By Luis Felipe de Campos, Tax Partner, Rolim, Viotti, Goulart, Cardoso Advogados, São Paulo

The substitute tax reform bill presented by Brazil’s Ministry of Economy to Congress on June 25 includes provisions affecting corporate tax rates, profit distributions, interest on net equity, and reorganizations. The changes would directly affect inbound investment.

As the tax reform bill must still go through both houses of the Brazilian Congress, additional changes are expected, including discussions on progressive tax rates for dividend distributions, which are already on the table.

Multinational groups investing in Brazil should keep a close watch on continuing tax reform developments with an aim to plan ahead for potential adverse tax consequences.

Brazilian tax policy background

Following the establishment of the Real (BRL) currency in Brazil in 1994 as a result of the Real Plan (Plano Real), a successful stabilization plan against the inflationary spiral Brazil had found itself in since the mid-80s, legislation was enacted aiming at adjusting the national tax system to the new economic reality.

Among the main features of the legislation issued in 1995 (Law 9,249/1995) was a corporate income tax rate cut from 25% to 15%, with a 10% additional tax rate for amounts exceeding BRL 240,000 (approximately USD 45,000), granting a certain level of progressivity to the system. Additionally, to equalize the tax treatment among the various capital income categories and to balance the debt-bias, the legislation also allowed the deduction of interest accrued on shareholders’ equity, the interest on net equity.

Finally, this 1995 legislation supported a full integration system between the shareholder and invested company, taxing all profits at the level of the company at 34% (15% + 10% for the corporate income tax and 9% for social contribution on net profit) and exempting any profit distributions/dividend payments from withholding tax.

Aiming at simplifying the Brazilian tax system and aligning it to the revamped worldwide international tax environment – i.e., the OECD’s base erosion and profit shifting (BEPS) project – the Ministry of Economy, supported by studies performed by the Brazilian Internal Revenue Service, proposed tax reform legislation in June 2021, reassessing these established features of Brazilian tax policy.

Reform bill – a long road ahead?

The original reform bill presented by the Ministry of Economy to Congress in mid-June contained certain features that were promptly criticized – e.g., the extinction of interest on net equity, a timid corporate income tax rate cut, and a withholding tax upon dividend distributions. Given the backlash the bill created in the market, substitute bills were put forward aimed at easing the approval process within both houses of Congress.

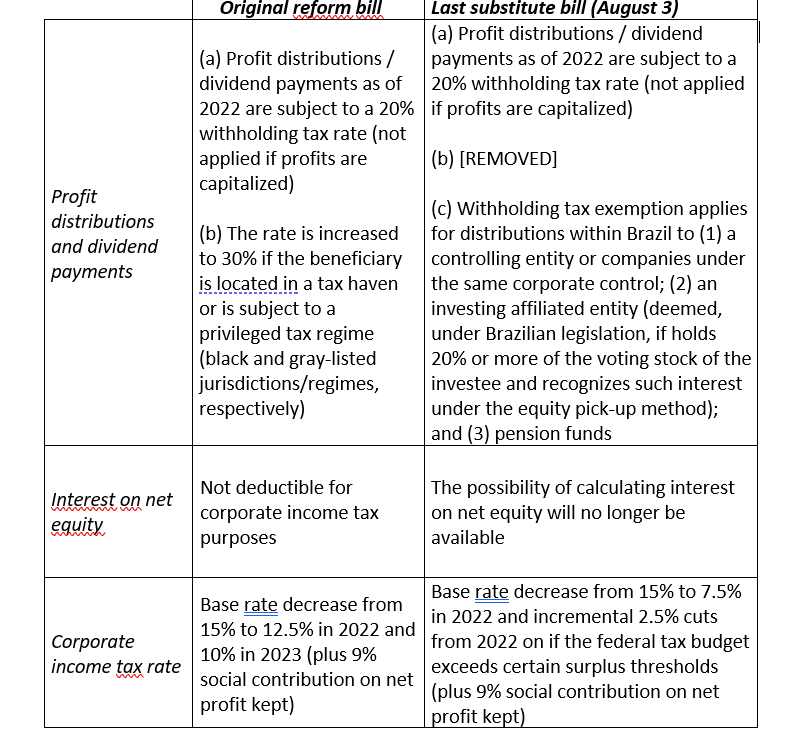

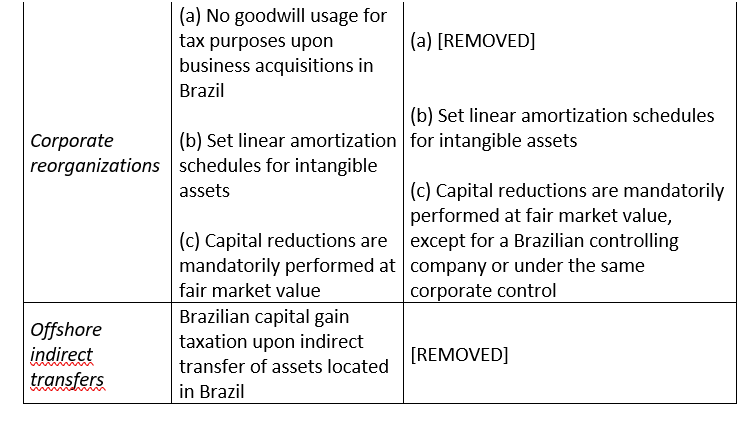

The following table highlights the differences between the original and the last substitute bills side-by-side.

Impacts of the reform on inbound investments

Under current rules, Brazilian legal entities are subject to a 34% corporate income tax rate. Such investment remunerates its foreign shareholders via withholding tax-free dividends and interest on net equity subject to a 15% withholding tax but deductible at the full tax rate in Brazil (34%).

The most common structures to hold investments in Brazil – via European holding companies in Luxembourg, Netherlands, Spain, etc. – would characterize such interest in the Brazilian subsidiary as a qualifying participation, assuming a non-portfolio investment, under ordinary participation exemption regimes (under which dividends received from the qualifying investment are exempt). Accordingly, dividends paid to such holding entity would not be subject to tax in the corresponding jurisdiction.

The tax treatment applicable to interest on net equity would depend on the income characterization by the receiving country. If treated as dividends (as it is equity-based), the income flow would be exempt under the same abovementioned participation exemption rules. Conversely, if treated as interest (as it generates a tax deduction in Brazil), the income would be included in the tax base of the receiving entity but a foreign tax credit for the 15% withholding tax would be allowed (certain tax treaties signed by Brazil also have tax sparing clauses that could increase such foreign tax credit to 20% or even 25%, possibly neutralizing the effect for corporate income tax purposes at the level of the holding company).

In the proposed new scenario, assuming the tax burden included in the last substitute bill, legal entities in Brazil would be taxed at 24% (for 2022) and 21.5% (for 2023 onwards), assuming overall federal tax budget surplus thresholds are reached.

However, upon dividend distributions, a 20% withholding tax would apply. Such rate could be reduced to 15%/10% if there is double tax treaty in place between Brazil and the country of residence of the beneficiary. As noted, interest on net equity payments would no longer be available (although several commentators in Brazil recommend this instrument be perfected into a debt-equity bias reduction allowance, “DEBRA”, similar to the one currently open for consultation in the European Union).

Under the new tax reform, assuming the income flow would be exempt under the holding company participation exemption regime, the withholding tax at source in Brazil would be a cost for the investor as it would not be creditable at the level of the receiving entity. Given the exemption of dividends income at the level of the holding company, potential tax sparing clauses in double tax treaties signed with Brazil would not mitigate the overall tax burden.

Potential approaches for investors to dealing with this new reality could include reevaluating their investment structure in Brazil or injecting capital into Brazilian subsidiaries via interest-bearing debt instruments.

Reevaluating the investment structure into Brazil could involve searching for jurisdictions that include dividend income in the taxable base and allow a foreign tax credit for the withholding tax levied in Brazil or promoting investments in Brazil through an intermediate holding company located in a country with which Brazil has signed a double tax treaty (aiming at reducing the overall tax burden).

With respect to capital injections into Brazilian subsidiaries via interest-bearing debt instruments, entity capitalization via intercompany loans would decrease the overall tax burden due to ordinarily deductible interest expenses and potential foreign currency expenses accrued therein. Such debt injection, surely, would need to be compliant with Brazilian thin capitalization rules (2:1 debt-to-equity ratio if the entity is not located in the black/gray-listed jurisdiction) and interest rates would have to comply with domestic transfer pricing legislation.

Introduction of DDT would be regressive step and may stop fresh investments in Brazil. The author has rightly pointed out to revaluate the investment structure.

Thank you for your feedback, Vikash! The investment structure reassessment is a must now.