by Julie Martin, MNE Tax

As expected, the OECD today published a work plan setting out a process for reaching global consensus on revised rules for taxing multinational groups. This key document had been agreed to by a 129-country coalition, known in the tax world as the “Inclusive Framework on BEPS,” on Tuesday.

The work plan takes forward the Inclusive Framework’s decision to try to reach agreement international tax reform by the end of 2020 using two “pillars” as a launching point for discussions.

Under the first pillar, countries will consider whether more multinational enterprise profit should be taxed in countries where the multinational’s clients or users are located, and if so, how much profit should be allocated.

Under the second pillar, dubbed the global anti-base erosion or GloBE proposal in the work plan, countries will explore the possible introduction of a coordinated worldwide minimum tax on multinational enterprises to reduce the incentive for profit shifting.

These pillars were first introduced in a January 9 Inclusive Framework policy note and then expanded upon in a February 13 OECD document that was the subject of a two-day March consultation. The new work plan takes this work significantly further, identifying multiple approaches and questions to be explored for each pillar.

Today’s document also states that the Inclusive Framework has agreed that the technical work must be complemented by impact assessments addressing how the proposals will affect government revenue, growth, and investment. The document discusses how this work will be carried out, stating, for example, that the assessment will explore the impact on different business sectors and different types of economies (for example on developing countries, resource-rich countries, R&D intensive economies).

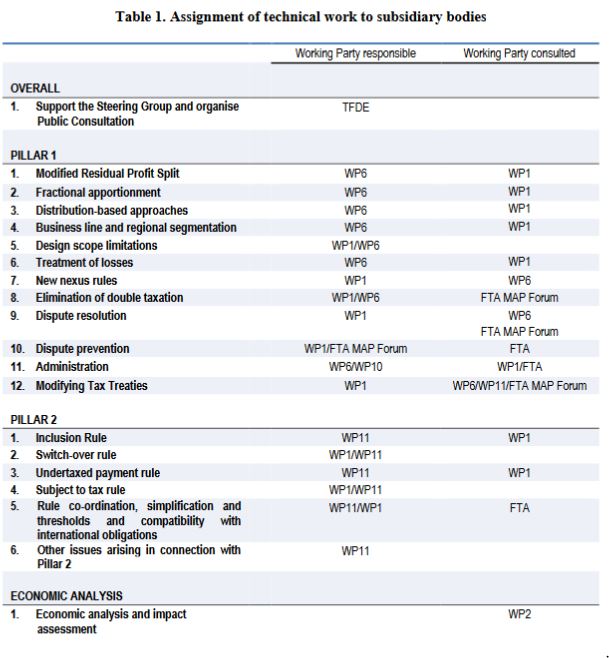

An Inclusive Framework Steering Group will be responsible for advancing the work; however, the technical work will be done by OECD Committee on Fiscal Affairs (CFA) working parties (WPs) and other OECD CFA subsidiary bodies, such as the Forum on Tax Administration MAP Forum and the CBC Reporting Group.

The document assigns the technical work to CFA working parties as follows, illustrating the scope of the project at hand:

The OECD work plan states that countries should strive to reach a political agreement on a comprehensive and unified solution before year-end to ensure adequate time to complete the work before the end of 2020.

“Important progress has been made through the adoption of this new programme of work, but there is still a tremendous amount of work to do as we seek to reach, by the end of 2020, a unified long-term solution to the tax challenges posed by digitalization of the economy,” said OECD’s Secretary-General Angel Gurría, commenting on today’s release.

Gurría said that the work plan must be followed up with by strong political support for a solution that maintains, reinforces, and improves the international tax system.

The OECD-led effort seeks to respond to concerns by some countries that multinational firms are undertaxed because they can take advantage of outdated rules.

While the discussion began by focusing exclusively on digital firms’ ability to skirt the tax laws, and continues to be described as an effort to address the tax problems caused by “digitalization,” the debate has since expanded to a larger discussion about whether the international tax rules for allocating income should change for all types of multinationals.

MNE Tax will be publishing further updates on this development next week.

Good afternoon,

Serge de Reus, Group Head of Tax Naspers would like a copy of the doc linked to “OECD Publishes Work Plan for sweeping international tax reform”. would be so grateful if you are able to assist and send this to me please. Many thanks,

Hi Laura – sure, this is a link to the document: https://www.oecd.org/tax/beps/programme-of-work-to-develop-a-consensus-solution-to-the-tax-challenges-arising-from-the-digitalisation-of-the-economy.pdf