime which differs for small and large taxpayers. Large taxpayers are taxpayers with a five-year average turnover resulting from innovative assets of more than EUR 7.5 million and a total five-year average turnover of more than EUR 50 million.

To qualify for the innovation box regime, both categories of taxpayers must have obtained an R&D certificate for the development of the relevant intangible asset. For large taxpayers an additional condition applies: only income from patents, utility models, software, plant breeders’ rights, and pharmaceutical certifications qualifies for the innovation box regime. A small taxpayer may also include unprotected IP in the innovation box regime.

It is proposed that all intangible assets developed after 30 June will be governed by the new regime for financial years beginning on or after 1 January 2017. A grandfathering rule is proposed, providing that qualifying intangible assets created before 30 June continue to benefit from the current regime until 1 July 2021. Further, patented intangible assets or breeders’ rights developed by the taxpayer before 1 January 2017 will be considered qualifying intangibles under the new regime, even if no R&D certificate has been issued. These will continue to qualify for the innovation box without a time limit.

If the changes to the innovation box regime are adopted in their current form, some profits currently eligible for the lower innovation box tax rate will become ineligible, and certain intangibles will no longer be covered. All existing tax rulings regarding the application of the Dutch innovation box regime will, with the exception of those involving grandfathering periods, be terminated.

Dutch corporate income tax rate

Finally, the Bill aims to change the corporate income tax rate. Corporate income is currently taxed at a rate of 20 percent up to a profit of EUR 200,000, with the excess being taxed at a rate of

Dividend withholding tax, withholding exemption

The Bill and the Letter include several proposals to modify the Dutch dividend withholding tax. The first change regards the withholding tax exemption, which currently provides that profit distributions to EU and EEA resident corporate shareholders with an interest of 5 percent in a Dutch entity are usually exempt from dividend withholding tax.

It is proposed to extend this exemption to all corporate shareholders resident in a country the Netherlands has concluded tax treaties with. An anti-abuse provision will prevent this exemption being applicable in wholly artificial situations. According to the Letter, this means that the withholding exemption will only be applicable to active business structures. It is uncertain to what extent conditions for application of the relevant treaty must be met for the purpose of claiming the extended domestic exemption.

Dividend withholding tax, cooperatives

Second, changes to the dividend withholding tax position of cooperatives are proposed. Currently, distributions by cooperatives are not subject to dividend withholding tax, unless an anti-abuse rule that applies to a restricted scope of anti-avoidance structures is applicable. It is proposed that distributions by a cooperative with a mere holding function, i.e. holding participations, investing funds and financing related parties to a member who holds an interest of 5 percent or more, will become subject to dividend withholding tax.

However, holding cooperatives used in active business structures may benefit from the abovementioned withholding tax exemption. If a member of a holding cooperative has an interest below 5 percent, a distribution can be made without dividend withholding tax.

Thus, the withholding exemption will not be applicable to holding cooperatives if the members of the cooperative are located in non-tax treaty jurisdictions. As a result, distributions by international holding cooperatives to such members would always become subject to 15 percent dividend withholding tax.

This deviates from the current situation where, in the case of an active business structure, distributions by international holding cooperatives are not subject to dividend withholding tax. The extension of the withholding exemption and the changes to the dividend withholding tax liability of cooperatives are not yet part of a legislative proposal, but it is envisaged that the new rules will enter into force on 1 January 2018.

The Letter does not address the consequences of the proposed rules with respect to the rules regarding the taxation of a non-resident companies with a substantial interest in a company resident in the Netherlands.

Dividend refunds, withholding tax exemption

Third, changes to the Dutch dividend refund rules are proposed. Under Dutch law, a domestic portfolio shareholder (a less than 5 percent shareholding) can credit the Dutch dividend withholding tax levied against Dutch personal income tax or Dutch corporate income tax. However, non-Dutch resident shareholders can generally not credit the Dutch dividend withholding tax. This could result in a heavier tax burden compared to a pure domestic situation.

To align Dutch dividend refund rules with recent case law of the Court of Justice of the European Union (ECJ), a refund facility for dividend withholding tax will be introduced for non-Dutch resident individuals or entities if the Dutch dividend withholding tax cannot be fully credited and therefore results in a heavier tax burden compared to a pure domestic situation.

This rule will apply to both individuals and entities resident in countries with which the Netherlands has concluded a treaty that includes exchange of information possibilities. As noted in our update of 15 June, some of these rules are still debatable from an EU law perspective.

Lastly, a new optional dividend withholding tax exemption is introduced which applies to dividend payments made to certain exempt non-resident entities (i.e. entities that are (partly) not subject to corporate income taxation). This new regime will relieve the administrative burden of the current refund procedure.

VAT – building sites

The current definition of building site in the VAT Act is not aligned with the definition of a building site as defined by the ECJ. The Bill proposes to align this definition to make it clear that the definition of building site also encompasses land that is intended to being built on, which currently is, according to the Dutch definition, not always the case.

This intention must be apparent from an overall assessment of the facts and circumstances at the moment of the transfer and must be supported by evidence. The alignment of the definition of building site with the definition of the ECJ ensures that the transfer of a building site is subject to VAT and exempt from real estate transfer tax.V

VAT – refund scheme for non-performing loans

The Netherlands VAT Act contains a VAT refund scheme for bad debt. Under the current rules, it is often unclear at which moment a bad debt becomes uncollectible and a refund of VAT must be filed. The Bill proposes to amend these rules so that bad debts are deemed uncollectible after one year, although taxpayers may still demonstrate that non-payment occurs at an earlier date. This new regime will also be applicable when debt is transferred, for instance to a factoring company. In all cases, the amount of VAT to be refunded will be calculated in proportion to the uncollectible part of the debt. The proposed rules provide a safe haven after one year for determining if debt is uncollectible, but still provides flexibility to demonstrate that non-payment occurs at an earlier date.

Wage tax, supervisory board members

Currently, supervisory board members are deemed to be employed for Dutch wage tax purposes. It is proposed to terminate this deemed employment provision. As a result, supervisory board members are no longer deemed to be employed by the company.

The abolishment of the deemed employment provision also has consequences for foreign supervisory board members. For instance, a previously applicable 30 percent ruling can no longer be applied, since this ruling is only applicable to (deemed) employees. The supervisory board member and the company may decide to opt for withholding for payroll purposes via the ‘opting-in’ regime to avoid the potentially unfavourable consequences of the proposed amendment.

Be the first to comment